London-based BaaS fintech startup Rackle has raised €200,000 in a seed funding round aimed at supporting the company’s continued product development and imminent launch. Including a mid-2020 pre-seed round, the company has raised approximately half a million Euro.

The seed round was provided by Istanbul-based Arz Portfolio.

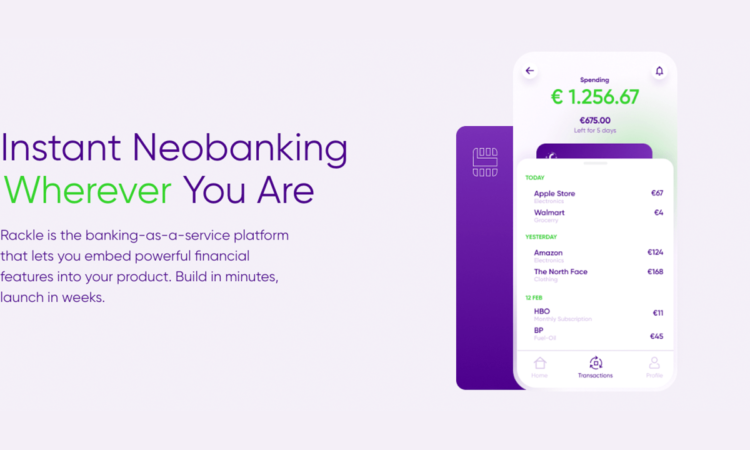

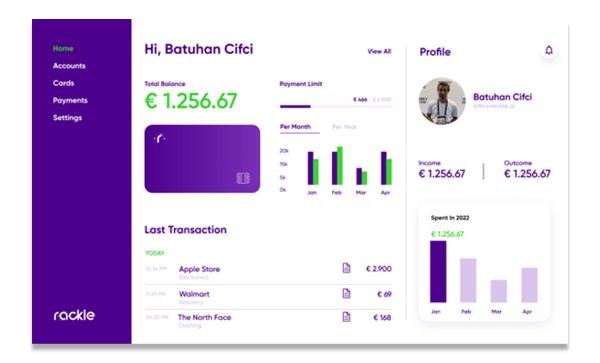

By no means a completely unique solution, Rackle plans to offer a one-stop shop for businesses to get their own banking services up and running in a matter of weeks. Where the startup does stand apart from a crowded marketplace is in the fact that it’s specifically targeting any number of Turkish businesses ranging from sports clubs and tourism companies to airline companies and large chain brands, allowing them in turn to offer banking services to the 10 million Turks living in Europe.

Rackle has secured a partnership with Berlin-based fintech heavyweight Solarisbank and QNB Finansbank in Turkey and is piggybacking their business atop each outlet’s service banking APIs.

According to Istanbul-based co-founder Doğukan Gözeten, “Rackle brings together the marketing, technology, and risk units that are the components of the banking ecosystem. Companies that want to provide their own banking applications to customers can offer banking services without requiring any technological development by using Rackle’s services. They can also rapidly expand their customer base through cross-marketing with other companies in the Rackle ecosystem.”