Stock Market LIVE: Indices trim gains, Sensex up 200 pts; Metal, Realty shine

Investors are looking for hints at the next course of action from central banks. Though the signs are mixed, most investors seem to be still betting on Fed’s continuing its hawkish stance against inflation.

L&T’s construction arm bags ‘significant’ orders from auto major

The construction subsidiary of engineering behemoth Larsen & Toubro (L&T) has bagged “significant” orders from a leading automobile major to construct a state-of-the-art manufacturing facility in Haryana. The company classifies orders worth ₹1,000 crore to ₹2,500 crore as significant. The scope involves design and execution of civil, structural and architectural works including external development works. (Read More)

India bond yields jump to 3-month high as JPMorgan holds off on index inclusion

The yield on benchmark 10-year bonds surged as much as 12 basis points to 7.48%, the highest since June. Indian bonds tumbled as JPMorgan Chase & Co. refrained from adding local government bonds to its emerging markets debt index. The rupee also edged lower. Higher US Treasury yields and oil prices also contributed to the move, according to traders. (Read More)

Can Fin Homes mulls raising up to ₹4,000 cr debt capital

Canara Bank promoted housing loan provider Can Fin Homes is planning to raise debt capital of up to ₹4,000 crore and will seek board of directors’ approval on this proposal later this month.

The board of directors of the company is scheduled to meet on October 17, 2022 to approve financial results for the company’s second quarter and first half ended September 2022-23.

“At the said meeting the proposal is being placed to the board seeking approval and authorisations for issuance of non-convertible redeemable debentures up to an amount of ₹4,000 crore, on private placement basis,” Can Fin Homes said in a regulatory filing on Thursday.

The company said it will raise the funds in one or more tranches for a period up to the date of the annual general meeting of the current fiscal year. (PTI)

Excess capacity big concern for a volatile aviation sector

Indian airlines have faced near-constant turbulence since the onset of the pandemic. Initially, the sector witnessed its worst nightmare in the form of grounded aircraft for two months during the national lockdown. A slump in demand followed this, along with a restriction on capacity deployment by the civil aviation regulator. Then came the volatility in fuel prices and the weak rupee, which continue to cloud their path to profitability. The capacity deployment equation has remained a constant worry for the sector since the onset of the pandemic.

Demand for air travel has not recovered sustainably to pre-covid levels so far as jet fuel prices soar.

IndiGo operated 9,748 flight departures per week against DGCA approval to operate 11,130 flights per week. (Read More)

Prabhudas Lilladher on Healthcare – Jul-Sep’22 Earnings Preview: Margin to improve QoQ

Param Desai – Research Analyst, Prabhudas Lilladher: We expect pharmaceuticals companies under our coverage to report flat EBITDA growth YoY (up 13% QoQ) mainly led by 1) high base, 2) normalized expenses and 3) comparatively higher inflationary COGS on YoY. However, we see strong sequential growth aided by niche launches in US, steady domestic formulation business and easing of overheads like freight, commodity prices. The benefit of INR depreciation vs USD (+7% YoY and 3% QoQ) will also aid profitability. On the flip side, profitability will be negatively impacted by EM currency volatility.

Amongst PL universe we expect companies like Cipla and JB Chemicals to report EBIDTA growth of 24% and 28% YoY, aided by robust growth in US market and ramp up in India business. On other hand, companies like Aurobindo, Glenmark and Lupin will see EBIDTA decline of 14%, 25% and 40% YoY, led by continued weak margins. Dr. Reddy’s to report EBIDTA growth of 4% YoY adjusted for one off milestone income in Q2FY22. Sun pharma to report EBIDTA growth of 6% YoY led by continued growth momentum in Specialty.

US sales to improve on QoQ: We expect US sales to increase by 7% QoQ, aided by niche launches like gRevlimid. Cipla, Zydus, DRRD have launched the gRevlimid in Sept month with DRRD having 6 months exclusivity for two strengths. We have factor in $25-40mn of sales from gRevlimid across companies. We see QoQ growth of 17%, 16% and 10% in US sales for DRRD, Cipla, Zydus. In case of Lupin, normalization of base business along with new launches should aid sales run-rate to $155mn ($121mn in Q1FY23). SUNP should witness +16% YoY (flat QoQ) growth in US sales aided by specialty.

Sectoral in consolidation mode: BSE Healthcare Index grew in line with Sensex in Jul-Sept22 quarter. Our sectoral outlook remains positive led by tailwinds in US generics, healthy domestic formulations segment and easing of freight cost & API prices. We expect profitability to improve henceforth, with steady domestic business, strong launches in US market and continued cost optimization. We prefer companies with steady domestic franchises and strong US visibility. Accordingly, our top picks remain SUNP, CIPLA, JBCP and TRP.

Euro zone yields edge higher, ECB minutes in focus

Euro zone government bond yields edged back towards September’s multi-year highs on Thursday as investors await the minutes from the European Central Bank’s September meeting for clues on the future pace of tightening.

The ECB raised their three key interest rates by 75 basis points each at that policy meeting and signalled they expected interest rates to rise further in the coming meetings to bring inflation back towards their 2% medium-term target.

The minutes will be scrutinised for hints on how high the central bank plans to take rates and whether there was any discussion on the central bank’s plans to shrink its balance sheet.

“Of particular interest should be the question as to how much consensus there was within the Governing Council regarding the pace of the rate-hike cycle,” said Daniel Lenz, head of strategy for euro interest rate markets at DZ Bank. (Reuters)

BNP Paribas IT Report | Top Picks – TCS, Infosys, HCL Technologies, Mphasis Ltd, Redington, Mindtree Ltd, Tech Mahindra

Kumar Rakesh, Analyst – IT & Auto, BNP Paribas India has shared his views in detail. Appended are the key takeaways:

Demand trends keeping us cautiously optimistic

· Fears of macroeconomic weakness not reflecting in demand; structural drivers intact

· 2QFY23 preview: Growth momentum and margin stability; INFO best pick for results

· Large-scale strategic IT vendors better placed, higher valuation comfort; INFO is our top pick

· India IT services revenue growth has a strong correlation with US IIP growth

· Accenture (ACN) reported solid revenue growth in 4QFY22

· ACN’s outsourcing bookings suggests IT Services demand boom continues

BNPP industry outlook indices (BNPP IOI)

· Confident outlook for revenue growth; deal wins to stay strong; margin outlook cautious

· Outlook strong for Americas, pockets of softness in Europe

· Outlook for BFSI, CPG & Retail slightly weak, while that for healthcare and manufacturing is strong with healthy sales growth q-q likely to continue in quarters ahead, in our view

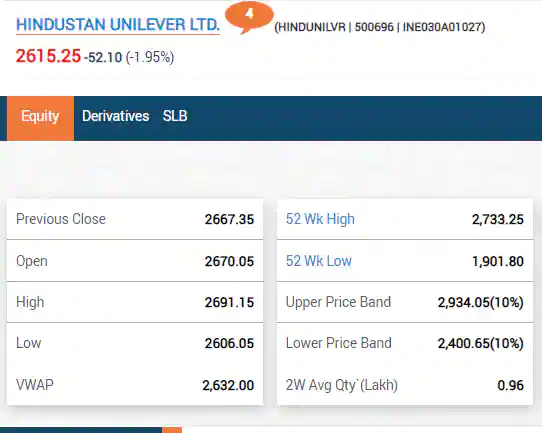

Hindustan Unilever stock drags in today’s trading, sheds 2%

View Full Image

Akasa Air performance ‘satisfying’ in first 60 days: CEO

Akasa Air CEO Vinay Dube on Thursday said the airline’s performance in the first 60 days since starting operations has been “satisfying”.

The airline started operations on August 7 and has six planes in its fleet. It plans to have a total of 18 aircraft by the end of this fiscal.

“We are very happy, satisfied with… our performance,” Dube said here.

He also said the airline is “on track” as per plans and that the performance has been satisfying. The airline is currently flying 30 flights daily.

The airline has placed an order for 72 Boeing 737 MAX planes.

The airline will soon allow travellers to carry domesticated dogs and cats in cabin and cargo. (PTI)

NBFC stock rises 4% on rating upgrade, AAA; up 95% in a year

Poonawalla Fincorp shares have been rising for last two successive sessions. The NBFC stock has risen from ₹306.55 to ₹329 apiece levels, logging over 7 per cent rise in this time horizon. However, in intraday session, Poonawalla Fincorp share price opened upside and went on to hit intraday high of ₹329 apiece on NSE, logging near 4 per cent rise on Thursday session. (Read More)

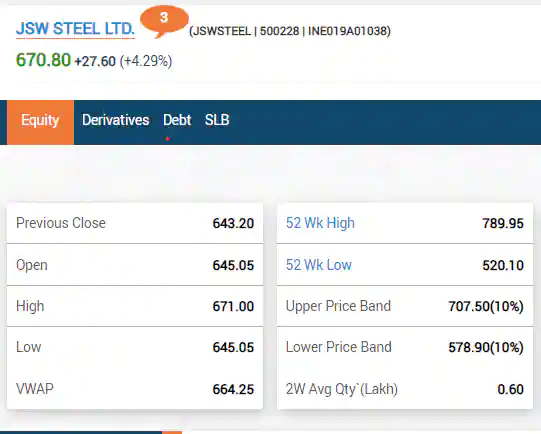

JSW Steel surges in today’s session, adds more than 4%

View Full Image

Oil Holds Surge on OPEC+ Output Cut and Russian Supply Warning

Oil held a three-day rally after the OPEC+ alliance agreed to the biggest production cut since 2020 and Russia reiterated a warning that it won’t sell crude to any countries that adopt a price cap.

West Texas Intermediate traded near $88 a barrel after jumping 10% over the previous three sessions. OPEC+ plans to slash daily output by 2 million barrels, a move that drew a swift rebuke from the US. The Biden administration has previously sought more oil from producers as it battles energy-driven inflation. (Bloomberg)

Weekly expiry below 17400, signals options data

Heavy selling has been witnessed at the 17400 strike weekly call option in the Nifty, making the level a strong resistance today. The weekly option expires today.

The premium is already down from an intraday high of ₹67 a share to ₹19.55, causing a significant loss to option buyers who didn’t place a stop loss. (Read More)

Japan’s Nikkei hits two-week top amid jump in energy, chip shares

Japan’s Nikkei index closed higher on Thursday, after touching a two-week peak during the session, as markets extended their rebound from multi-month lows, helped by energy and chip-related stocks.

The Nikkei share average ended 0.7% higher at 27,311.30, after reaching a high of 27,399.19, a level not seen since Sept. 21.

The benchmark faded in the final minutes of trading, after spending most of the afternoon preserving the strong gains from the morning.

The broader Topix rose 0.5% to 1,922.47, also gaining for a fourth day and touching a two-week peak of 1,930.47. (Reuters)

World Trade Organization cuts global trade forecast for 2023 to 1%

The growth in world trade is expected to slow down to 1 percent in 2023, down sharply from the previous estimate of 3.4 percent, due to global uncertainties, World Trade Organization (WTO) has said in its forecast.

“World trade is expected to lose momentum in the second half of 2022 and remain subdued in 2023 as multiple shocks weigh on the global economy,” it in its press release. (Read More)

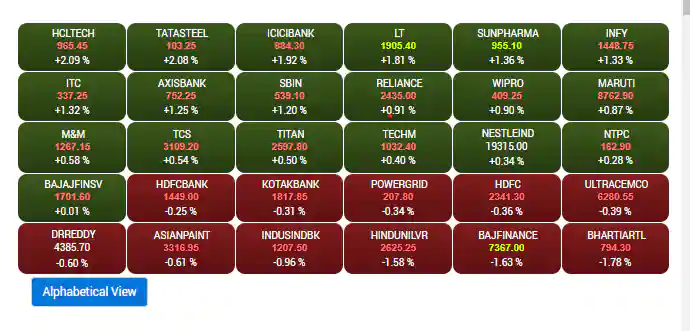

Noon Update: Sensex adds 300 points and Nifty 100 points. Metal, Media and Realty shine

View Full Image

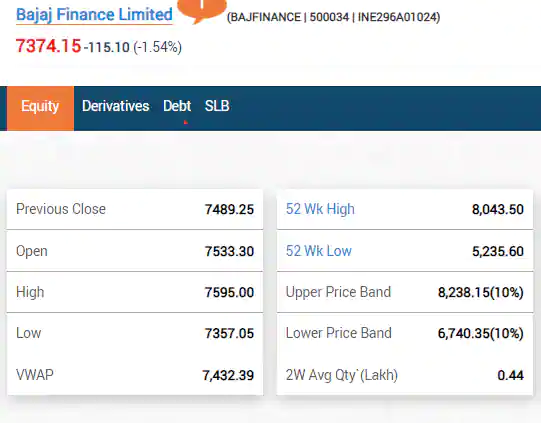

Bajaj Finance stock drags, sheds 1.5% in today’s session

View Full Image

Covid-19 update: India’s active cases decline to 32,282

India recorded 2,529 new coronavirus infections taking the total tally of COVID-19 cases to 4,46,04,463, while the active cases dipped to 32,282, according to the Union Health Ministry data updated on Thursday.

The death toll climbed to 5,28,745 with 12 fatalities which includes eight deaths reconciled by Kerala, the data updated at 8 am stated.

A decline of 1,036 cases has been recorded in the active COVID-19 caseload in a span of 24 hours. (Read More)

Sri Lanka says Japan agrees to help in its credit reconciliation process

Japan has agreed to assist Sri Lanka in its credit reconciliation process, the South Asian island nation said on Thursday.

Japan has also agreed to co-chair the summit on negotiations with the creditor countries, President Ranil Wickremesinghe told Parliament, a statement from his media division said. (Reuters)

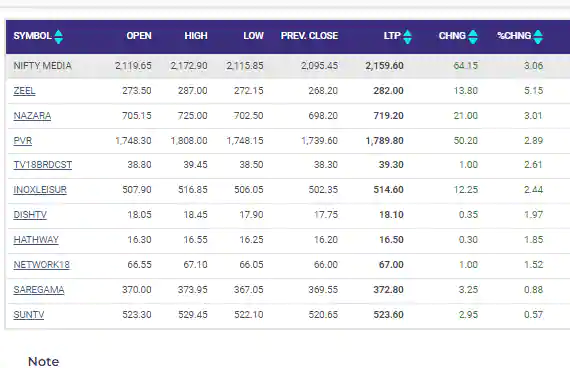

Media index shines as it gains 3% in today’s trading

View Full Image

India Sept services growth slumped to 6-month low on cooling demand -PMI

Growth in India’s services industry slumped in September to a six-month low, led by a substantial easing in demand amid high inflation, a private survey showed.

The S&P Global India services Purchasing Managers’ Index fell to 54.3 in September from August’s 57.2, much lower than the Reuters poll expectation for a gentle drop to 57.0.

Despite staying above the 50-mark separating growth from contraction for the fourteenth straight month – the longest stretch of expansion since October 2016 – the index fell to its lowest since March.

“The Indian service sector has overcome many adversities in recent months, with the latest PMI data continuing to show a strong performance despite some loss of growth momentum in September,” noted Pollyanna De Lima, economics associate director at S&P Global Market Intelligence. (Reuters)

Lodha reports decent pre-sales in Q2FY23, stock rises 2%

Shares of Macrotech Developers Ltd. (Lodha) rose 2% on the National Stock Exchange in opening deals on Thursday, reacting to the company’s Q2FY23 operational update. The real estate developer has reported sales bookings despite Q2 typically being a weak quarter for the industry due to monsoon and the inauspicious shradh period. (Read More)

Axis Securities Auto Monthly Volume Update: Robust growth momentum in PV & CV sales; 2Ws lag behind

“The wholesale volumes in Sep’22 picked up in line with our expectations as the OEMs ramped up supply to fill in the inventories ahead of the festive season. The easing chip shortage also aided in the broad-based growth in auto supply as against previous quarters. According to our estimates, PV domestic wholesale dispatches posted impressive growth of 95%/7% YoY/MoM, suggesting improving supply to fulfil order backlogs. However, 2W Domestic wholesale volumes growth lagged the PV and CV segment, growing by 15%/10% YoY/MoM (ex. HMSI), indicating a slower pick up in the rural demand. The growth was mainly driven by the low base of the last year and inventory buildup for the festive season. The CV segment growth remained steady and was up 44%/12% YoY/MoM, indicating the continuation of demand momentum led by the pick-up in the infrastructure activities. Domestic tractor sales jumped MoM which was driven by improved farmer sentiments on account of the above-normal monsoon and onset of an early festive season. Moving forward, we expect PV growth will be led by easing supply with chip supply normalising as well as due to demand led by premiumisation and new vehicle launches. 2W demand will be contingent on the pick up in rural demand, product premiumisation for urban centres, and response to new EV launches. The pick-up in the Capex cycle for completion of the infrastructure projects post the monsoon, correction in oil prices, and replacement demand will continue to drive the CV growth momentum.”

BillDesk, Byju’s, Zetwerk, Swiggy among startups hit by defaulting investors

A growing number of startups have seen investors renege on binding contracts or share purchase pacts in the past few quarters, a trend that is likely to exacerbate, said several executives, as a funding winter engulfs the broader startup ecosystem.

Startups that have faced investor default over the last six to eight months include BillDesk, Byju’s, Zetwerk, Goqii and Swiggy, said the executives familiar with the potential deals, on the condition of anonymity.

On Monday, Prosus NV, the investment unit of South Africa’s Naspers, said it was walking away from buying payments service provider BillDesk in an all-cash transaction of $4.7 billion after the long stop date to close the deal expired. (Full Story)

Rupee slips as oil price rises, bond inclusion delay weighs

The Indian rupee was trading lower against the dollar on Thursday, weighed by the uptick in oil prices and the delay in the inclusion of local bonds into a widely followed index.

The rupee was quoted at 81.63 per U.S. dollar by 0426 GMT, against 81.52 in the previous session.

The local unit opened almost flat at 81.51, before slipping on dollar demand by foreign banks and speculators, traders said.

Brent crude futures inched up to $93.56, extending its advance after OPEC agreed to slash production by about 2 million barrel per day, the largest reduction since 2020. (Reuters)

Bajaj Finance sees healthy loan growth in Q2, Jefferies sees upside on stock

While sharing its Q2 FY23 business update, Bajaj Finance said that consolidated net liquidity surplus stood at approximately ₹9,300 crore as of 30 September 2022 and the company’s liquidity position remains strong.

New loans booked during Q2 FY23 were 6.8 MM as compared to 6.3 MM in Q2 FY22. Assets under management (AUM) grew by 31% to approximately ₹218,350 crore as of 30 September 2022 as compared to ₹166,937 crore as of 30 September 2021. AUM in Q2 FY23 grew by approximately ₹14,350 crore. (Read More)

SpiceJet share jumps after government raises credit guarantee limit to help stressed airlines

Shares of SpiceJet Ltd surged about 9% on Thursday after a report said that the budget airline is expected to receive an additional 10 billion Indian rupees ($122.7 million) loan under the government’s modified Emergency Credit Line Guarantee Scheme.

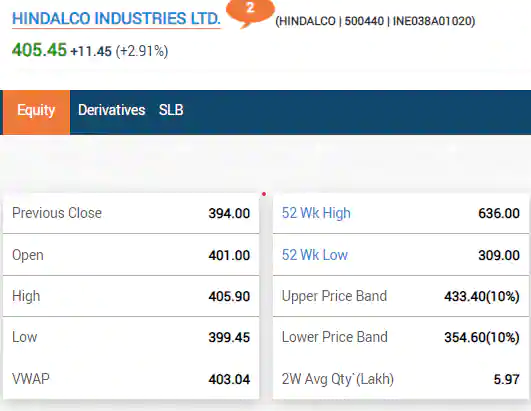

Hindalco shines in today’s trading, gains almost 3%

View Full Image

Ashika Stock Broking views on today’s market: Unless Index provides a decisive close above 17350, it would be a sell-on-rise market

Tirthankar Das, Technical & Derivative Analyst, Retail, Ashika Stock Broking Ltd: On the technical front, Nifty formed a long bullish candle following a rather larger Engulfing candle indicating of an upside breakout of the larger consolidation movement around 16,800-17,200 levels. Key to note that Index is presently flirting around the crucial 200dma sustaining above or below which would dictate the direction of the Index. However, for the Index to end its prolonged correction, it needs to close above 17350 in order to buck the trend else corrective bias might continue though Index presently trading in neutral to oversold price conditions hence pullback seems inevitable. Presently a trader needs to show patience and need to avoid trading aggressively in the market as the risk of a bare minimum correction of 38.2% of the entire rally from 15,183 to 18,096 comes around 16990 followed by 50% correction at 16650 remains. During the day index is likely to open on a positive note, tracking positive morning global cues. Formation of lower high- lower low signifies corrective bias. Hence, until and unless Index provides a decisive close above 17350, it would be a sell-on-rise market.

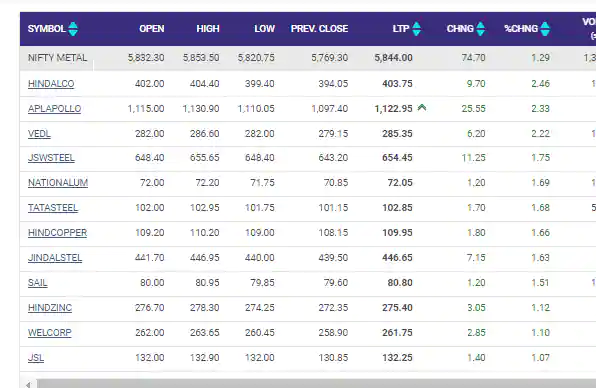

Metal index leads the indices race, gains more than a percent in early trading with almost all stocks in green

View Full Image

Macrotech Developers shares Q2 biz update, pre sales up 57%, net debt reduces

Sharing its key operational updates for Q2 FY23, Macrotech Developers Ltd (Lodha) said on Thursday that the company achieved its best ever Q2 pre-sales performance of ₹3,148 crore, showing a growth of 57% on a YoY basis. Macrotech Developers’ net debt reduced by around ₹60 crore to ₹8,796 crore, the company said. (Full Story)

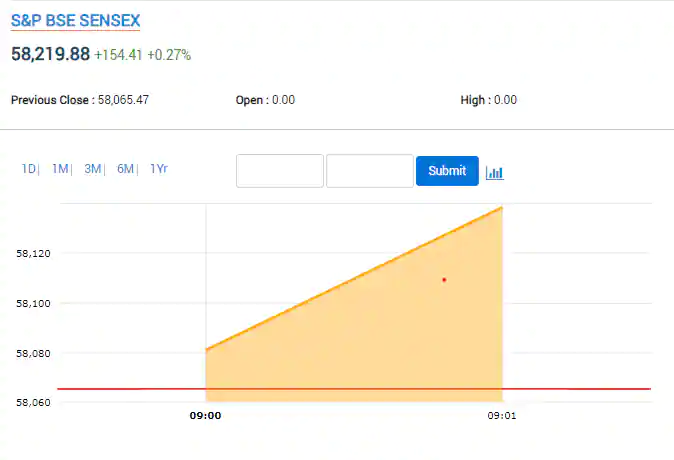

Indices soar at open with a gain of 0.6%. Sensex adds 350 points and Nifty around 100 points

View Full Image

Reliance Securities Stock in Focus for today: SAIL

STOCK IN FOCUS

SAIL (CMP Rs.80)

We have a BUY rating on the company with a Target Price of Rs90.

Intraday Picks

HINDUNILVR (PREVIOUS CLOSE: 2668) SELL

For today’s trade, short position can be initiated in the range of ₹2680-2700 for the target of Rs.2630 with a strict stop loss of ₹2710.

APOLLOHOSP (PREVIOUS CLOSE: 4404) BUY

For today’s trade, long position can be initiated in the range of ₹4320-4380 for the target of Rs.4490 with a strict stop loss of ₹4270.

BALRAMCHIN (PREVIOUS CLOSE: 349) BUY

For today’s trade, long position can be initiated in the range of ₹344- 347 for the target of Rs. 357 with a strict stop loss of ₹341.

Japan’s Nikkei hits two-week high as energy, chip shares gain

Japan’s Nikkei share average hit a two-week high on Thursday, extending its rebound from a multi-month low to a fourth session, with energy and chip-related stocks leading the way.

The Nikkei ended the morning session 0.92% higher at 27,370.37. Earlier in the session, it rose to its highest level since Sept. 21 at 27,391.69, poking above the 200-day moving average at around 27,317.

The broader Topix rose 0.79% to 1,928.08, also gaining for a fourth day and touching a two-week peak of 1,930.47.

Of the Nikkei’s 225 components, 179 rose, 41 fell, and five were flat. (Retuers)

Sensex preopens flat with marginal gains; ONGC, SpiceJet, HDFC Bank stocks are in focus in today’s session

View Full Image

Electronics Mart India IPO: GMP, subscription status on day 2 of the issue

The Initial Public Offering (IPO) of consumer durables retail chain Electronics Mart India was fully subscribed 1.69 times on the first day of offer on Tuesday. The IPO received bids for 10,58,09,796 shares against 6,25,00,000 shares on offer, according to the data available with the NSE. The issue closes on Friday, October 7, 2022. The market was closed on Wednesday for a public holiday. (Read More)

IT companies likely to slash campus hiring in FY24

The hiring boom in the software services industry during the pandemic is sputtering, with companies likely to slash campus and entry-level hiring by as much as 20% in the year starting 1 April, recruiters said. Recession fears have already delayed onboarding of freshers, even those hired six months ago. (Read More)

Geojit Financial Services view on today’s market: Investors should not be carried away by the rallies

Dr V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services: “The mother market US is now signalling a base case scenario of a short and mild recession. That’s why markets are bouncing back sharply from oversold levels. And whenever there is a rally in US markets, India is outperforming reflecting the resilience of Indian economy and markets. Investors should not be carried away by the rallies because there are major challenges for the global economy and markets. In a stable environment, markets will respond to Q2 results which will start flowing in from October 10th onwards. Financials, particularly leading banks, leading NBFCs and fintech company, automobiles particularly CV, PV, tractors and high-end motorcycle manufacturers will post good results. IT results are likely to be good but market response will depend on the management commentary. In other segments telecom, capital goods, select FMCG and construction-related segments are likely to post good numbers.”

Stocks to Watch: Zee Entertainment, SpiceJet, Tata Steel, JSW Energy, HDFC Bank, DMart, Apollo Hospitals, Happiest Minds, HUL, ONGC

Indian bourses will open after remaining closed on Wednesday and gaining around 2% on Tuesday. The markets are expected to remain volatile on Thursday as investors remain vigilant with regard to signs of an economic downturn. (Read More)

India investigating deaths in Gambia linked to India-made cough syrup – sources

India is investigating the deaths of dozens of children in Gambia linked to the use of an India-made cough syrup, two federal health ministry sources told Reuters on Thursday.

The World Health Organization said late on Wednesday deaths of dozens of young children in Gambia from acute kidney injuries may be linked to contaminated cough syrup that had been manufactured in India.

The sources said the Indian government had asked the WHO to share the report establishing causal relation to death with the cough syrup. (Reuters)

Cryptocurrency prices today: Bitcoin, ether rise while Shiba Inu slips

Cryptocurrency prices today remained higher with Bitcoin trading above above the $20,000 mark. The world’s largest and most popular cryptocurrency was trading nearly a per cent higher at $20,397. The global crypto market cap today was back above the $1 trillion mark, as it was up about a per cent in the last 24 hours at $1.01 trillion, as per CoinGecko. (Read More)

World currency reserves shrink by $1 trillion in record drawdown

Global foreign-currency reserves are falling at the fastest pace on record as central banks from India to the Czech Republic intervene to support their currencies.

Reserves have declined by about $1 trillion, or 7.8%, this year to $12 trillion, the biggest drop since Bloomberg started to compile the data in 2003.

Part of the slump is simply due to valuation changes. As the dollar jumped to two-decade highs against other reserve currencies, like the euro and yen, it reduced the dollar value of the holdings of these currencies. But the dwindling reserves also reflect the stress in the currency market that is forcing a growing number of central banks to dip into their war chests to fend off the depreciation. (Read More)

Bonus shares 4 times: PSU stock turns ₹1 lakh to ₹2.77 crore in 22 years

Bharat Petroleum Corporation Ltd or BPCL share price history may not look attractive on the chart but when you look at its bonus share history, then a smart investor would understand how this PSU company has remained a money-making stock for its long-term investors. In the last 22 years, BPCL share price has ascended from ₹13.50 to ₹311.60 apiece levels, but when we add bonus share impact during these 22 years, we come to know that one’s ₹1 lakh invested 22 years ago would have turned to ₹2.77 crore today. (Read More)

OVL plans $1 bn investment in offshore Petrobras block

State-run ONGC Videsh Ltd (OVL) is looking to invest around $1 billion in a Brazilian offshore hydrocarbon block and also raise its stake, a person aware of the development said, in the latest Indian effort to strengthen energy security.

Brazil’s state-run Petroleo Brasileiro SA (Petrobras) operates the BM Seal-4 block with a 75% participating interest, while OVL holds the rest. It saw a major gas discovery in 2019 and is expected to start production after 2026. OVL’s stake in the block is expected to go up after the investment.

OVL’s decision to invest follows the declaration of commerciality (DoC) for the BM Seal-4 block, with the final investment decision (FID) to be taken shortly. The block lies in the Sergipe Alagoas Offshore Basin in a 320 sq. km area. (Read More)

Apollo Hospitals acquires 60 pc stake in AyurVAID

Apollo Hospitals Enterprise Ltd on Wednesday said it has acquired a 60 per cent stake in leading classical Ayurveda hospital chain AyurVAID for a consideration of ₹26.4 crore.

The investment will be used to upgrade existing centres, set up new centres, strengthen enterprise platforms, and for digital health initiatives, the healthcare major said in a regulatory filing.

Beginning with a revenue estimate of over ₹15 crore for FY23 for AyurVaid, the target is to achieve ₹100 crore in the next three years, it added. (PTI)

Buy or sell: Vaishali Parekh recommends 2 stocks to buy today — October 6

Vaishali Parekh, Vice President – Technical Research at Prabhudas Lilladher believes that Nifty and Bank Nifty have breached crucial hurdles and it may give strong recovery if the indices manage to sustain its gains on Thursday session. Vaishali Parekh of Prabhudas Lilladher recommended two stocks to buy today and those two stocks are Torrent Power and L&T Finance.

1] Torrent Power: Buy at ₹502, target ₹535, stop loss ₹490; and

2] L&T Finance: Buy at ₹77, target ₹81, stop loss ₹75.

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. (Read More)

Britannia Industries expands in Africa with Kenya deal

India’s biggest cookie manufacturer, Britannia Industries Ltd., clinched a deal for operations in Kenya as part its plan to expand in Africa.

The company teamed up with Nairobi-based Kenafric Industries to purchase Catalyst Capital-backed Britannia Foods Ltd. in Kenya in a $20 million transaction that also involved acquiring property and a plant, Mikul Shah, a director at Kenafric, said in an interview. Britannia Industries, unrelated to Britannia Foods, took a controlling stake in the partnership, he said.

The refurbished factory in Nairobi is scheduled to be commissioned this week, according to Kenafric. (Read More)

Centre raises credit guarantee limit to help stressed airlines

The Department of Financial Services (DFS) has modified the Emergency Credit Line Guarantee Scheme (ECLGS) for the aviation sector, raising the scheme’s cheaper loan limit to ₹1,500 crore from ₹400 crore to help the sector tide over cash-flow problems.

Recognizing that “an efficient and strong civil aviation sector is vital for the economic development” of the country, the DFS, an arm of the finance ministry, modified ECLGS on Tuesday, the ministry said.

As per the modified ECLGS, an airline would be eligible for 100% of its fund-based or non-fund-based loan outstanding or ₹1,500 crore, whichever is lower.

The move is aimed at giving the necessary collateral-free liquidity at reasonable interest rates to the aviation industry. (Read More)

India Inc’s foreign commercial borrowings rise by 4.6 pc in Aug

India Inc’s foreign commercial borrowings in August this year rose by nearly 4.6 per cent to USD 2.98 billion, according to the RBI data.

In August 2021, the Indian businesses borrowed USD 2.85 billion in the form of external commercial borrowings.

Of the total borrowings in August this year, over USD 2.47 billion was through the automatic route of raising funds from foreign sources. While more than USD 502.79 million was raised by way of issuing rupee denominated bonds (RDBs) or masala bonds. (PTI)

Rupee rises 20 paise on Tuesday to close at 81.62 against dollar on forex inflows

The rupee appreciated by 20 paise to end at 81.62 against the US dollar on Tuesday as heavy buying in domestic equities and weakness in the greenback strengthened investor sentiment.

However, rising crude prices in the international market capped the rupee’s gain, forex dealers said.

At the interbank forex market, the local unit opened strong at 81.66 against the greenback. It witnessed an intra-day high of 81.36 and a low of 81.66 during the session.

It finally ended at 81.62, up 20 paise from its previous close. In the previous session, the rupee had settled paise 42 lower at 81.82 against the dollar. (PTI)

Stocks dip, yields climb as rate hikes seem to stay the course

U.S. stocks slipped Wednesday, ending the strongest two-day rally since 2020, while the dollar and Treasury yields rose on the back of signs the U.S. economy remained hot and Federal Reserve officials were resolute in rate hikes.

Signs of softening in the labor market in earlier the week gave way to new data showing the jobs market remains hot bolstered ongoing hawkish talk from Fed officials and dwindled hopes for a pivot from a steady stream of rate hikes to fight inflation.

Wall Street shrank its steepest losses on the day but still ended lower. The Dow Jones Industrial Average fell 0.14%, the S&P 500 lost 0.20% and the Nasdaq Composite dropped 0.25%.

The MSCI world equity index, which tracks shares in 45 nations, was last down 0.12%.

U.S. Treasury yields and dollar regained lost ground from the last two days in turn. The yield on benchmark 10-year Treasuries, was up 14 basis points to 3.749%. (Reuters)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!