Banks in the eurozone will see liquidity and funding tighten in the coming quarters due to the repayment of ultra-cheap funds to the European Central Bank, the European Banking Authority (EBA) said.

The squeeze comes amid heightened vigilance toward banks’ stability in the wake of the collapse of Silicon Valley Bank (SVB) and UBS Group AG’s emergency takeover of Credit Suisse Group AG.

Eurozone banks are in the process of repaying about €2.2 trillion of ultra-cheap funding the ECB provided through its third targeted longer-term refinancing operation (TLTRO III). Banks received most of the funds to help support eurozone economies during the COVID-19 pandemic. The ECB changed the terms of the funding in October to hasten repayment as it struggles to rein in inflation.

“Going forward, a downward trend in liquidity and funding ratios is expected due to upcoming repayments of ECB’s targeted longer-term refinancing operations,” the EBA said in its Q4 2022 Risk Dashboard report.

Refinancing cost

European banks’ total assets declined about 7% in the fourth quarter, driven by a 16% fall in cash balances likely linked to TLTRO repayments, the EBA said. The figures are based on a sample of 162 banks that covers more than 80% of banking assets in the European Economic Area, which includes the 27 countries of the European Union plus Iceland, Liechtenstein and Norway.

The repayment of TLTRO III funds will require the banks to refinance some, if not all, of the volume of funding they will lose, the regulator said. This will probably drive funding costs higher for banks, independent from the funding instrument they may use, whether wholesale funding or deposits, it said.

Certain jurisdictions could see stronger competition for funding, particularly deposits, leading to an increase in the interest paid for deposits, known as the deposit beta.

“This will presumably add to a rise in funding costs driven by recently materializing market uncertainty amid the SVB and [Credit Suisse] related events,” it said.

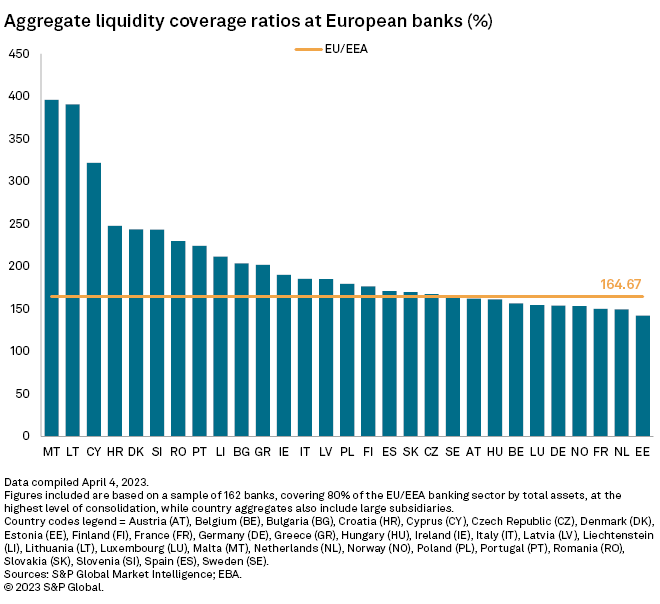

Banks in the EEA entered the recent period of market turbulence with resilient liquidity and funding positions, the EBA said. The weighted average liquidity coverage ratio of the 162 European banks included in the EBA’s sample increased to 164.7% in the last quarter of 2022, from 162.4% in the previous three-month period.

Rising deposits

The banks’ weighted average loan-to-deposit ratio also improved during the period, falling to 108.1% in the fourth quarter of 2022 from 109.2% in the previous quarter, EBA data shows. The improvement was “mainly driven by rising client deposits,” the report said.

The result was the lowest in the eight-year period covered by the report, which goes back to the fourth quarter of 2014 when the banks’ weighted average loan-to-deposit ratio was 124.7%.

Still, some deterioration in the banks’ funding profile was evident as the average net stable funding ratio fell to 125.8% in the fourth quarter from 126.9% a quarter earlier, EBA data shows. Banks’ scheduled repayment of TLTRO III funding in the coming year — only capital and liabilities that will remain with a bank for more than one year can be included in the net stable funding ratio calculation — is likely to have impacted the result, the EBA said.

The repayment of TLTRO III funds may have also reduced the banks’ average asset encumbrance ratio, said the EBA. Encumbered assets are those pledged as collateral which are not available to meet the claims of unsecured creditors in the event of a default. Central bank funding is among those secured funding instruments that give rise to encumbered assets.

The banks’ average asset encumbrance ratio “decreased significantly” to 25.8% in the fourth quarter from 28% in the previous three-month period, its lowest level since 2016, the EBA said.