Al Messerschmidt

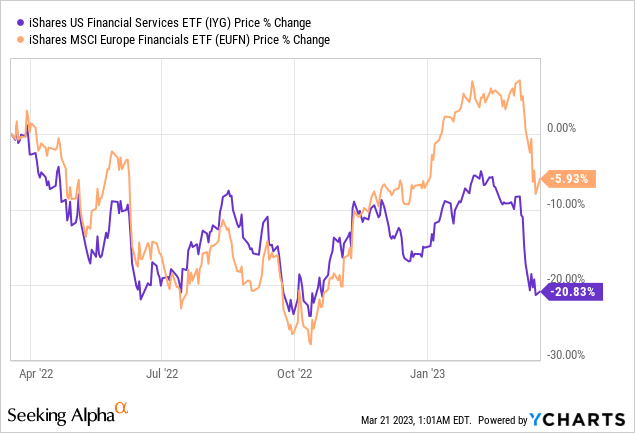

The iShares U.S. Financial Services ETF (NYSEARCA:IYG) currently trading around $150 has underperformed the iShares MSCI Europe Financials Sector Index ETF (NASDAQ:EUFN) by about 15% in the last year. This period has been characterized by a rapid pace in tightening of monetary policy, both by the Federal Reserve and ECB (European Central Bank), and more recently a number of banking hardships both in the U.S. and Europe.

Looking solely at the historical performance, one would think that European financial institutions are doing better but this thesis will show that in light of the current turmoil, one should rather choose their American counterparts.

For this purpose, in addition to touching upon specific banking metrics related to assets and liabilities, this publication will go through the events which happened during the last two weeks to highlight both depositors’ and investors’ behavior.

Herd Mentality and IYG’s Holdings

First, whatever we may say about the quality of assets & compare metrics like the liquidity or liabilities ratios of different banks, it is the particular stress context that is created that count.

Hence, learning from Silicon Valley Bank Financial (SIVB), and psychology, something which comes into play here is behavioral science, or how human beings behave when confronted with a particular situation, in this case for deposits above $250K which were initially not covered by Federal Deposit Insurance Corp (FDIC). Thus, when seeing people withdraw their money from the smaller regional banks, others did the same, resulting in herd mentality and a bank run, somewhat analogous to a large group of bison running wildly after a cowboy fired a shot.

This in turn triggered a liquidity problem, which, in theory, can adversely impact any bank especially if all depositors remove their money all at once. In this case, few banks could have survived the extent of withdrawals SVB experienced, to the extent of requiring outside intervention.

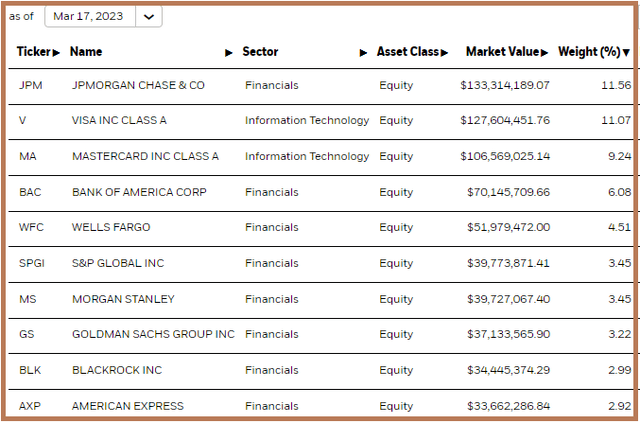

Now, even if there is no en masse withdrawal as was the case with the big banks which on the contrary saw more deposits, it is investors’ confidence that gets shaken as they fear a contagion effect from one bank to the next. As such, Bank of America (BAC) was exposed to fixed-rated securities at 28% of total assets compared to 56% for SVB. These, in contrast to floating rate loans, see their value go down with rising interest rates. As a result, BAC, just like other top banks forming part of IYG and which are normally considered “too big to fail” was also impacted last week with the ETF’s shares being down by around 3% at one time. These are JPMorgan Chase (JPM), Wells Fargo (WFC), Morgan Stanley (MS), Citigroup (C), Goldman Sachs (GS), Bank of New York Mellon (BK), and State Street Corp (STT), which combined make up for 33% of IYG’s assets.

Top Holdings – IYG (www.ishares.com)

On the other hand, as per my calculation, First Republic Bank (FRC), SVB, and Signature Bank (SBNY) together only constitute 0.33% of the ETF’s assets. This is a tiny fraction when compared with the big banks, but illustrates how contagion risks can rapidly impact the value of a fund, even if skewed toward big names with better asset-to-liability ratios. In this case, their loans held-to-maturity as a percentage of deposits was much better than Signature or SVB.

Ultimately, for the banking sector to recover, it came to bailing out of the bank by ensuring the protection of all depositors together with a joint announcement made by the Fed, U.S. Treasury, and FDIC.

Even these extraordinary actions could not eradicate bearish investor sentiment due to troubles in Europe.

Europe and EUFN’s Holdings

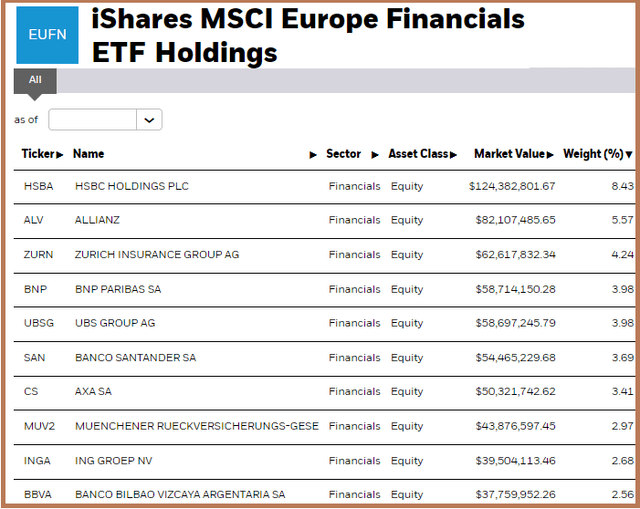

Here, enter Credit Suisse, which forms about 0.47% of EUFN assets and which, with the blessing of the Swiss regulators has been acquired by UBS Group (UBS) with a 4% weight as pictured below.

EUFN’s Top Holdings (www.ishares.com)

Now, Credit Suisse was not particularly well managed as evidenced by the decline of 70% of its share price, compared to less than 6% by EUFN during the last year. However, despite the current management being amid a restructuring process, and injection of liquidity by the Swiss National bank, the markets were far from calm last week as the events in Europe were in turn impacted by those in the U.S., with SVB being the spark that ignited the whole thing.

As such, after its largest shareholder, Saudi National Bank refused to add to the capital, extraordinary action was required, and Swiss regulators in agreement with counterparts in the U.K. and the U.S. had to engineer a buyout from the largest lender UBS Group AG. These arrangements seem to have calmed Europe’s investors as on Monday the STOXX Europe 600 Banks Index EUR managed to gain 1.27% while EUFN for its part gained 2.19%.

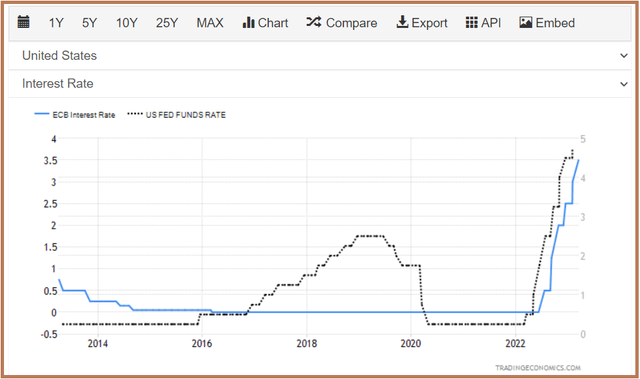

Coming back to the price action, despite recent outperformance as seen in the introductory chart, EUFN’s European banks have underperformed IYG during the last five years. This should continue due to the massive change in the interest rates the Eurozone has seen relative to the U.S. as shown in the blue chart below.

Interest Rates Evolution – E.U. and U.S. (tradingeconomics.com)

Noteworthily, while the U.S. has known a cycle of Fed fund rate raises between 2016 and 2020, the Eurozone knew zero interest rates for a more prolonged period, namely from 2016 to 2021. Now, with interest rates at more than 4%, “duration risk” can even be more pronounced than in America. Here duration risk refers to holding long-term government bonds whose value has gone down as a percentage of banks’ total assets, which are the result of rising yields.

Duration Risk, the 2008 GFC and Depositors Protection

Now, with Credit Suisse being most probably the weakest link due to its troubled history, there could be contagion risk as any bank can come across a liquidity problem as they tend to lend for the long term while depositors can exit any time.

Here, the Lehman Brothers subprime mortgage crisis of 2008 comes to mind when depositors coordinated to remove their money at the same time, leading to severe stress in the banking system. Sure, things were different then as there were complex “securitized products” whereas now there is more transparency with bank regulations having made a lot of progress providing for better capital, liquidity ratios, and stress tests. While these regulations are not perfect, they are much better than what was in force during the GFC (Great Financial Crisis).

Now, when considering duration risks, it is difficult to know with certainty how many unrealized losses E.U. and U.S. banks are carrying on their books, but, the stunning moves by the American authorities as I mentioned earlier were both designed to avert more bank runs as well as support companies that deposited large sums with the banks for normal business operations.

Looking at the old continent, the ECB increased interest rates by 50 basis points on March 16 showing that it continues to prioritize the fight against inflation. At the same time, its President said that in addition to price stability (or fighting inflation), financial stability also remained a priority with the institution having different tools to address these. Thus, while continuing to be impacted by higher rates, European banks are assured that the ECB is also taking measures to ensure appropriate levels of liquidity.

Still, judging by the unprecedented move whereby the authorities orchestrated the additional liquidity support of $30 billion to the FRC through big banks, the U.S. appears to be innovating with more market-driven rescue methods. This comes on top of the $109 billion and $10 billion borrowed from the Fed and Federal Home Loan Bank. This said, the lender’s shares plummeted following a downgrade by the S&P ratings agency, but have rebounded since following a JPM-led move to stabilize FRC, illustrating investors’ confidence toward the rescue plan.

Also, compared to depositors being covered for only 100K euros in the EU, the U.S. deposit insurance scheme is significantly higher with $250K, plus the authorities have already shown the ability to move swiftly to fully guarantee full deposits in the event of bank insolvencies.

Conclusion

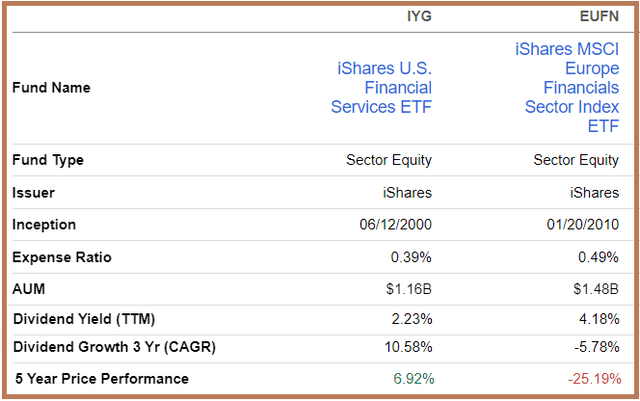

Therefore, the U.S. banking sector appears better shaped to withstand contagion risks, and, IYG is one of the investment vehicles available. I chose it instead of the iShares U.S. Financials ETF (IYF) as it also includes companies providing financial services, like Visa (V) and Mastercard (MA), which are relatively more immune to volatility at the current juncture. Also, when compared to EUFN, IYG actually pays fewer dividend yields, but, one has to take into account that these have grown faster, or at a CAGR of 10.58% during the last three years as shown below.

Comparison EUFN and IYG (seekingalpha.com)

As for valuations, after having suffered from a downside of 14.81% during the last month alone, IYG could deliver gains of 10% to $165 (150×1.1) as some of the more market-driven risk containment mechanisms materialize. However, it is better to wait for the FOMC meeting as, after the first signs of cracks start to appear on the liquidity front, the rates decision will be closely watched by market participants and banks’ shares could be particularly volatile.

As for EUFN, I have a hold rating as it is better to wait for any sign of deterioration in liquidity conditions in Europe after the recent hike and how the ECB responds.

Finally, the volatility of the past week has shown that duration risk for banks is something real, and that, despite bearing favorable asset metrics, it is investors’ perception of financial conditions that ultimately plays a large role in how the market behaves.