This Week in European Tech: SoftBank’s Arm picks US over London for IPO, Klarna reports $1 billion loss for 2022, HTGF closes €500 million fund, and more

This week, our research team tracked more than 75 tech funding deals worth over €832 billion, and over 20 exits, M&A transactions, rumours, and related news stories across Europe.

As always, we are putting all weekly deals together for you in a list sent in our round-up newsletter (note: the full list is for paying customers only, and also comes in the form of a handy downloadable spreadsheet).

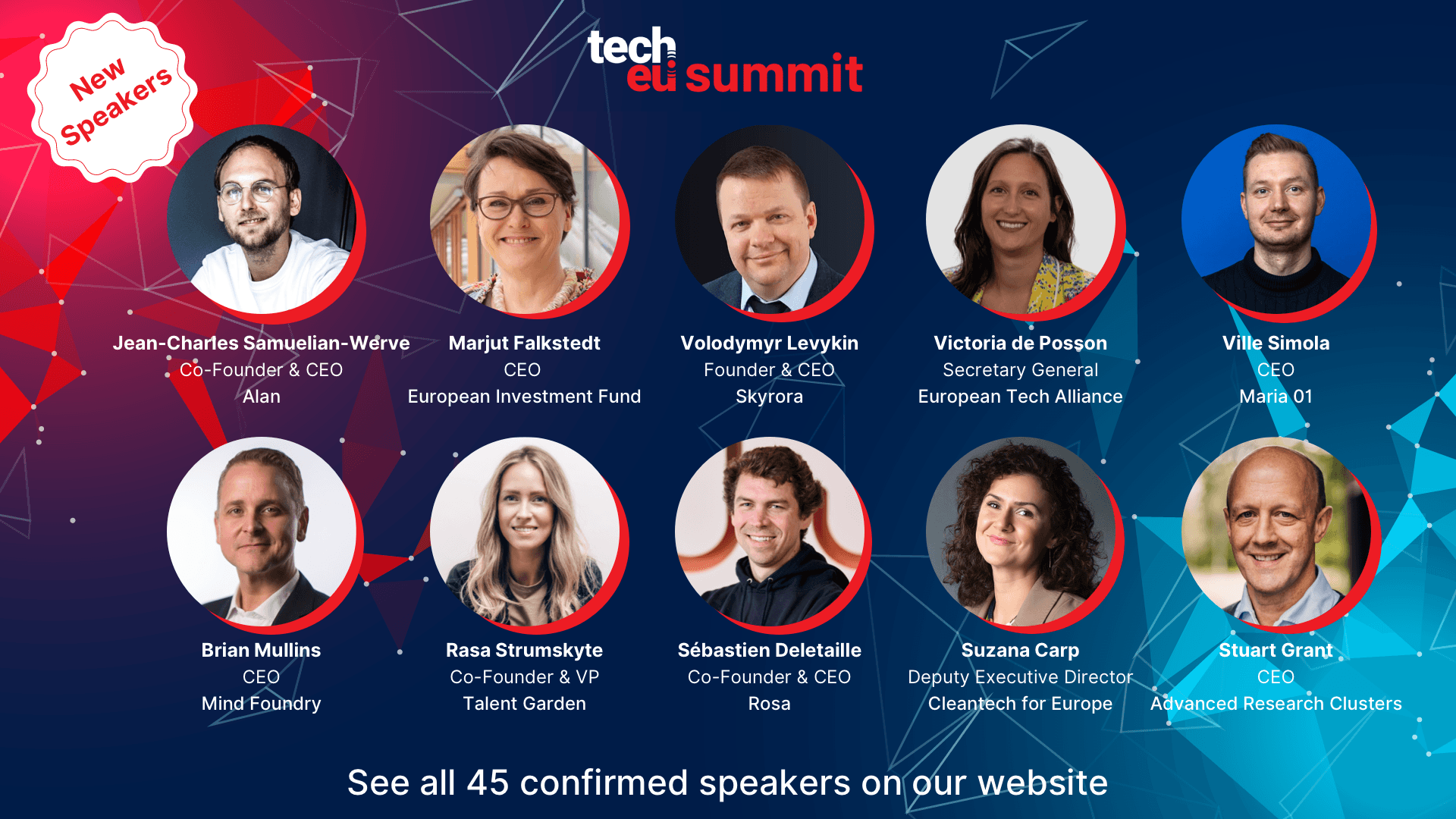

And don’t forget: we’re busy prepping for the next Tech.eu Summit, it’s gonna be epic!

Still on the fence? Check out our 45 confirmed speakers! and the 10 latest additions to the line-up!

With that said, let’s get down to business with the biggest European tech news items for the past couple of days (subscribe to our free newsletter to get this round-up in your inbox).

—–

>> Notable and big funding rounds

Utrech-based business transformation and IT services provider Conclusion has completed a refinancing round that will see €410 million of operating capital aimed at international expansion plans beginning with the expansion of existing operations in South Africa and Portugal.

London-based Flock has raised $38 million in a Series B funding round led by Octopus Ventures with CommerzVentures, Social Capital (led by Chamath Palihapitia), Dig Ventures (the family office of MuleSoft Founder Ross Mason), Anthemis, and Foresight Ventures participating.

Madrid-based upskilling platform StudentFinance has raised €39 million in a Series A funding round comprised of both debt and equity.

Paris-based NLP startup SESAMm has raised €35 million in a Series B2 funding round.

Dutch battery innovator LeydenJar has landed a €30 million EIB ‘quasi equity’ financing round, backed by a European Commission guarantee, to scale up its technology and production.

With its no-code CRM interface, London’s Attio is attempting to address decades-old architecture without undermining actual business utility from the underlying customer data. Recently the company raised $23.5 million in a Redpoint Ventures-led round also involving Balderton Capital and Point Nine.

Enapter, a green hydrogen production company based in Berlin, has secured a €25 million bearer bond with Patrimonium Middle Market Debt Fund.

Berlin-based health tech startup Doctorly has raised a $10 million Series A round to try and get rid of disk-based operating (DOS) healthcare systems.

—–

>> Noteworthy acquisitions, mergers, IPOs and SPAC deals

Euronext has withdrawn an indicative €5.5 billion offer for investment-platform Allfunds after both sides were unable to agree on the terms of a takeover.

Arm has decided against selling shares on the London Stock Exchange for now, dealing a blow to UK politicians who were lobbying the home-grown technology giant ahead of its initial public offering.

Munich, Germany-based Infineon has signed a definitive agreement to acquire GaN Systems of Ontario, Canada (a fabless developer of gallium nitride-based power switching semiconductors for power conversion and control applications) for $830 million.

Inflexion makes its fourth investment in the Nordics and has acquired a majority stake in treasury and cash management software provider Nomentia from PSG Equity and Verdane. According to a report filed by Private Equity News, the deal is rumoured to be worth €300 million.

Offering credit, debit and pre-paid card services, Milan’s Nexi and Alicante-based Banco de Sabadell have come to an agreement that will see the former purchase 80 percent of the latter’s property PayComet for €280 million in upfront cash.

After entering administration on January 17, 2023, Britishvolt has now been acquired by Recharge Industries.

Paris-based Doctolib, a platform that helps make appointments with specialist doctors nearby, has acquired Amsterdam-based Siilo, a startup that offers an instant messaging app for communication between healthcare workers.

Fujitsu has submitted an offer to acquire Germany’s GK Software, a provider of enterprise software catered to large retail company branches.

Summa Equity has acquired a majority stake in cybersecurity firm Logpoint.

London’s Quantexa has acquired Aylien, a language processing software company based in Dublin, in a bid to empower its decision intelligence platform with enhanced unstructured data analysis and language modelling.

Global energy major Shell has struck a deal to acquire the evpass EV charging network in Switzerland.

—–

>> Interesting moves from investors

Bonn-based High-Tech Gründerfonds has announced the closing of its fourth fund at a total value of €493.8 million.

Amsterdam-based StartGreen Capital, an impact investment firm, announced the launch of its sixth fund, the StartGreen Transition Fund (SGTF). The fund aims to hit the €200 million mark and is now open to investors.

The French entrepreneur who’s put his money behind unicorns like medical AI company Owkin and payroll software Payfit is now backing Resonance, a €150 million evergreen early-stage VC fund.

Investment firm Spex Capital has launched a fund to invest in health tech companies and is targeting a final close of €100 million.

With a track record spanning over 20 years, including EMEA founder and GVP at $33 billion IPO cloud data platform Snowflake, Thibaut Ceyrolle has become the latest Partner at Atomico.

The UK Space Agency has unveiled a £51 million funding package for space tech companies to create communication and navigation services for Moon missions.

The Czech government has plans to create a €55 million fund of funds to back three independent VCs.

Backed by Quantum Delta NL, QDNL Participations has launched a €15 million fund to support early-stage quantum technology startups in the Netherlands.

Sure Valley Ventures’ SVV3 venture fund is announcing a €30 million inaugural close thanks to LPs including London-traded investment firm Pires Investments.

Barcelona-based Glovo has announced the launch of its own Impact Fund, according to the company the first-of-its-kind in the delivery industry.

Since the beginning of 2023, the Bulgarian VC fund for early-stage companies, Vitosha Venture Partners has invested €1.1 million in 8 local startups.

—–

>> In other (important) news

Swedish payments group Klarna aims to return to profit by the summer, the “buy-now, pay-later” company said on Tuesday, as it reported wider losses for 2022 but an improving performance in the fourth quarter. Klarna posted a full-year operating loss of $1 billion.

EU antitrust regulators on Tuesday narrowed their case against Apple, focusing on its App Store rules that prevent developers from informing users of other purchasing options, while dropping another charge related to in-app payments.

Revolut has posted its first annual profit of £26.3 million in 2021, following a tripling of revenues to £636 million from £220 million in 2020. The numbers come from Revolut’s annual report for the year, finally published after reported delays between the fintech company and its auditors BDO.

US tech giant Apple said Thursday it would spend an additional €1 billion on expanding its microchip design hub in Munich.

The European Parliament on Tuesday banned TikTok from staff devices over cybersecurity concerns, meaning the Chinese video-sharing app is now barred in all three of the EU’s main institutions.

The electric vehicles arm of Octopus Energy’s parent company is seeking a £100 million funding boost to accelerate its growth amid soaring production of greener cars.

British audio and computing hardware startup Kano is planning to raise equity funding from its users and fans, as the company tries to chart a path forward after cutting business ties with Kanye West.

Parisian SME-focused payroll and HR management solution PayFit is in the process of reducing its workforce by 20%, affecting some 200 individuals.

The Financial Conduct Authority is monitoring the financial health of Railsr, the banking-as-a-service provider, amid emergency sale talks.

OnlyFans, an online platform known for adult content, should pay UK VAT on the full amount paid by subscribers to content creators, not only its 20% cut of the fees, Europe’s top court said on Tuesday, siding with Britain’s tax authority.

A UK entrepreneur group has called on the government to make improvements to the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS) to better support tech startups.

Money transfer firm Wise has unveiled a new look and feel as it reaches 16 million customers worldwide.

—–

>> Recommended reads and listens

In an analysis of VC hiring trends over the course of 2022, Berlin and London accounted for 51.4 percent of all publicised job listings at 253.

The questions founders should be asking potential investors.

2022 sees Europe’s IoT startups smashing funding records – 10 fundraisers to watch

February 2023 in European Tech: Deals, exits and continued falling numbers

A new storytelling initiative will aim to encourage more women and minority entrepreneurs into the world of tech, taking on one of the main barriers to inclusion: a paucity of role models for aspiring female and minority innovators.

How the Biggest Fraud in German History Unravelled

Bpifrance: Inside the machine powering French tech’s rise

Forget hybrid work or in-office perks. What employees really want is increased flexibility, particularly around when they work, which is why momentum behind a four-day week is gaining traction.

What Europe’s Economy Needs Now

20 people who matter in UK tech

“Losing Tech Nation is one step forward, two steps back“

How the AI Act could unintentionally impact access to healthcare

How UK’s Online Safety Bill fell victim to never-ending political crisis

—–

>> European tech startups to watch

Robin AI scoops $10.5 million for its “lawyer-in-the-loop” generative AI model.

Brussels-based Cycle has raised $6 million in a seed funding round that will see the company further its end goal of becoming the be-all-end-all reference when it comes to product management.

Text-video transition company Colossyan has secured $5 million in Series A funding.

Silicon Valley Bank’s UK subsidiary agreed terms on a venture debt facility with Humanising Autonomy, a UK-based developer of behaviour and computer vision AI that’s bringing context to deep visual automation in mobility — including connected vehicles and traffic sensors — without infringing ethical standards.

UK-based Mendelian is preparing further trials of its AI case-finding tool for diagnosing rare diseases at scale after being awarded $1.4 million from a national health innovation grant making body.

Belgian legal tech Henchman has picked up another €6.5 million for its assisted contract drafting platform and now has a GPT-3 integration to further accelerate contract work.

Former L’Oreal, Palantir MVPs join forces, take £1.8 million pre-seed for Sourcerie beauty venture.

Germany’s Secfix has locked down €3.6 million in an oversubscribed seed round led by pan-European VC Octopus Ventures.

London-based digital telco startup Devyce has raised $2.7 million in a seed funding round. The company plans to use the investment to spur on its ambition to create a global mobile network for business using its own mobile network.

Meeting the millennial demand for increasingly more and more flexibility, Jobgether offers nomads and remote workers a wheels-up method of finding work in one go.