(Bloomberg) — Equity strategists who had urged caution on European stocks even amid January’s roaring rally are being vindicated, as more of their peers accept the market probably won’t see much more upside this year.

This advertisement has not loaded yet, but your article continues below.

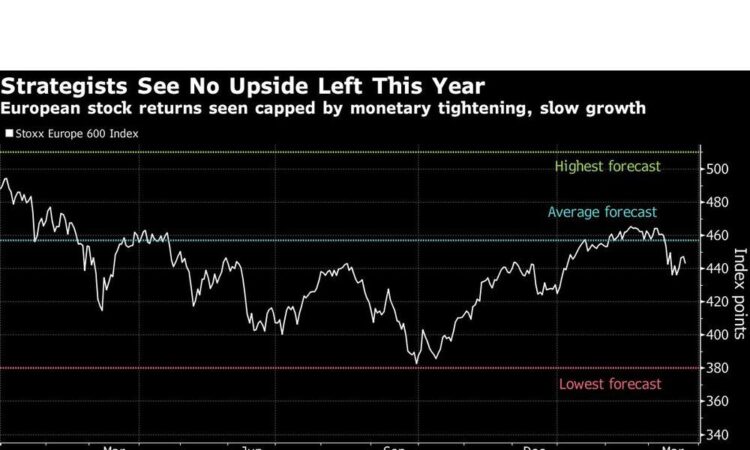

After a 4% year-to-date gain, the Stoxx Europe 600 index will rise to 457 points by end-2023, according to the average of 17 forecasts in a Bloomberg survey, implying a gain of only about 2% from Wednesday’s close. While most strategists are wary of making wholesale changes to predictions after a few volatile weeks, some formerly bullish participants are becoming more circumspect.

That’s the case at Citigroup Inc. where Beata Manthey has sharply cut her targets for the Stoxx 600. She expects the benchmark to end the year at 445 points — around its current level — down from a 475-point forecast issued just last month. “Downside risks to growth and a volatile market environment” are reasons for the cut, Manthey said in a note?

This advertisement has not loaded yet, but your article continues below.

Company earnings will likely contract 5% to 10% this year, with earnings-per-share staying flat even in 2024, Manthey said, adding that “volatility in the global banking sector should shift investors’ attention to recession risks and deteriorating fundamentals.”

March has renewed the risk of a serious economic downturn, a concern that had diminished earlier in the year. The collapse of several US banks and an emergency government-brokered rescue of Credit Suisse Group AG have rocked the financial industry, but central banks in the US, euro zone, the UK and Switzerland have proceeded, nonetheless, with interest-rate hikes.

“Monetary policy has been tightened by the sharpest pace in 40 years, which is resulting in a sharp deterioration of credit and monetary conditions,” said Bank of America Corp. strategist Milla Savova, who was among those who started the year with a bearish call. “We expect this to lead to recessionary growth conditions over the coming months, as the full impact of monetary tightening materializes with the customary lag.”

This advertisement has not loaded yet, but your article continues below.

Savova and her team expect the Stoxx 600 to plunge 18% by the third quarter, toward the 365-point level, as earnings downgrades gather pace. However, this will be followed by a recovery in the second part of the year, they predict, taking the benchmark back to 430 points by year-end.

The range of predictions for the benchmark index remains wide. The most optimistic forecast came from ZKB, which has a target of 510 points — an upside of nearly 14% from Wednesday’s close. TFS Derivatives has the most pessimistic view at 380 points, representing 15% downside.

Deutsche Bank AG strategists Maximilian Uleer and Carolin Raab are among the optimists, forecasting the benchmark to close the year at 495 points, a gain of nearly 11%. Uleer and Raab acknowledge short-term risks from interest rates, but expect European stocks to benefit from China’s economic recovery, given their exposure to export-reliant sectors such as travel, chemicals, miners, luxury and autos.

This advertisement has not loaded yet, but your article continues below.

The largely downbeat sell-side view is mirrored in the investment community. Of European fund managers canvassed by Bank of America for its March investor survey, 66% saw further downside for the region’s equities in the coming months because of monetary tightening, up from 53% in February. Over a one-year horizon however, 55% of respondents saw some upside, according to the survey, which was published this week.

The market also faces a positioning challenge — after six consecutive months of rising allocations, the 19% overweight on European shares is the highest since Feb. 2022, just before the Ukraine war. Consequently, global investors now see European equities as the most crowded trade, the BofA survey showed.

This advertisement has not loaded yet, but your article continues below.

Valuations are still in Europe’s favor. Trading at about 12.7 times forward earnings, the Stoxx 600 is almost a third cheaper than the S&P 500 Index. But for most strategists, that’s not sufficient to justify a rally.

“While at first glance European equities may seem attractive, this ‘cheapness’ is very much concentrated in three sectors – banks, energy, autos – which are trading close to their historical lows,” said Societe Generale SA strategist Roland Kaloyan. Excluding these sectors, the benchmark’s valuation is actually above its 20-year average, according to Kaloyan, who sees “limited upside” into year-end.

—With assistance from Sagarika Jaisinghani, Jan-Patrick Barnert and Tommaso Isak Rognoni.