If you go to a flea market or buy an item from a small vendor, you may have noticed the payment options have changed. For some sellers who once relied on traditional cash payments, Venmo has become a business option to collect revenue.

Venmo, owned by parent company PayPal, had almost 90 million accounts as of August 2022. Several studies conducted by the digital wallet service found that shoppers are 19% more likely to complete a purchase using Venmo than traditional payment methods, and Venmo users shop twice as much as the average shopper.

How to add money to Venmo

Only Venmo Debit Card holders can add money from their bank account to their Venmo balance. Venmo’s Mastercard Debit Card allows users to purchase directly from their Venmo balance.

If you have a Venmo Debit Card, here’s how to add money to your Venmo balance:

- In the Venmo app, navigate to the “Me” tab on the far right

- Make sure you’re in the wallet section (not transactions) and select “Manage” on your Venmo balance

- Enter the amount you’d like to transfer, then hit next

- Confirm your bank account and transfer, then tap “Add now”

Netflix password sharing:How much will it cost you? What we know so far

Security tip:Should I set my Wi-Fi to private or public?

What is Venmo?

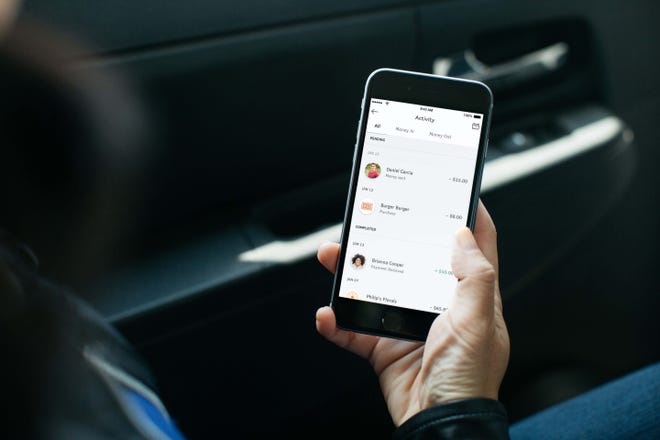

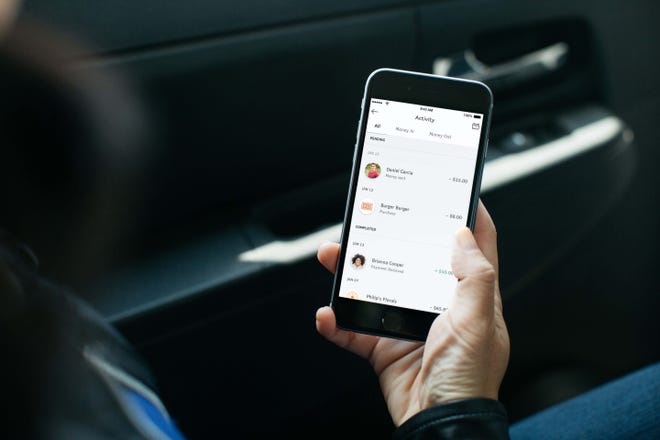

Venmo is a peer-to-peer digital wallet where users link their bank accounts to send money back and forth. Venmo allows you to pay and request other users, and it also has a social component, allowing friends to see each other’s payment activity without seeing the exact dollar amount they send.

Business owners can also use Venmo for sales transactions at a small fee.

How does Venmo work?

Download the Venmo app to use the digital wallet. Once you’ve created your account, add a card or link a bank account using the app or on desktop. You’ll have to verify your bank account, either by signing in with your bank or by verifying two small transfers from Venmo.

Now you can send and request funds to your friends. Hitting the “V” in the bottom middle on your phone brings up the payment process, where you can enter a username, name, email or phone number to locate your friend. Once you’ve entered their name, enter an amount and add a note about the payment and hit request or pay.

A $5 Venmo request?:Inflation is changing the way people use payment apps

Zelle, Venmo and Cash App user?:How to protect yourself when using payment apps

How to pay with Venmo balance

You don’t have to have money in your Venmo balance to pay other users on the app, but using your Venmo balance makes for a hassle-free payment without getting your bank account involved.

Tap the “V” in the bottom middle of the app to make a payment. Enter the user, amount, a note and then hit “Pay.” It should come up automatically if you have enough in your Venmo balance to cover the payment. Venmo only allows you to pay from your bank if your balance doesn’t cover the transaction.

How to transfer Venmo balance to your bank account

Transferring your Venmo balance to your bank account can be done in a few simple steps. Press “Transfer balance” in the “Me” section of the app, enter the amount you want to transfer and select the account to transfer it to.

You can also select a traditional transfer in 1-3 business days or transfer instantly, but it comes with a small fee.

Done with digital wallets?:How to delete your PayPal account permanently

Why can’t I use my Venmo balance to pay?

Venmo is required by the U.S. Patriot Act to verify users’ identities. If you’re having trouble making payments with your Venmo balance, it may be because you haven’t verified your identity.

Here’s how to verify your identity in the app:

- Go to the “Me” tab on the far right

- Tap “Settings” in the top right corner

- Scroll down to “Security,” where you should see “Identity Verification.”

Venmo collects a variety of documentation and information to verify you, including your name, address, date of birth, Social Security Number or Individual Taxpayer Identification Number. You may also be asked to upload up-to-date documents for other purposes:

If Venmo needs additional verification of your name and date of birth:

- U.S. passport

- Driver license

- Government-issued ID

- DHS card

- Tribal ID card

If Venmo needs additional verification of your proof of address:

- Bank, credit card or brokerage statement

- Utility bill

- W2 or paystub

- Lease

- Car registration

- IRS letter

- Drivers license or other government-issued ID with a current address

If Venmo needs additional verification of your SSN or ITIN:

- SSN card or assignment letter

- W2 or paystub

- IRS letter

Is Venmo safe?

Venmo is generally safe, as it uses encryption to protect your account and financial information.

You can safely verify the identity of the user you’re paying by ensuring the username and profile picture is accurate. Venmo may also ask you to confirm the last four digits of the user’s phone number if this is the first time you’ve paid them. You can bypass this step if needed, but it’s an added security measure for comfort.

You can also add a PIN code to the app for two-step authentication. If your phone is lost or compromised, remove the account from the device on Venmo.com by going to “Settings” and then “Security” to remove the session.

If you’re worried about other users seeing your transactions, try modifying Venmo’s privacy settings. Venmo users will never see the exact dollar amount sent, but they may be able to see the note attached to the transaction. In the “Pay or Request” screen, hit the privacy setting in the bottom right corner above “Pay.” You’re given three options here:

- Public: Anyone on the internet can see this transaction

- Friends: Only the sender, the recipient and their Venmo friends can see

- Private: Only you and the recipient can see

Tax season:IRS delays $600 1099-K tax reporting for Venmo, PayPal, CashApp