Most people with a checking or savings account have never heard of “shadow banking.”

Yet, shadow banking may pose an even bigger threat to the financial system than the failure of traditional banks.

As Oxford Languages defines it, shadow banking is “lending and other financial activities conducted by unregulated institutions or under unregulated conditions.”

This lack of regulation means that shadow banks will often take on greater risk than traditional banks.

Even though the term “shadow banking” sounds mischievous, well-known entities like investment banks, mortgage lenders, money market funds, insurance companies, etc. engage in it.

So, shadow banking is enormous, and so are the risks.

On March 27, Bloomberg mentioned “the huge pile of hidden leverage that’s been quietly built over the past decade”:

More than a dozen regulators, bankers, asset managers and former central bank officials interviewed by Bloomberg News say shadow debt and its links to lenders are becoming a major cause for concern as rising interest rates send tremors through financial markets. [emphasis added]

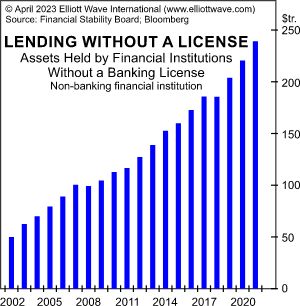

Getting back to the size of shadow banking, this is from our just-published April Elliott Wave Financial Forecast:

The U.S. Federal Reserve’s Financial Stability Board’s estimate for the size of the shadow banking sector at the end of 2022 [is] $240 trillion, which is 10 times the total assets at all U.S. commercial banks.

The enormity of unregulated financial activities is one of the reasons why the entire financial system is vulnerable.

Elliott Wave International posits that another financial crisis, perhaps more severe than 2008, is likely and that it will occur in conjunction with the next leg down in the stock market.

Now is the time to get our analysis and forecast for the stock market as you follow the link below.