(Bloomberg) — Volatility gripped financial markets as fresh turmoil at Credit Suisse Group AG days after the collapse of some American regional banks spurred a frantic rush for cover, evoking memories of the 2008 global financial crisis and bolstering speculation that major central banks will have to curb their hawkishness to prevent a harsher economic landing.

Most Read from Bloomberg

Equities pared a selloff that at one point topped 2% for the S&P 500 after Bloomberg News reported that Swiss authorities and Credit Suisse are discussing ways to stabilize the firm, following comments by its biggest shareholder that sent the stock tumbling. A gauge of US financial heavyweights like JPMorgan Chase & Co. and Citigroup Inc. also came off session lows, but was still on track for its lowest since November 2020.

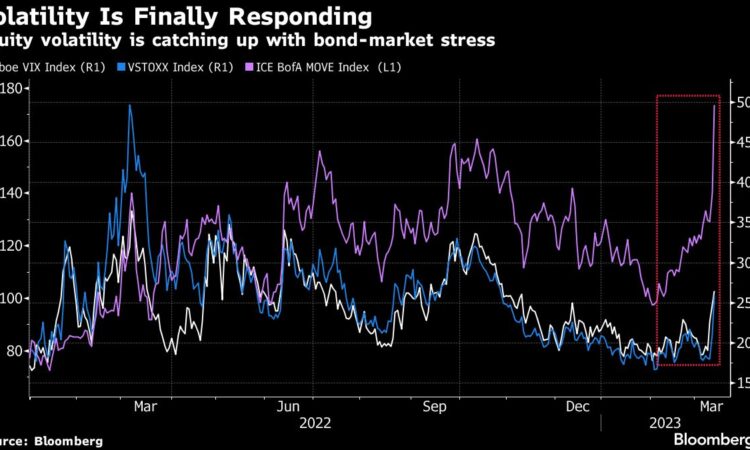

Wall Street’s so-called fear gauge soared to a more than four-month high on Wednesday amid strong trading volume. As investors dashed to the safest corners of the market, gold reversed an earlier slide and the dollar rallied against all of its developed-market peers except the Japanese yen.

Bond yields plunged globally as mounting financial-stability concerns prompted traders to abandon bets on additional rate hikes and begin pricing in cuts by the Federal Reserve. They priced in a drop of more than 100 basis points in the US policy rate by year-end and downgraded the odds of additional tightening by the Bank of England and the European Central Bank.

Banks that trade with Credit Suisse rushed to safeguard their exposure with the lender on Wednesday, snapping up contracts that will compensate them if the crisis rocking the Zurich-based firm deepens. So intense was the demand for the derivatives, known as credit-default swaps, that they spiked to levels that signal the lender is in deep financial distress — something unseen at a major global bank since at least the throes of the financial crisis.

Read: US Treasury Reviewing US Banks’ Exposure to Credit Suisse

The renewed bout of banking turbulence spurred some worrisome remarks from prominent Wall Street voices.

As Credit Suisse nosedived, economist Nouriel Roubini — who’s known as “Dr. Doom” — said the troubled lender might be “too big to be saved.” BlackRock Inc.’s Larry Fink noted that the banking crisis could worsen, worrying aloud about cracks in the financial system that formed during more than a decade of easy money and low interest rates. Bridgewater Associates’ Ray Dalio expects problems to start mounting in the fallout from contractions in debt and credit markets, saying the recent failure of Silicon Valley Bank was just a “canary in the coal mine.”

“Are the dominoes starting to fall?” Fink, chairman of the world’s largest asset manager, said in a letter on Wednesday. “It’s too early to know how widespread the damage is.”

With the banking turmoil rippling through financial markets, Bob Michele, the chief investment officer of JPMorgan Asset Management, warned of an economic hard landing.

He now expects the Fed to pause rate hikes next week, saying that a recession is “inevitable” and that the best investment strategy right now is to stick to high quality bonds. Michele reckoned the whole Treasury yield curve will come down to as low as 3% by August, but he stopped short of predicting the end of a hiking cycle. The 10-year rate is currently near 3.4%.

Read: Recession Fears Soar as Credit Suisse Woes Threaten Loan Crunch

Now that’s not to say everyone is buying the idea of a “financial crisis 2.0” at this stage.

Lisa Shalett at Morgan Stanley’s wealth management division stopped short of buying into the latest mega-bear-case on equities — namely that the failure of three American banks would be a prelude to a crisis such as the one that laid global economies low in 2008.

She says the collapse of a few regional lenders was mostly driven by poor risk management at a time when the Fed is aggressively tightening monetary policy to slow the economy. While more banks are likely to fall, Shalett considers the threat to the broad financial industry and economy as contained.

“Remember, in the great financial crisis, there was a lot of this that was about cross-counterparty credit risk,” she told Bloomberg Television. “This is less about immediate contagion.”

Read: Pimco Warns That Not All Cash Is King as SVB Debacle Revealed

Key events this week:

-

Eurozone rate decision, Thursday

-

US housing starts, initial jobless claims, Thursday

-

Janet Yellen appears before the Senate Finance Committee, Thursday

-

US University of Michigan consumer sentiment, industrial production, Conference Board leading index, Friday

Some of the main moves in markets:

Stocks

-

The S&P 500 fell 0.9% as of 2:58 p.m. New York time

-

The Nasdaq 100 rose 0.3%

-

The Dow Jones Industrial Average fell 1.1%

-

The MSCI World index fell 1.3%

Currencies

-

The Bloomberg Dollar Spot Index rose 0.8%

-

The euro fell 1.4% to $1.0585

-

The British pound fell 0.7% to $1.2075

-

The Japanese yen rose 0.6% to 133.46 per dollar

Cryptocurrencies

-

Bitcoin fell 0.9% to $24,421.61

-

Ether fell 3.4% to $1,647.63

Bonds

-

The yield on 10-year Treasuries declined 20 basis points to 3.49%

-

Germany’s 10-year yield declined 29 basis points to 2.13%

-

Britain’s 10-year yield declined 17 basis points to 3.32%

Commodities

-

West Texas Intermediate crude fell 4.3% to $68.27 a barrel

-

Gold futures rose 0.4% to $1,919.40 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Robert Brand.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.