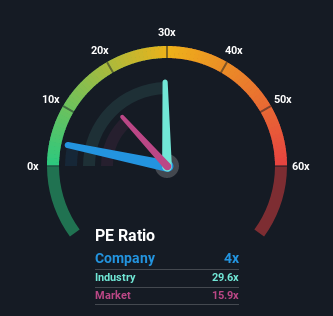

Pepper Money Limited’s (ASX:PPM) price-to-earnings (or “P/E”) ratio of 4x might make it look like a strong buy right now compared to the market in Australia, where around half of the companies have P/E ratios above 16x and even P/E’s above 34x are quite common. Nonetheless, we’d need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Pepper Money hasn’t been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn’t going to get any better. If you still like the company, you’d be hoping this isn’t the case so that you could potentially pick up some stock while it’s out of favour.

View our latest analysis for Pepper Money

If you’d like to see what analysts are forecasting going forward, you should check out our free report on Pepper Money.

How Is Pepper Money’s Growth Trending?

The only time you’d be truly comfortable seeing a P/E as depressed as Pepper Money’s is when the company’s growth is on track to lag the market decidedly.

Taking a look back first, the company’s earnings per share growth last year wasn’t something to get excited about as it posted a disappointing decline of 12%. Even so, admirably EPS has lifted 46% in aggregate from three years ago, notwithstanding the last 12 months. Although it’s been a bumpy ride, it’s still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings growth is heading into negative territory, declining 1.5% per year over the next three years. That’s not great when the rest of the market is expected to grow by 13% each year.

With this information, we are not surprised that Pepper Money is trading at a P/E lower than the market. Nonetheless, there’s no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We’ve established that Pepper Money maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn’t great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Pepper Money is showing 3 warning signs in our investment analysis, and 2 of those don’t sit too well with us.

If these risks are making you reconsider your opinion on Pepper Money, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here