Hypergrowth stocks have been hit hard by the stock market sell-off. Many early-stage companies don’t generate profits or positive free cash flow. Rather, they are valued based on their future cash flows.

Inflation, of which there’s been a lot lately, effectively dilutes the value of the future cash flows. Therefore, it’s unsurprising that many investors have gravitated toward established businesses that are doing well right now and can continue to achieve results.

Despite these headwinds, there’s no denying the potential for companies with a multidecade runway. And while these investments should be approached with caution, the valuation of many growth stocks has gotten much more attractive as equity prices have fallen. Rocket Lab USA (RKLB -1.21%), ChargePoint Holdings (CHPT -3.25%), and Bentley Systems (BSY -0.10%) are three stocks that are worth the risk. Here’s why.

Image source: Getty Images.

Shoot for the stars with Rocket Lab

Scott Levine (Rocket Lab): It’s not hard to find companies promising the moon to investors. Management teams often provide investors with rosy pictures of where their companies are headed. However, for those looking for stocks that have a real chance at delivering out-sized growth, it’s smart to consider a company that’s actually headed to the moon — Rocket Lab.

No longer the stuff of science fiction, the space economy is huge and growing fast. For example, the space economy was valued at $469 billion in 2021, according to the nonprofit space industry advocacy organization Space Foundation. Morgan Stanley forecasts the space economy could grow to $1 trillion by 2040.

Rocket Lab already holds a top position in the industry. Among U.S. rockets, the company’s Electron rocket is the second-most frequently launched U.S. behind SpaceX. Delivering small satellites to orbit, Electron has logged 33 launches and deployed 155 satellites.

However, Electron isn’t the only vehicle launching from the company’s pads. Currently under development, Neutron is planned to be a reusable rocket capable of transporting humans and providing cargo resupply missions.

Besides rockets, the company’s Photon spacecraft is also a noteworthy achievement. NASA selected Rocket Lab and its Photon spacecraft for the CAPSTONE mission, which helped deliver a CubeSat to the moon in support of the Artemis mission. Regarding future missions, Rocket Lab is designing Photon to assist NASA on a mission to Mars in 2024.

While Rocket Lab has logged numerous rocketry achievements, it hasn’t succeeded in proving that its space endeavors can be profitable. This means growth investors should closely monitor the company’s financials to ensure that Rocket Lab is on a path to see its bottom line rocket higher.

An industry-leading EV infrastructure company for patient investors

Daniel Foelber (ChargePoint): On Wednesday, the Biden-Harris administration announced further support for expanding U.S. electric vehicle (EV) charging infrastructure, including funding and standards that support domestic manufacturing and make it easier to charge an EV when traveling long distances. ChargePoint was one of several companies that were spotlighted in the White House press release.

Specifically, the White House gave its support for ChargePoint’s partnership with Mercedes-Benz and MN8 Energy for over 400 direct-current (DC) fast-charging hubs across the U.S. and Canada, as well as ChargePoint’s partnership with Volvo and Starbucks for 60 DC fast chargers along a pilot route from Seattle to Denver. On the manufacturing front, the press release highlighted ChargePoint’s domestic production expansion through a facility that is expected to produce 10,000 DC fast chargers and 10,000 Level 2 chargers (like those typically used in residences) by 2026.

The Bipartisan Infrastructure Law and Inflation Reduction Act includes support for EV charging and charging infrastructure, including $7.5 billion directly for EV charging. This latest announcement strengthens public commitment to making long-term emission reduction goals a reality.

For example, the Biden-Harris administration wants EV to make up 50% of new car sales by 2030. And states such as California plan to ban the sale of internal combustion vehicles by 2035.

With more than 210,000 activated ports, ChargePoint is an industry leader in EV charging in North America and Europe. The company has been investing heavily in expanding its DC fast charging and now sports a network of 16,700 DC ports. To illustrate the pace of ChargePoint’s growth, consider that the company had just over 2,200 DC ports in June 2021, which grew to 11,000 DC ports and 163,000 total ports in December 2021.

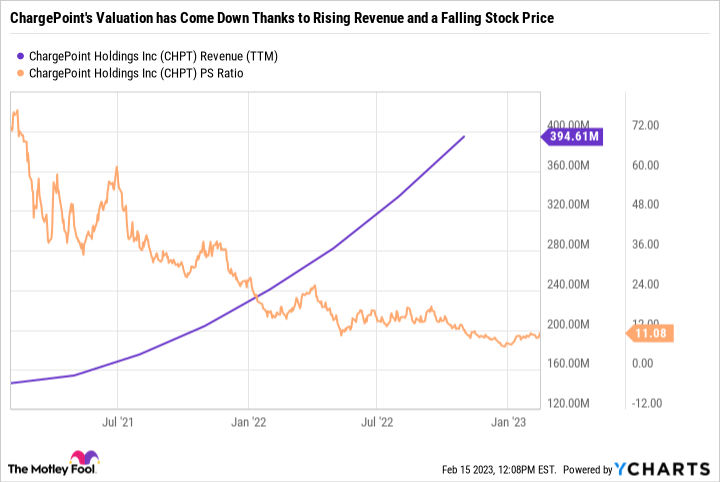

ChargePoint stock remains expensive. But as the stock price has languished and sales have spiked, its valuation has also come down. What’s more, the company expects to be cash flow positive by Q4 of calendar year 2024.

CHPT Revenue (TTM) data by YCharts

All told, ChargePoint is an exciting hypergrowth stock in a rapidly evolving industry that is worth a look for risk-tolerant investors.

A bull market is coming for infrastructure stocks

Lee Samaha (Bentley Systems): Management describes Bentley as “The Infrastructure Engineering Software Company.” It’s a succinct description that also serves to highlight the investment case for the stock. There are three key growth drivers for the company, and the good news is they are all mainly secular trends, meaning they are somewhat independent of the economy’s direction.

Bentley provides software solutions that help architecture, engineering, and construction customers design, construct, and maintain projects. The word “maintain” should not be taken lightly, because construction and infrastructure projects tend to require decades of maintenance.

The case for buying the stock rests on the following:

- The potential for significant global spending on infrastructure, including the $1.2 trillion infrastructure bill.

- Increasing use of digitization infrastructure construction.

- Closely connected with increased digitization is the opportunity for so-called “digital twin” technology to revolutionize a project’s design, construction, and long-term maintenance.

Traditionally, infrastructure projects have involved multiple contractors working on major projects, all keeping data in physical files that are stored disparately. With digital technology, the data can be collated and used to manage projects better, eliminating costly overruns and waste.

For example, consider the logistics involved in designing and constructing a high-rise building in the middle of a business city. Moreover, the creation of digital copies (twins) of physical assets allows them to be modeled digitally using real-time physical data to improve maintenance over many decades.

The benefits are significant, and Bentley Systems is the leader in its class, with plenty of growth potential over the next decade.