Quantamental Technologies LLC trimmed its holdings in shares of Murphy USA Inc. (NYSE:MUSA – Get Rating) by 60.7% in the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 2,243 shares of the specialty retailer’s stock after selling 3,465 shares during the period. Quantamental Technologies LLC’s holdings in Murphy USA were worth $617,000 as of its most recent SEC filing.

Quantamental Technologies LLC trimmed its holdings in shares of Murphy USA Inc. (NYSE:MUSA – Get Rating) by 60.7% in the third quarter, according to its most recent Form 13F filing with the SEC. The institutional investor owned 2,243 shares of the specialty retailer’s stock after selling 3,465 shares during the period. Quantamental Technologies LLC’s holdings in Murphy USA were worth $617,000 as of its most recent SEC filing.

→ YIKES! 220 Pounds of Graphite in Each EV Battery? (From Investing Trends)

Several other hedge funds have also recently added to or reduced their stakes in MUSA. Financial Management Professionals Inc. acquired a new position in shares of Murphy USA in the 3rd quarter worth $27,000. Quadrant Capital Group LLC raised its holdings in Murphy USA by 47.6% during the 2nd quarter. Quadrant Capital Group LLC now owns 121 shares of the specialty retailer’s stock worth $28,000 after buying an additional 39 shares during the period. Ronald Blue Trust Inc. purchased a new stake in Murphy USA during the second quarter valued at about $33,000. Private Trust Co. NA acquired a new position in shares of Murphy USA in the second quarter worth about $34,000. Finally, Pinebridge Investments L.P. acquired a new stake in shares of Murphy USA during the second quarter valued at approximately $43,000. Institutional investors and hedge funds own 85.30% of the company’s stock.

Murphy USA Price Performance

MUSA opened at $260.91 on Tuesday. The stock has a market cap of $5.66 billion, a price-to-earnings ratio of 9.29 and a beta of 0.81. Murphy USA Inc. has a 1 year low of $164.30 and a 1 year high of $323.00. The company has a current ratio of 0.85, a quick ratio of 0.48 and a debt-to-equity ratio of 2.80. The stock has a fifty day moving average price of $267.42 and a 200 day moving average price of $281.31.

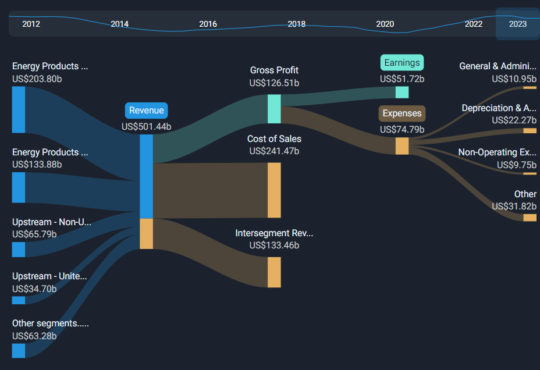

Murphy USA (NYSE:MUSA – Get Rating) last released its quarterly earnings data on Wednesday, February 1st. The specialty retailer reported $5.21 earnings per share (EPS) for the quarter, missing analysts’ consensus estimates of $6.16 by ($0.95). The firm had revenue of $5.37 billion for the quarter, compared to analyst estimates of $5.40 billion. Murphy USA had a net margin of 2.87% and a return on equity of 90.90%. Murphy USA’s revenue for the quarter was up 12.6% on a year-over-year basis. During the same period in the previous year, the business posted $4.23 EPS. Analysts forecast that Murphy USA Inc. will post 18.89 EPS for the current fiscal year.

Murphy USA Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Wednesday, March 1st. Investors of record on Tuesday, February 21st were given a dividend of $0.37 per share. This is a boost from Murphy USA’s previous quarterly dividend of $0.35. The ex-dividend date of this dividend was Friday, February 17th. This represents a $1.48 dividend on an annualized basis and a yield of 0.57%. Murphy USA’s dividend payout ratio (DPR) is presently 5.27%.

Analyst Upgrades and Downgrades

MUSA has been the topic of several research analyst reports. StockNews.com cut shares of Murphy USA from a “strong-buy” rating to a “buy” rating in a research report on Wednesday, February 8th. Wells Fargo & Company dropped their price target on Murphy USA from $350.00 to $325.00 and set an “overweight” rating on the stock in a research report on Friday, February 3rd. Royal Bank of Canada began coverage on Murphy USA in a research report on Wednesday, December 14th. They set a “sector perform” rating and a $360.00 price objective for the company. Finally, Raymond James dropped their target price on Murphy USA from $335.00 to $305.00 and set an “outperform” rating on the stock in a report on Friday, February 3rd. One research analyst has rated the stock with a sell rating, one has issued a hold rating and four have assigned a buy rating to the company. According to data from MarketBeat, the company currently has an average rating of “Moderate Buy” and a consensus price target of $314.60.

Murphy USA Company Profile

Murphy USA, Inc engages in marketing motor fuel products and convenience merchandise through retail stores, namely Murphy USA and Murphy Express. It collaborates with Walmart to offer customers discounted and free items based on purchases of qualifying fuel and merchandise. The company was founded on March 1, 2013 and is headquartered in El Dorado, AR.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat’s editorial team prior to publication. Please send any questions or comments about this story to [email protected].

Before you consider Murphy USA, you’ll want to hear this.

MarketBeat keeps track of Wall Street’s top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on… and Murphy USA wasn’t on the list.

While Murphy USA currently has a “Hold” rating among analysts, top-rated analysts believe these five stocks are better buys.