By Keith Griffith For Dailymail.com and Reuters

23:09 21 Mar 2023, updated 23:09 21 Mar 2023

- SVB Financial demanded the return of funds from seized unit Silicon Valley Bank

- FDIC says it froze the deposits as it investigates potential claims against SVB

- Meanwhile, US government is reportedly eying backing for First Republic Bank

The bankrupt parent company of failed Silicon Valley Bank is seeking access to frozen funds from regulators who seized the bank unit and removed $2 billion of its cash.

SVB Financial Group, which filed for bankruptcy on Friday, in court filings accused the FDIC of ‘improper actions’ to cut off access to cash deposited at its former banking unit, which was seized by regulators to stem a national bank run.

Though the FDIC guaranteed the uninsured deposits at Silicon Valley Bank, including the cash deposits of the parent firm, regulators said they had frozen SVB Financial’s accounts as part of an ongoing investigation into potential claims against the parent company.

Meanwhile, Wall Street CEOs and US officials are discussing the possibility of government backing to encourage potential buyers for battered First Republic Bank, according to Bloomberg News.

The government could play a role in taking on First Republic’s most troubled assets, as well as offering liability protection or easing limits on ownership stakes for a potential buyer, the report said, citing people with knowledge of the situation.

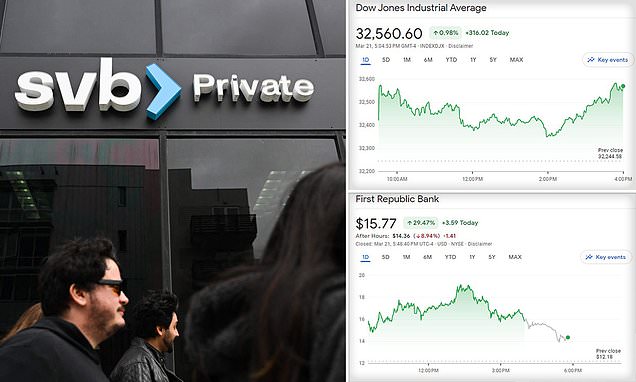

Shares of First Republic Bank sank as much as 18 percent in extended trading, after surging 29 percent at the closing bell and leading regional bank stocks higher.

In Tuesday’s session, Wall Street extended its rally on Tuesday as fears of a wider banking crisis eased and investors turned their attention to the Federal Reserve’s next move.

The Dow Jones Industrial Average rose 316 points, or 1 percent, at the closing bell, after Treasury Secretary Janet Yellen said the government could offer the banking industry more assistance if needed.

Markets around the world have pinballed this month on worries the banking system may be cracking under the pressure of the fastest set of hikes to interest rates in decades.

Global markets now turn their attention to Federal Reserve policymakers, who will announce on Wednesday whether they plan to continue raising interest rates to fight inflation, or pause rate hikes to calm chaos in the banking sector.

On Tuesday evening, financial markets were pricing in a nearly 90 percent probability that the Fed will forge ahead with a 25-basis-point rate increase.

The banking crisis started with the collapse this month of two US lenders, Silicon Valley Bank and Signature Bank, which sank under the weight of bond-related losses due to a surge in interest rates last year.

The turmoil culminated in the $3.2 billion Swiss government-engineered takeover of Credit Suisse by rival UBS over the weekend, heading off fears that the global banking giant could fail.

‘The banking sector’s near-death experience over the last two weeks is likely to make Fed officials more measured in their stance on the pace of hikes,’ said Standard Chartered head of G10 FX research, Steve Englander.

The fallout from Silicon Valley Bank’s collapse continued to play out this week in bankruptcy court this week, where former parent SVB Financial sought access to the frozen deposits.

SVB Financial’s attorney told US Bankruptcy Judge Martin Glenn at a hearing in Manhattan on Tuesday that the financial company lost access to its deposits the day before it filed for Chapter 11 protection.

‘Not only has the bank been taken, all the cash has been taken,’ said James Bromley, an attorney for SVB Financial. Bromley told Glenn that without access to cash, SVB Financial was unable to pay healthcare costs for employees.

Bromley said he is hoping to create a working group with regulators to sort out which employees work for the parent and which work for the seized bank, among other complications.

California banking regulators on March 10 closed Silicon Valley Bank in the largest US bank failure since the 2008 financial crisis.

The company said in court filings that the FDIC receiver had blocked a $250 million wire transfer, removed $19 million from an SVB Financial bank account, and attempted to claw back payments to SVB Financial’s bankruptcy attorneys and financial advisers, among other ‘improper actions.’

The company has asked the judge to allow it to move funds held at Silicon Valley Bank to a different bank.

But the FDIC said in court filings on Tuesday that it had placed a hold on all of SVB Financial’s bank accounts, as part of its investigation of potential claims against the bank’s former parent.

That action was a legal and necessary part of stabilizing banking operations during the transfer to new management, according to the court filings.

SVB Financial and two top executives were sued last week by shareholders who accused them of concealing how rising interest rates would leave the Silicon Valley Bank unit ‘particularly susceptible’ to a bank run.

SVB Financial has $3.4 billion in debt and it manages about $9.5 billion of other investors’ money across its portfolio of venture capital and credit funds, according to court filings.

Silicon Valley Bank was SVB Financial’s largest asset, accounting for more than $15.5 billion of SVB Financial’s $19.7 billion in total assets.

In the latest effort to calm jitters, Secretary Yellen said the country’s banking system was sound despite recent pressure.

Yellen said she was committed to taking actions that would mitigate risks to financial stability and taking necessary steps to ensure the safety of deposits and the U.S. banking system.

Political pressure continued to grow in the United States to hold bank executives accountable. The Senate Banking Committee’s chairman said the panel will hold the “first of several hearings” on the collapse of SVB and Signature Bank on March 28.