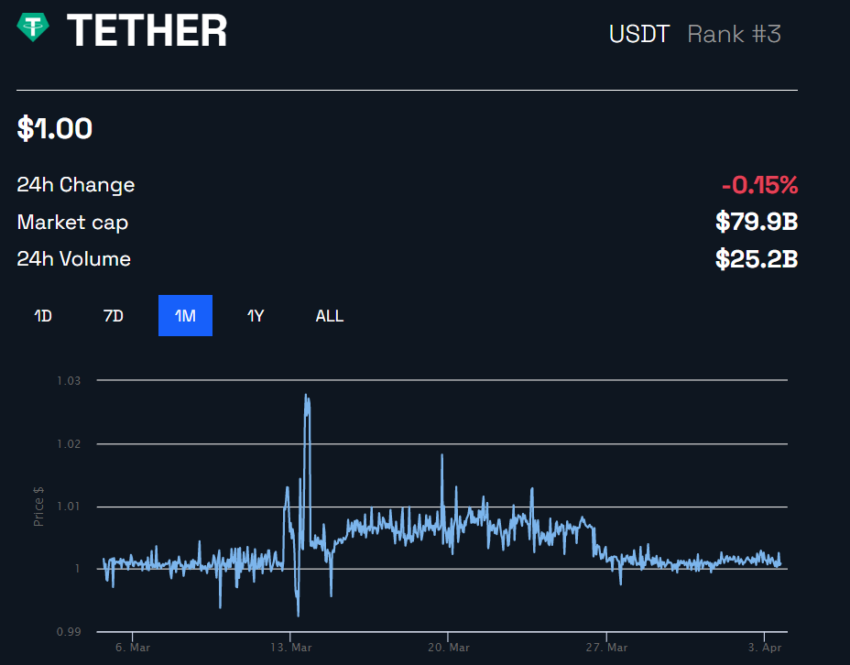

Tether, the company behind the most-traded cryptocurrency on the market today, produced $9,700,000,000 worth of stablecoin in March. This figure surpasses even the $400 billion issued by the US Federal Reserve during the same month.

The output of Tether’s stablecoin is a sign of surging investor demand amid the crisis enveloping Silicon Valley Bank (SVB), Silvergate, Signature Bank, and First Republic Bank. Not to mention the fall of Swiss-based Credit Suisse and its bailout by rival UBS.

These developments have shaken confidence in banks while driving the Federal Reserve to pump out $400 billion of liquidity in two weeks.

This perfect storm has proven to be a boon for stablecoin and other digital currencies. The stablecoin issued by Hong Kong-based Tether has met increasing demand in the face of attacks in the legacy media.

Targeting Tether

Among the harshest critics is the Wall Street Journal, which has linked the company to shady businesses and to terrorism.

In recent months, the Wall Street Journal has published numerous stories questioning the legitimacy of Tether.

On March 3, the Journal published an exposé about companies dealing in Tether and sister exchange Bitfinex. It detailed their efforts to stay connected to the global banking system. Backers of Tether, the article claimed, were resorting to fraud. Allegedly they falsified documents and used shell companies in the face of a Justice Department investigation. The Manhattan US District Attorney’s office is spearheading the investigation.

“The companies often hid their identities behind other businesses or individuals,” the Journal’s report stated. “Using third parties occasionally caused problems, including hundreds of millions of dollars of seized assets and connections to a designated terrorist organization.”

Tether has hit back hard against these allegations and those in other recent stories. It states on its website that the Journal has been selective about what firms to investigate.

“Tether continues to be the target of outdated, inaccurate, and misleading coverage and allegations from the Wall Street Journal,” Tether states. “As the high-profile failures of FTX, Celsius, and Genesis among others revealed, they have rarely focused on the right targets.”

“Biased coverage from legacy media outlets like the WSJ will not stop Tether from continuing to build a global financial infrastructure.”

Tether did not respond by press time to a request for comment.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.