During the early Asian session, major cryptocurrencies were trading in the negative, as the global crypto market cap fell 0.05% on the previous day to $918.19 billion. Over the last 24 hours, overall crypto market volume fell 9.88% to $44.13 billion.

The overall volume in DeFi was $2.40 billion, accounting for 5.44% of the total 24-hour volume in the crypto market. The overall volume of all stablecoins was $41.54 billion, accounting for 94.13% of the total 24-hour volume of the crypto market.

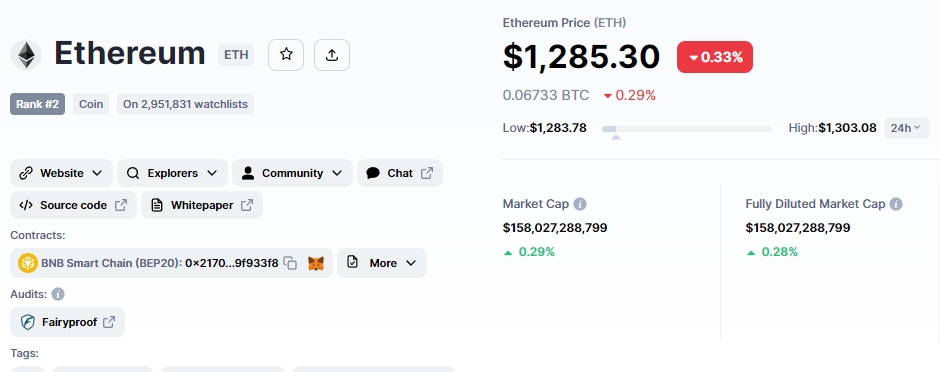

Bitcoin, the leading cryptocurrency, has gained 0.21% after losing more than 6% in the previous seven days. Ethereum, on the other hand, is still trading below $1,300 (the psychological level), having lost nearly 6.19% this week.

Top Altcoin Gainers and Losers

Huobi Token (HT), Terra (LUNA), and OKB (OKB) continued to be the top performers in the Asian session. Huobi’s price has risen by more than 12% to $7.31, while Terra’s price has risen by 5.06% to $2.68. In contrast, OKB rose 1.65% to $16.68.

The TerraClassicUSD price has remained bearish, falling 22.36% to $0.0455 in the last 24 hours. The trading sentiment in the cryptocurrency market is slightly negative, and digital assets are struggling to rise.

As a result, we have a good opportunity to enter positions, especially given how oversold the markets are.

Cryptocurrency News Highlights

Here are some of the events that stood out in the crypto news section:

US Dollar on the Rise

The US Dollar Index (DXY) has moved to 113.20 after breaking a five-day rise with slight losses the day before. The US dollar index against the other six major currencies was flat on Thursday, before the release of the crucial US Consumer Price Index (CPI) data for September, failing to justify recent hawkish Fed bets and cheery Fed governor comments.

The greenback’s value retreated after minutes from the most recent Federal Reserve meeting revealed some dovish undertones. In the meeting minutes, it was noted that some people talked about the need to slow down the pace of further tightening to lessen the threat to the US economy.

However, the Fed maintained its plan to increase interest rates in an effort to slow inflation.

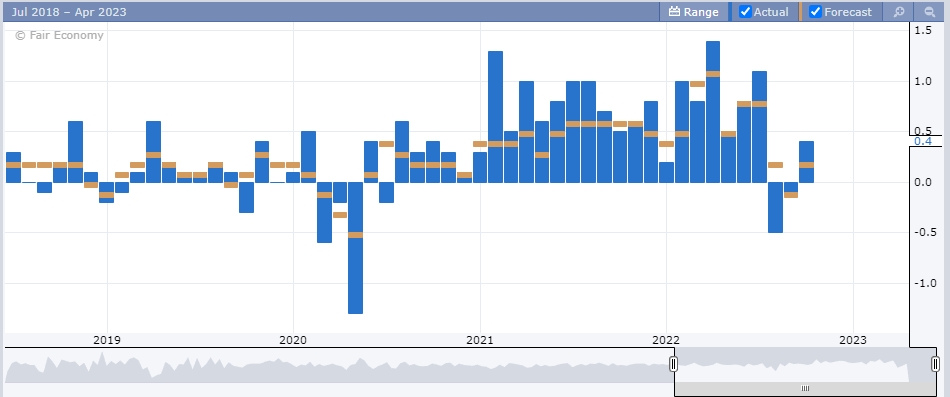

US PPI Figures

The dollar gained ground versus most cryptocurrencies after news that US producer prices rose more than expected in September.

The PPI for final demand rose 0.4%, more than the 0.2% increase economists had predicted. The PPI rose 8.5% year-over-year in September after rising 8.7% in August.

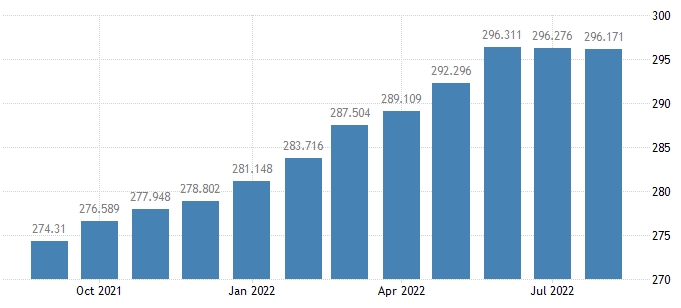

US CPI Figures Ahead

Inflation in the United States slowed for a second consecutive month in August 2022, falling to 8.3% from 8.5% in July but still coming in above market expectations of 8.1%. The US consumer price index came in at 296.17 in August, slightly below the previous month’s reading of 296.28 and above the 295.53 that had been anticipated by the market.

The latest Consumer Price Index (CPI) report for September will be made public by the US Bureau of Labor Statistics (BLS) on Thursday, October 13, at 8:30 ET. As for the core (ex-food and energy) CPI data, the consensus forecast is for it to print at 0.4% m/m, 6.5% y/y, while the headline CPI is predicted to come in at 0.2% m/m, 8.1% y/y.

What effect will stronger US economic figures have on the cryptocurrency market?

The cryptocurrency market may take a bearish turn with higher US CPI figures. It is primarily because the US Federal Reserve closely monitors economic statistics such as inflation, labor, GDP, and other events to determine its upcoming policy.

The improved economic data will persuade Jerome Powel and the rest of the FOMC to raise interest rates. As a result, investors may shift their investments away from risky investments like cryptocurrency, forex, and stocks and toward safe-haven investments like gold and government bonds.

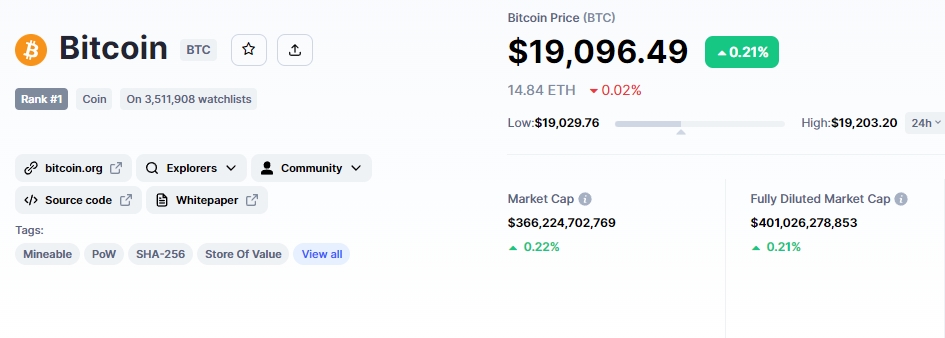

Bitcoin Price Prediction & Technical Outlook

The current Bitcoin price is $19,094.36, and the 24-hour trading volume is $25 million. Bitcoin has increased by 0.23% in the previous 24 hours.

CoinMarketCap now ranks first, with a live market cap of $366 billion. It has a total quantity of 21,000,000 BTC coins and a circulating supply of 19,177,593 BTC coins.

On October 13, the Bitcoin price prediction remains bearish although it’s gaining immediate support near $18,857. Closed Doji and spinning top candlesticks above this level are likely to fuel Bitcoin’s uptrend. As shown in the 4-hour chart above, the relative strength index (RSI) has entered the oversold zone, indicating that sellers have been exhausted and buyers are on the horizon.

They are simply waiting for a glimmer of hope, such as a weaker US CPI, before taking advantage of the opportunity.

On the upside, Bitcoin’s immediate resistance remains at $19,295 and $19,550 which has been extended by the 50-day moving average. A bullish crossover above the 50-day moving average could push the price of bitcoin up to $20,470.

Ethereum Price Prediction & Technical Outlook

The current price of Ethereum is $1,287.17, with a 24-hour trading volume of $8.5 billion. In the last 24 hours, Ethereum has gained 0.28%. With a live market cap of $158 billion, CoinMarketCap currently ranks second. It has a circulating supply of 122,771,325 ETH coins and no maximum supply.

Ethereum price prediction remains bearish as ETH has broken through a symmetrical triangular formation at $1,303, and candles closing below this level are likely to push the price down. Ethereum may regress back to retest the crucial level of $1,300; failure to break above this level confirms the continuation of the downturn.

On the downside, ETH’s immediate support remains at $1,260, and a break below this level may result in selling ETH around $1,220. A surge in selling pressure might push ETH below $800, but this is unlikely because the $1005 level will provide significant support along the way.

IMPT – The Green Alternative Crypto

Tamadoge, a meme coin, is gaining traction, having increased by more than 33% in the last 24 hours to trade at $0.04143. OpenSea now sells the Ultra-rare Tamadoge NFTs, with a start price of 1 WETH. Tamadoge has become the 3rd biggest meme coin in the crypto space.

After only 9 days of the presale, the project’s native currency, the IMPT token, has already raised an incredible $3.9 million, having sold 217 million tokens.

Even though the blockchain-based carbon credit marketplace began its auction during a bear market for cryptocurrencies, demand for the marketplace token remained high.

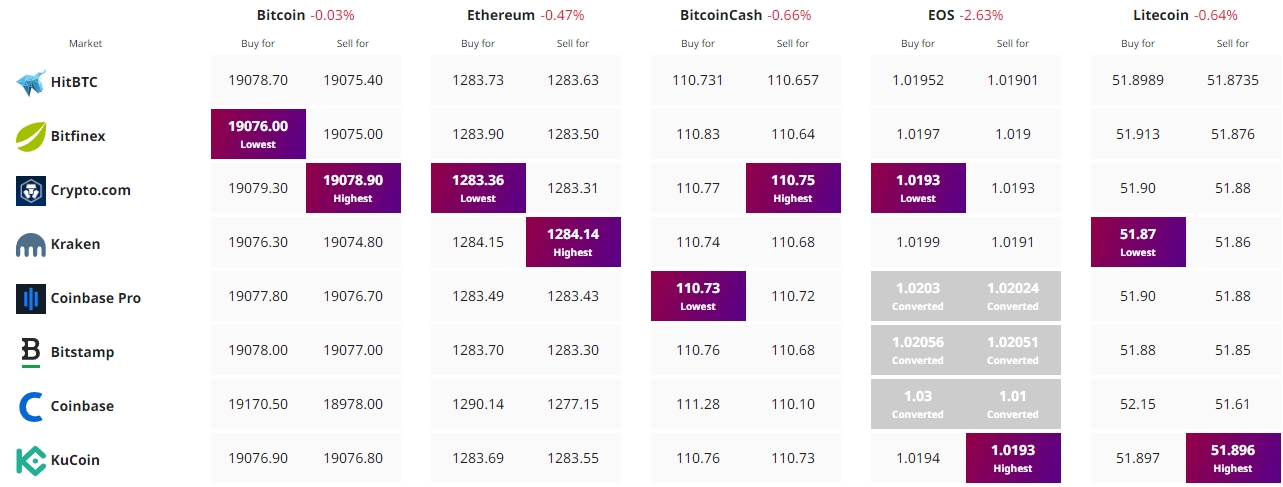

Find The Best Price to Buy/Sell Cryptocurrency: