Bet_Noire

Author’s Note: This article was previously published on iREIT on Alpha and Dividend Kings.

Dear subscribers,

I’m fairly contrarian in nature. When everyone else seems to be dancing with joy at the amazing numbers they’re seeing in their portfolios YTD, I’m taking a step back and surveying the market with the care of a doctor looking for symptoms of illness.

Being a value investor is not synonymous with being uncaring about short-term losses. In fact, this article should “prove” to you that I am anything but when it comes to this.

But let’s not waste time here – let me show you and explain to you what exactly I mean, from a macro perspective.

What we’ve seen YTD

I don’t often write macro-oriented articles such as this one. Usually, it takes something very specific.

I too have seen impressive performance YTD. My portfolio is up almost 14.5% including paid dividends and options premiums since the 1st of January 2023. Sweden and Europe especially have been on an absolute tear, with Sweden and the OMX almost up 14% YTD, but most stock markets in the world are showing impressive numbers.

Just as when a company or a market drops down to extreme levels, and I ask myself “is this justified”, so do I take a step back here and ask myself if this is justified?

In Sweden specifically, we’ve seen bull rushes like these twice in the past 10 years – once in 2015, and once in 2019. Historicals are useless here because for one year, that year ended with a 10% RoR and the other at 35% RoR. There are no good historical proxies of what might happen here due to the overall macro uncertainty we’re currently in.

So what is driving this?

1. The assumption that we’ve seen “top inflation”.

The current assumption the markets seem to be working under is that we’ve seen inflation reach the heights that it’s going to be and that they are of inflation is going to be declining – perhaps even quickly – to more normal levels in the coming few months. This is a view that seems to be gaining some traction among central banks in the west.

I believe this assumption to be dangerous, and potentially false, because if we’re looking at core inflation numbers (where volatile energy prices are accounted for), it seems extremely dubious that’s going to be as quick as that.

2. Lower pace in inflation means that many believe we’ve seen “top interest rates”

This goes hand-in-hand with top inflation. The assumption seems to be that most central banks are “dying” to stop increasing rates – and indeed, some national sentiments seem to echo this. And this is despite most central banks actually, and clearly, flagging for further increases. The joyous bounces in stock market numbers have been despite such messages – it seems to be based on a very dovish interpretation of not only the FED but of European central banks as well.

It’s my clear stance that most investors and the market seem to be overinterpreting these signals on the positive side. This is false.

3. There is no European Energy Crisis

This one was an “easy” one for me to debunk when it actually was spoken about. I never believed there to be an energy crisis in the sense that we would run out of power, natgas, or resources in the sense that Russian propaganda has been depicting. (Source 1) (Source 2)

What we have seen however is incredible volatility and energy price increases which have struck European households to where now over 7% of European households can’t pay their energy bills even in better times (Source), and an ever-increasing number of loans are in NPL status (stage 2), and currently, one of three European households is expecting to miss at least one bill payment the next 12 months. (Source, page 5)

So, we didn’t have Europeans dying of cold in the street because we have no electricity or gas – but to go ahead and say that the difficulties are over, that’s again going a step too far.

Guess what – the war with Russia is still ongoing. And it’s not going anywhere. As someone with extensive political experience in this part of the world, I do not see any quick or expedient way, even if the war ended today, for Russia to rejoin what we would consider the “rest of the world”. Companies would still stay outside, and we would need to see what happens with sanctions and how Russia would have to repair what it has done – but I don’t think it would be easy.

4. China is back in business

Obviously, China doing a 180 on its COVID-19 strategy is also contributing to this. The nation has let go of restrictions and is opening up again, and many investors are expecting a return to “growth normalcy” here. I don’t think that’s on the table as positively as people seem to think, and I think China’s troubles, with its property sector, the current geopolitical situation, and ancillary troubles are still very much there.

Of course, I’m not really invested in China as such – I don’t own any Chinese companies in any of my current portfolios, nor do I have plans to do so. However, even without this, the way China goes still has major impact on the overall macro and how things go in the rest of the world – especially on the stock market.

What’s the problem with what we’re seeing

The problem is essentially doing a 36-hour shift at your job, then taking a massive injection of Caffeine and suddenly thinking that “oh, this is great – I can do another 36!”

Not so much.

Just because we’ve seen some signs that the peak inflation has been reached does not equate to the central banks suddenly halting interest rate hikes, or that inflation will drop down as far or as fast as we saw it rise. Typically, inflation decline takes far longer than it rising. That’s the reason central banks usually want to be out ahead, and that’s the reason why communication regarding inflation expectations and cycles is done so carefully – those in charge know that once it’s talked about, it’s a cycle that can pretty much start feeding off itself.

I’m watching Core inflation numbers, and from a broader perspective, things have absolutely gone nowhere.

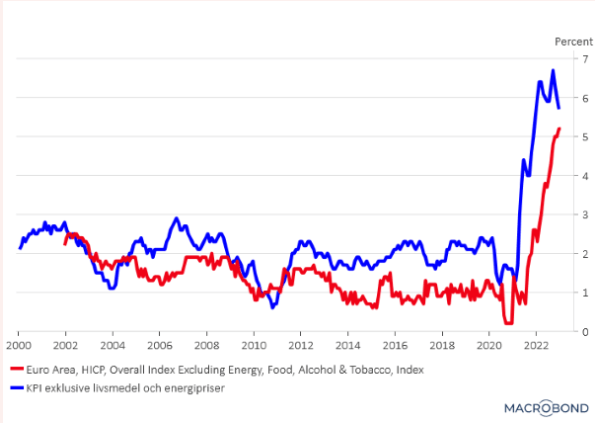

KPI/Inflation/EUR/USD (Macrobond)

Blue is KPI excluding food/necessities and energy prices, the corresponding metric. We’re up on a mountain – and even if we drop one or even two percent here, we’re far from where most central banks want to be.

It’s also unclear whether we’re really “in” for a soft landing in terms of economic growth. The economic pressure on the majority of western-world households remains hard, and forecast levels, generally speaking, are very low, which is a real threat against the coming numbers in terms of employment/jobs and related metrics. The central banks are hoping the job market is going to be cooling off, but the current state here, coupled with the inflation, interest rates, and a property sector in trouble in most nations, is really something to watch.

Now, before January and back in October, I would have said that the market is too far on the other side. Back then, the view was excessively bearish, and I was investing every cent I could get my hands on. That paid off today. Since mid-January though, I’ve really cooled off on things in terms of Macro.

Remember, we’re in mid-earnings season. Not just any earnings seasons, but companies are posting annuals. It’s relatively typical, historically speaking, that a bullish run will be intensified by a slew of companies beating expectations – and we’ve seen that across not just one, but multiple sectors, as well as from many companies. Let’s remember that it’s not unusual that companies do beat estimates, because most estimates, especially now, are set with a very low bar.

To say that just because these companies are doing well, or because there are some signals that things are perhaps cooling down, that things are suddenly fine, is a false equivalency. It’s a real problem, and it’s what I see on the market today.

Now, let me be clear: I’m not saying 2023 will be a repeat of 2022.

I think overall, we’re in for a year of some recovery, unless things really turn sour somewhere along the line. However, this sort of massive push that has seen some parts of my portfolio and some sectors up nearly 23% in a single month, that’s just…odd.

And to me, it’s a very good example of market overreaction in the exact opposite way.

How to handle it

Well, I can tell you how I handle it.

I’m trimming.

Yep, that’s right. I don’t often do this, but this time, I’m actually harvesting profits in my portfolio with the precision of a Bonsai gardener. I’m talking about companies that might have gone up too quickly or companies where much of the original upside has really been seen in the short term.

Examples?

Sure – Allianz (OTCPK:ALIZY) and Munich RE (OTCPK:MURGY).

None of these companies are bad businesses, and none of them are “excessively overvalued”, but the valuation history here is very clear. Both of them have trouble rising above the levels where they’ve been trading here – and being that I’m up extremely on both, this is where I start harvesting profits.

Every position needs to justify its existence in my portfolio.

I want an upside. I want good yield, good safety, and good forecasts.

I don’t want companies where a bullish thesis is based on “flat” growth for the next 2-3 years, along with a 3-4% dividend. That’s not good enough for me.

I’m an active value investor, and I’m not tied to any of my investments.

I’ll “kill” a position if my math says I should and push that capital to work elsewhere. There are literally hundreds of qualitative, dividend-paying conservative businesses in the western world. Hundreds.

And I cover, or know a fair share of them, in many sectors. My coverage spectrum means that I’m capable of seeing trends with greater granularity and efficiency than analysts I know mostly cover a single sector. I’m not saying that’s a bad way to go, and my contact list is full of experts in singular fields I can speak to if I have a question about the German chemicals sector, the French Real Estate sector, or the Scandinavian consumer staples sector. But personally, I’m higher-level in my approach – and it works for me.

That’s one reason I was so confident in not investing in tech when it was in a bubble, and it’s the reason I’m so heavily invested in the communications sector at this time. It was the reason I was able to forecast European outperformance and financial outperformance a year ago.

I’ve made many mistakes on the way, of course, ignoring sectors that I shouldn’t have ignored (and I’m always learning as I go along). The clearest miscalculation was not going into energy/oil when the sector was down in the dumps. This is a mistake I don’t mean to repeat for any sector, regardless of what sector that is – even “growth tech”.

My career as an analyst has taught me, alongside my investment history and performance, that spotting undervaluation in a sector or a market is entirely possible. So is spotting overvaluation, or a dangerous set of trends – such as the ones we’re currently in.

I wrote an article this week on some of my favorite REITs I’m still buying – and I urge you to read that one because it illustrates the points that I’m making here fairly well.

I’m not ceasing to invest – I’m just extremely picky about where I go with my capital at this point. And it might very well be that this article is maybe 1-2 months too early – this bullish run might go on well into March.

But I don’t believe it will – I believe we’re in for a contrarian shock to the downside.

Wrapping Up

The macro-level valuation trends I follow in the literally hundreds of companies I look at tell me one thing: Valuations are too high for where North America, Europe, and Asia are currently in terms of inflation, interest rates, and macro. This requires correction.

A correction will come, as I see it.

Out of hundreds of aforementioned companies, less than 45 are now truly “investable”. That’s the first time in over 6 months that this has been the case.

A month or three ago, I would have said that you can throw a wad of cash on the market, and you’re likely to hit undervalued equity. Now I say you need to approach investments with far more precision to secure good returns.

I will try to do my best to inform you of my approach to these changes.

I will highlight companies, be as clear as possible about trimming and cutting and answer questions and queries to the best of my ability.

This is a time to stay safe in the market, not a time to go hay wild and follow the masses, which seem to be moving towards heavy investing in a market they see going up more.

Questions?

Let me know!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.