Table of Content

Show more

Show less

China is the second largest and one of the fastest-growing economies in the world but has largely failed to capture the attention of overseas investors.

Yet it boasts global corporate giants such as Tencent and Alibaba, and is forecast to have the third-highest growth in gross domestic product (GDP) over the next few years, according to the latest figures from the OECD.

Although the country’s zero-covid policy weighed on stock market valuations, the eventual lifting of restrictions has fuelled a near 20% rise in the CSI 300, China’s leading large-cap index, over the last three months.

Geopolitical and regulatory concerns are likely to remain on the radar, particularly given tensions with the US and neighbouring Taiwan. That said, China may offer an attractive investment opportunity for investors looking to diversify their portfolios.

We’re going to take a look at some of the benefits and risks of investing in China, together with the wider outlook for the sector.

Remember that investing is speculative and your capital is at risk. It is possible to lose some or all of your money.

How has the sector performed?

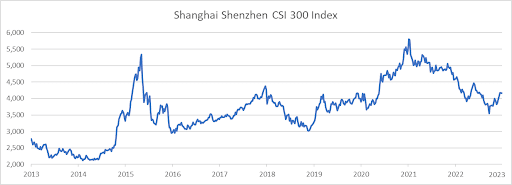

After an impressive bull run, the Chinese stock markets crashed in 2015 during the two days coined ‘Black Monday and Tuesday’. However, they steadily recovered their losses over the following years, as shown below.

By 2021, the CSI 300, the 300 largest-cap stocks traded on the Shanghai and Shenzhen stock exchanges, hit an all-time high of over 5,800. However, share prices started to head downwards again as a number of factors conspired to dampen investor appetite.

Darius McDermott, managing director of FundCalibre, comments: “We had government intervention in a number of sectors such as technology and education, which – coupled with ongoing concerns about the property market and further strict covid lockdowns – led to widespread falls in share values.”

As a result, the Greater China fund sector has delivered a five-year return of just over 10%, compared to 50% for the global equity sector, according to Trustnet.

The turning point came in late 2022, when the Chinese government abandoned its zero-covid policy and reopened its borders. This was the catalyst for a rebound in stock markets, with Chinese funds delivering an average return of 24% over the last three months, by far the highest across the sectors.

Why invest in China?

China is the second-largest economy in the world thanks to its exponential growth, with the World Bank reporting that GDP reached $17 trillion in 2021. To put this in context, it’s over five times the UK’s output and dwarfs Japan, the third-highest.

It’s also home to some of the largest global companies. Tech giant Tencent is the 11th largest company in the world by market capitalisation, with a current value of $460 billion. And drinks manufacturer Kweichow Moutai and e-commerce leviathan Alibaba aren’t far behind.

Although exports have played a key role in China’s economic success, it also has a burgeoning domestic economy. Dale Nicholls, portfolio manager of the Fidelity China Special Situations investment trust, points to a potential boost to consumption from the ¥30 trillion in household savings built up over the last three years.

And while there is still uncertainty over the future direction of government policy, the threat of further anti-corporation regulations seems to be receding.

Mr McDermott comments: “The government is working towards common prosperity but it can significantly impact share prices. We think there will be less of this intervention in the coming months as the government wants to get the economy back on track.”

Dzmitry Lipski, head of funds research at interactive investor, adds: “In contrast to major developed economies at the moment, inflation is not a key concern for China, and this allows the government to implement more accommodative monetary and fiscal policy measures.

“For these reasons, the recovery in Chinese equities should continue, considering relatively cheap valuations.”

What are the drawbacks of investing in China?

One of the key risks of investing in China is the regulatory environment. The Chinese government introduced a raft of heavy-duty regulations against technology firms in 2020, amid concerns over their influence.

The ‘Big Tech Crackdown’ led to swingeing fines, with the highest-profile casualty being Alibaba, hit for a landmark $2.8 billion fine on anti-monopoly grounds.

Investors may also have concerns over the country’s political regime, including the future direction of policy under President Xi Jinping and fragile relations with the US and Europe.

Juliet Schooling Latter, research director at FundCalibre, comments: “Geo-political tensions are still high, but the rhetoric has been scaled down a bit. We’ve had a handshake between Biden and Xi, and there is the potential for a more pro-China party to come into power in Taiwan in its 2024 elections, so China upsetting its neighbours, at least immediately, is seeming like less of a concern.”

However, she adds: “Some of the damage has already been done with some manufacturing capabilities having been shifted away from China to more friendly nations: ‘friend-shoring’ is replacing offshoring.”

In addition, the US has warned Chinese companies that they may be de-listed from US stock exchanges if Beijing prevents regulators from reviewing audit records. This would substantially reduce the liquidity of Chinese shares, and have a knock-on effect on valuations.

What are the options for investing in China?

There are a range of options available, from investing in individual Chinese companies to broader-based Chinese and Asian funds.

1. Investing in Chinese companies

Chinese companies can issue different classes of shares, depending on where they’re listed and which investors are allowed to own them. There are two main options for UK investors wanting to buy shares in Chinese companies:

- shares that are dual-listed on a US stock exchange, such as retailers Alibaba and JD.com

- American Depository Receipts (ADRs), which represent a specified number of an overseas company’s shares and are denominated in US dollars, rather than renminbi. ADRs can be traded on US stock markets and include Alibaba and Tencent.

Looking at individual companies, Fidelity’s Dale Nicholls picks out Miniso Group for investors considering adding Chinese stocks to their portfolio.

Miniso is a low-cost retailer of lifestyle products with 5,000 stores globally, including in New York, London and Paris. Its share price has more than doubled over the past year, thanks to impressive growth in revenue and profits.

The company has a franchise-owned, company-operated retail model, meaning that Miniso retains operational responsibility for its stores. Mr Nicholls comments: “The company’s unique quasi-direct retail model enables fast store expansion, no upfront capital expenditure and strong operation control at store level including inventory ownership.

“Its recent better-than-expected results demonstrated good execution in brand and product upgrades, overseas business expansion and efficiency in cost savings.”

Another company worthy of consideration is wealth management service provider Noah Holdings. The company offers ‘one-stop shop’ advisory services for high net-worth individuals, with offices in China, Hong Kong, Singapore and the US.

Mr Nicholls comments: “We’ve been holding leading wealth and asset-management service provider Noah Holdings, a key beneficiary of significant wealth growth and the increasing number of high net-worth individuals in China.

“While the company’s business remains challenging in the near term given the weak market, its balance sheet remains strong, and the high private equity product mix will help management fee income. Noah’s core underlying strengths include trust from its client base in addition to its capable distribution team.”

2. Investing in Chinese funds

Investing in Chinese funds provides investors with exposure to the sector through a ready-made, diversified portfolio of shares. Investors have the choice of actively-managed ‘stock-picking’ funds or passively-managed ‘tracker’ funds.

interactive investor’s Mr Lipski picks the Fidelity China Special Situations Trust which provides diversified exposure to stocks listed in both China and Hong Kong. He comments: “Dale Nicholls [at the Fidelity China Special Situations investment trust] focuses on faster-growing, consumer-orientated companies with robust cash flows and capable management teams.

“Due to the trust’s single country exposure, its bias to small and mid-sized companies and its ability to use gearing, its return profile is likely to be more volatile, making it higher-risk and an adventurous holding in a well-diversified portfolio.”

The trust has achieved a five-year return of 30% compared to a 29% return for the sector, according to Trustnet. It has also performed particularly well in the last three months, delivering a top-quartile return of more than 50%.

FundCalibre’s Juliet Schooling Latter highlights the Invesco China Equity fund, commenting: “This is one of the best-performing Chinese equity funds over the past 12 months.

“The manager aims to identify companies with a competitive advantage and sustainable leadership and specifically targets those he feels are undervalued by about 25-30%. He will then hold them with the expectation they will reach fair value over a three to five-year time horizon.”

The trust has achieved a five-year return of 11%, in line with the wider sector, according to Trustnet, together with a top-quartile return of 34% over the last three months.

For investors looking for a broader fund with some Chinese exposure, Mr Lipski picks the Fidelity Asia and Guinness Asian Equity Income funds, in addition to the JPMorgan Emerging Markets Trust.

What’s the outlook for investing in China?

The reopening of the Chinese economy is expected to have a positive impact on equity investments. Although a global economic slowdown could hit the country’s exports, consumption is forecast to recover strongly in the home market.

Mr Lipski comments: “Overall, the long-term case for investing in China’s growth story remains intact. The growth of the middle class and the refocusing of China’s economy towards domestic consumption are expected to be key drivers of economic growth and the stock market in coming years.”

FundCalibre’s Mr McDermott agrees: “The subsequent faster-than-expected reopening of the economy, coupled with attractive valuations, means China has become interesting again.

“Economic growth has slowed but is still stronger than the West, inflation is lower, geopolitical tensions for now seem to have peaked, and the stock market, as well as being cheap, is home to a plethora of investment opportunities.”

Mr Lipski adds: “As China is increasingly recognised as being a major driver of global growth, investors should consider having exposure to China when building a balanced portfolio. China currently represents nearly 18% of world GDP but only 5% of world market capitalisation.”