Nearly half of investors plan to add cryptocurrency and digital asset-themed exchange-traded funds despite the fall in crypto prices and the collapse of exchange FTX last year.

Brown Brothers Harriman’s 10th annual Global ETF Investor Survey found that 48% of investors plan to add cryptocurrency and digital asset-themed ETFs, only 6% lower than a year ago. In particular three quarters, 74%, of institutional investors are extremely/very interested in this strategy.

“Initiatives such as the draft regulation from the EU’s Markets in Crypto Assets proposal is expected to significantly ‘derisk’ investments in crypto assets for asset managers and provide an ‘additional layer of comfort’ for fund managers to engage with crypto,” said BBH.

Crypto ETFs are still being launched. For example, ETC Group, a European provider of digital asset-backed securities, has announced that it intends to list the first crypto ETP based on an MSCI index in April. The ETC Group MSCI Digital Assets Select 20 ETP is expected to list on Germany’s Deutsche Börse XETRA.

Stephane Mattatia, head of thematic indexes at MSCI, said in a statement: “The digital assets ecosystem is evolving rapidly and investor demand for access to this new asset class is growing. MSCI Digital Assets Indexes are developed with a systematic and process-oriented approach to help global investors gain transparency into this long-term, disruptive trend and enable them to make better investment decisions.”

BBH surveyed more than 300 institutional investors, fund managers, and financial advisors from the United States, Europe, and Greater China, with 40% of respondents having more than $1bn in assets under management.

ESG demand

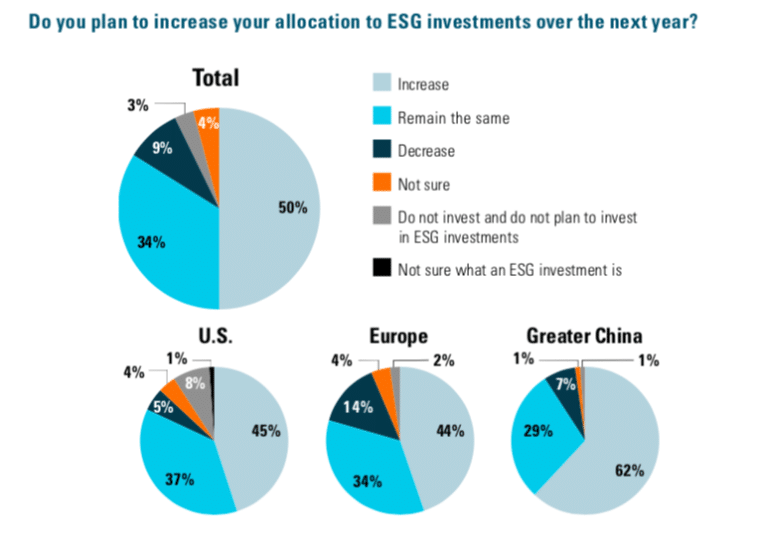

Environmental, social and governance funds also continue to attract attention with half of investors planning to add ESG exposures this year, while a third plan to keep the same allocation.

BBH said assets in ESG ETFs have grown at a 40% compound annual growth rate over the last five years. After 43 consecutive months of inflows, $403bn was invested in ESG ETFs at the end of last November. The study highlighted that ESG is dominating inflows in Europe, representing 65% of all inflows in the ETF market in 2022.

“By the end of 2022 ESG ETFs accounted for 19% of the European ETF market,” added BBH. “We expect momentum behind investor flows into ESG funds in Europe to continue.”

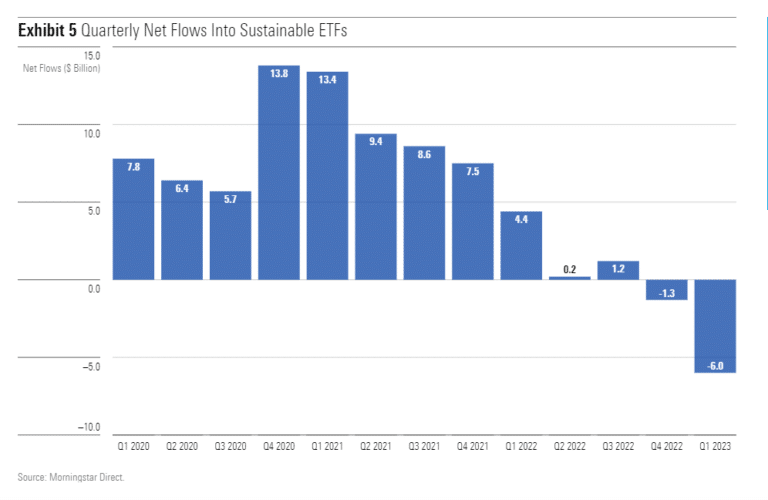

However, data provider Morningstar noted that in the US, Sustainable ETFs had outflows of $6bn exit in the first quarter of this year, their worst figure to date.

Fixed income

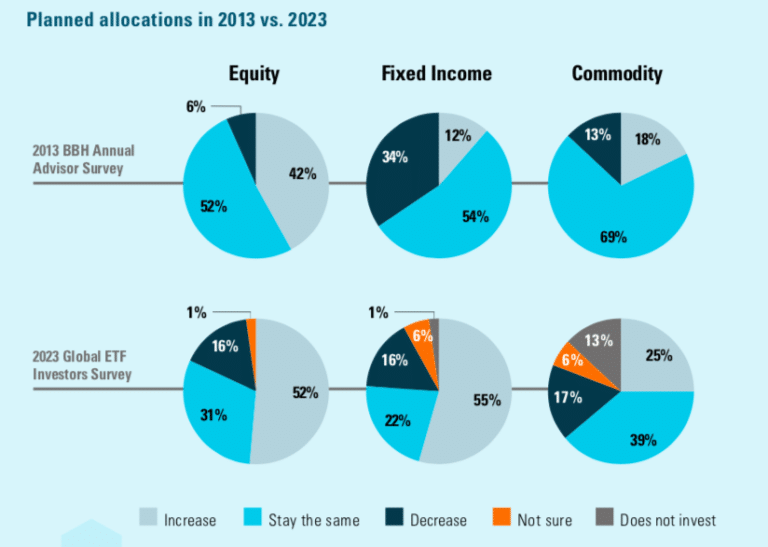

Fixed income ETFs were the vehicle of choice for investors globally in 2022 according to the BBH survey.

As interest rates have been rising nearly half, 46%, of respondents expect to increase their allocation to fixed income ETFs, and 40% expect to allocate more to short duration fixed income ETFs.

Recap of March and Q1 ETF flows from @TheETFObserver.

Bond ETFs grabbed 68% of Q1 flows despite representing ~20% of assets.

Foreign-stock ETFs raked in about $30 Bil in Q1, while their U.S. counterparts saw their first quarterly outflows since 2016.https://t.co/u0ofjPOice pic.twitter.com/6qzq1KLlhX

— Ben Johnson, CFA (@MstarBenJohnson) April 4, 2023

Ryan Jackson, manager research analyst, passive strategies, for Morningstar Research Services, said in a report that US ETFs had inflows of about $77bn in the first-quarter of this year.

“After a February of modest outflows, bond ETFs bounced back in March with $28.4bn of inflows,” added Jackson. “That pushed their first-quarter haul to $52.5bn, or about 68% of all ETF net flows for a cohort that only represents about 20% of the market.”

Ultrashort bond funds took in $17bn in the first quarter, which Morningstar said marks a stellar follow-up to their record-setting 2022. Long-term government bond funds led all categories with $9.1bn in first quarter flows but Morningstar added medium- and short-term offerings also fared well.

“In 2022, government bond funds accounted for 38% of bond ETF flows with only 18% of the market share,” said Jackson. “Ultrashort bond funds have taken over the mantle in 2023, but these categories still sit near the top of the heap.”

In contrast, riskier bond categories continued to endure outflows and high-yield bond funds had first-quarter outflows of more than $9bn, the most of all categories.

Growth

Shawn McNinch, global head of ETFs at BBH, said in the report that the data shows that investors continue to embrace ETFs as a vehicle of choice, with emerging categories such as active and fixed income continuing to gain ground.

“It also demonstrates that the way investors utilize ETFs is evolving, and asset managers and service providers must constantly adapt to meet these changing demands,” McNinch added.

The findings of our 2023 Global ETF Investor survey are out. Explore the report to learn about the shifts ETF investors are making in the face of macro and market changes, and what the last decade in ETFs can tell us about the next ten years. https://t.co/KeTeAUfz8G#ETFs pic.twitter.com/ueDlwvynNQ

— Brown Brothers Harriman (@bbh) April 3, 2023

BBH continued that ETFs are a $9.23 trillion market in total and had the second highest global inflows on record of $856bn in 2022.

“Our 2023 survey shows that 41% of U.S. investors, 25% of investors in Europe, and 38% of investors in Greater China have more than a quarter of their assets under management invested in ETFs,” added BBH.

Nearly all, 89%, of investors are planning to increase or maintain their ETF allocations in the next 12 months. As a result, the custodian and administrator projected that the ETF market could grow to more than $30 trillion by 2033.

“In 2022 alone, 66% of investors moved capital from mutual funds into ETFs,” added BBH. “We believe the next 10 years will see a significant focus on actively managed strategies to complement existing investor interest in low cost index products.”