winhorse

Investment Thesis

On Friday, March 10, SVB Financial Group (NASDAQ:SIVB) became the largest bank to fail since the financial crisis back in 2008. At the end of 2022, the bank still had $209B in Total Assets and was the 16th largest bank in the U.S. This resulted in banking turmoil with several regional U.S. banks decreasing on Monday 13 while recovering again strongly, on Tuesday 14.

In this article, I will not go into detail about what caused the bank to fail. Instead, I will take a closer look at the five largest U.S. banks (in terms of Total Assets) in order to identify which is currently my top pick among them.

JPMorgan (NYSE:JPM) (Total Assets of $3.20T), Bank of America (NYSE:BAC) ($2.42T), Citigroup (NYSE:C) ($1.77T), Wells Fargo (NYSE:WFC) ($1.72T) and U.S. Bancorp (NYSE:USB) ($585B) are among the 5 largest U.S. banks in terms of Total Assets and are the banks I will focus on in today’s article.

I consider JPMorgan to be the most attractive pick among these five banks. There are several indicators that confirm my investment thesis that JPMorgan is currently the top pick: the leading U.S. bank (not only in terms of Total Assets, but also in terms of Market Capitalization and Revenue) has the highest Net Income Margin (30.80%) when compared to its competitors as well as the highest Return on Equity (12.85%), indicating that it is the top pick when it comes to Profitability.

Furthermore, JPMorgan has the highest Revenue Growth 5 Year [CAGR] (5.24%). This serves as evidence that it is the best fit among its peers when it comes to Growth.

In addition to that, I consider the risk factors that come attached to an investment in JPMorgan to be lower than the one of any of the selected competitors.

JPMorgan’s management continuity, its focus on creating a long-term shareholder value, as well as its high Brand Value and broad product diversification, all contribute to making JPMorgan my top 5 pick among the 5 banks.

The Bank’s Competitive Advantages

The management team around JPMorgan CEO Jamie Dimon contributes to the company being my top choice among bank stocks. The fact that Jamie Dimon has been CEO of JPMorgan since December 2005 is an expression of its enormous continuity. The management team focuses on long-term shareholder value rather than short-term gains, which also contributes to my preference for JPMorgan.

I consider JPMorgan to have strong competitive advantages over its competitors, particularly over smaller and regional banks. Among the company’s competitive advantages is its strong brand image: according to the Most Valuable Global Brands Report from Kantar Brandz, JPMorgan is ranked 59th (with an estimated Brand Value of $37,412M). Among its competitors from the Banking Industry, only Wells Fargo, Bank of America and Morgan Stanley make it into the top 100. In 2022, JPMorgan’s Brand Value is up 55% when compared to the previous year.

JPMorgan’s high Brand Value helps to build an economic moat over its competitors. This economic moat is particularly important in these times of high uncertainty in the Banking Industry. In addition to that, I consider JPMorgan’s broad product diversification and its large economies of scale (for example: lower per-unit costs and bargaining power) to be strong competitive advantages that the bank has over smaller competitors. Among the 5 banks, I consider JPMorgan to have the widest economic moat due to its strong competitive advantages.

The Valuation of the 5 Largest U.S. Banks

If we look at the bank’s P/E GAAP [FWD] Ratio, we find out that JPMorgan has the highest Valuation (P/E [FWD] Ratio of 10.12) when compared to Bank of America (8.85), U.S. Bancorp (8.73), Citigroup (8.61) and Wells Fargo (8.64).

Citigroup has the lowest Valuation not only when considering the bank’s P/E [FWD] Ratio, but also when taking into consideration its Price to Book [TTM] Ratio: while Citigroup has a Price to Book [TTM] Ratio of 0.52, Wells Fargo’s is 0.98, Bank of America’s is 1.00, JPMorgan’s is 1.44 and U.S. Bancorp’s is 1.47.

Both the P/E [FWD] Ratio and the Price to Book [TTM] Ratio confirm that Citigroup is the pick with the lowest Valuation. However, from my point of view, this low Valuation is not enough to select it as the most attractive pick among these five banks.

The Fundamentals of the 5 Largest U.S. Banks

When comparing the Fundamental Data of the five largest U.S. banks, we discover that JPMorgan is the largest in terms of Market Capitalization ($383.64B) and Revenue ($122.31B). In second place is Bank of America, with a Market Capitalization of $244.44B and a Revenue of $92.41B. Third is Wells Fargo ($156.04B and $72.25B respectively) in front of Citigroup ($94.46B and $70.56B) and U.S. Bancorp ($64.79B and $22.14B).

JPMorgan also has the highest Revenue Growth Rate [CAGR] over the past 5 years: its Revenue Growth Rate of 5.24% is above the one of U.S. Bancorp (Revenue Growth Rate of 2.18% over the past 5 years), Bank of America (1.99%), Citigroup (1.57%) and Wells Fargo (-3.42%).

In terms of Profitability, JPMorgan is also ahead of its competitors. The company has the highest Net Income Margin (30.80%) when compared to Bank of America (29.79%), U.S. Bancorp (26.31%), Citigroup (21.04%) and Wells Fargo (18.25%).

The same is confirmed when taking into account the company’s Return on Equity. JPMorgan’s Return on Equity stands above U.S. Bancorp (Return on Equity of 10.95%), Bank of America (10.13%), Citigroup (7.50%) and Wells Fargo (6.93%).

Analyzing the Fundamental Data of these 5 banks, raises my confidence to select JPMorgan as the most attractive pick among the 5 largest U.S. banks. The bank seems to be the most appealing choice for investors, particularly when it comes to both Profitability and Growth.

The Bank’s Dividend and Dividend Growth

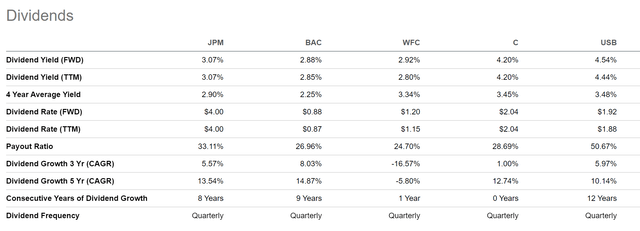

When looking at the Dividend Yield [FWD] that the five largest banks of the U.S. pay, it can be highlighted that U.S. Bancorp currently pays the highest Dividend Yield [FWD] to investors: while U.S. Bancorp pays a Dividend Yield [FWD] of 4.54%, Citigroup pays 4.20%, JPMorgan 3.07%, Bank of America 2.85%, and Wells Fargo 2.80%.

From looking at the Dividend Growth Rate [CAGR] over the past 5 years, we find out that Bank of America (Dividend Growth Rate [CAGR] of 14.87% over the past 5 years) is in front of JPMorgan (13.54%), Citigroup (12.74%) and U.S. Bancorp (10.14%). With a Dividend Growth Rate [CAGR] of -5.80%, Wells Fargo is far behind its peer group and is the only one out of these picks that has shown a negative Dividend Growth Rate during this time period.

If we take a closer look at the Payout Ratios of the banks, it can be highlighted that U.S. Bancorp has the highest Payout Ratio when compared to its peer group: Citigroup’s is 28.69%, Bank of America is 26.96% and Wells Fargo is at 24.70%

In my opinion, JPMorgan is an excellent pick for investors due to its combination of a relatively high Dividend Yield [FWD] (3.07%), a relatively low Payout Ratio (33.11%) and a relatively high Dividend Growth Rate 5 Year [CAGR] (13.54%). All of this combined, strengthens my thesis that JPMorgan is a great choice for those seeking Dividend Income and Dividend Growth.

The Seeking Alpha Dividend Grades

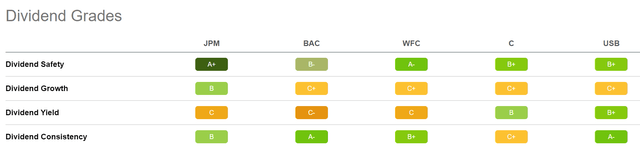

In the following, we will take a look at the Seeking Alpha Dividend Grades.

In terms of Dividend Safety, JPMorgan seems to be the most attractive pick among the 5 picks: the bank receives an A+ rating, while Wells Fargo receives an A- rating and both Citigroup and U.S. Bancorp receive a B+. Bank of America gets a B- in terms of Dividend Safety.

When it comes to Dividend Growth, JPMorgan is also the top pick out of the 5: the largest U.S. bank in terms of Total Assets, Market Capitalization and Revenue receives a B rating, while Bank of America, Wells Fargo, Citigroup, and U.S. Bancorp each get a C+.

When it comes to Dividend Yield, U.S. Bancorp and Citigroup receive the highest rating: U.S. Bancorp receives a B+ while Citigroup gets a B.

When it comes to Dividend Consistency, Bank of America and U.S. Bancorp achieve the best rating among the five picks: both receive an A-.

The Seeking Alpha Dividend Grades confirm my theory that JPMorgan seems to be the most attractive pick among the five banks. This is in particular for dividend income and dividend growth investors, since the bank receives the best rating among the five banks when it comes to Dividend Safety and Dividend Growth.

Risks

In my opinion, JPMorgan is also the best pick among these five banks when searching for a low risk investment from the U.S. Banking Industry.

JPMorgan’s A1 credit rating by Moody’s is a strong indicator of the relatively low risk level that comes with an investment in the bank. Bank of America has a A2 credit rating by the same rating agency. Wells Fargo has an A1 rating, Citigroup an A3 rating and U.S. Bancorp’s is A2.

Furthermore, JPMorgan has the highest Cash Position when compared to its peers: while JPMorgan has a Total Cash Position of $1.31T, the one of Citigroup (Total Cash Position of $1.02T), Bank of America ($725.81B), Wells Fargo ($361.90B) and U.S. Bancorp ($55.94B) is significantly lower. Indicating, once again, that an investment in JPMorgan comes with a lower risk than investing in its competitors.

JPMorgan also has the highest Operating Income when compared to these competitors: while JPMorgan’s Operating Income is $46.43B, Bank of America’s is 30.97B, Citigroup’s is $18.81B, Wells Fargo’s is $14.97B and U.S. Bancorp’s is $7.85B.

Particularly in these times of relatively high uncertainty and high volatility in the Banking Sector, such as right now, I would opt for the one that provides investors with the lowest risks.

Even though I consider the risks of a JPMorgan investment to be significantly lower than when investing in small and regional U.S. banks, larger banks like JPMorgan, Bank of America or Citigroup may still experience major price fluctuations in the coming days and weeks.

Due to the consequences for the Banking Industry still being difficult to predict, in combination with the industry’s high volatility of stocks (with stocks such as First Republic Bank (NYSE:FRC) decreasing 60% on Monday and then increasing strongly on Tuesday), I suggest only investing with a long investment horizon when thinking about whether or not to invest in JPMorgan. In addition to that, I strongly recommend not to speculate on short-term gains.

The Bottom Line

In this analysis, I have shown that I currently consider JPMorgan to be my top pick among the largest U.S. banks: it is the leading U.S. bank in terms of Total Assets, Market Capitalization and Revenue, it pays shareholders an attractive Dividend Yield [FWD] of 3.07% and has shown a Dividend Growth Rate [CAGR] of 13.54% over the past 5 years while having a relatively low Payout Ratio of 33.11%. All of this combined indicates that JPMorgan is an excellent pick for investors seeking Dividend Income as well as for those seeking Dividend Growth.

With a Net Income Margin of 30.80% and a Return on Equity of 12.85% it is the most attractive fit among its peers when it comes to Profitability. JPMorgan is also ahead of its competitors when it comes to Growth: proof of this is its Revenue Growth 5 Year [CAGR] of 5.24%, which is significantly higher than the one of U.S. Bancorp (2.18%), Bank of America (1.99%), Citigroup (1.57%) and Wells Fargo (-3.42%).

Furthermore, I consider the risk of investing in JPMorgan to be lower when compared to investing in its competitors. This is evidenced by JPMorgan’s A1 credit rating by Moody’s, its higher Total Cash Position ($1.31T), and its higher Operating Income ($46.43B) in comparison to its peers.

Author’s Note: It would be great to hear your opinion on this analysis and to know which is your top pick among the largest banking stocks? Do you own any of the picks mentioned in this article?