To print this article, all you need is to be registered or login on Mondaq.com.

Real estate investment trusts (“FIBRAs”) are

structured financing vehicles that-by means of the contribution

(whether direct or indirect) of a certain real estate portfolio to

the corresponding trust estate and their subsequent issuance and

offering of real estate trust certificates (“CBFIs”) in

the Mexican stock market-are used to raise funds for investing in

(i) real estate development, commercialization or

management; (ii) companies that carry out such

investments; (iii) securities or rights of any kind over

such real estate assets; or (iv) a combination of any of

the foregoing.

FIBRAs emerged at the end of 2003 as a result of tax law

amendments to attract investment in large-scale real estate

projects. As a result, FIBRAs became an attractive asset class

especially for those investors (e.g., retail investors or

institutional investors such as Afores, insurance companies and

surety companies) who wanted to diversify their investments safely

and securely. Additionally, investment returns related to FIBRAs

are easily predicted given that FIBRAs are engaged in the

acquisition or development of real estate assets for subsequent

leasing purposes, which makes investment returns fixed or even

increased by the revaluation of the underlying assets of the

issuing trust of the CBFIs.

FIBRAs became popular in the stock market as an alternative to

traditional investment schemes. Moreover, FIBRAs offer several

benefits (especially regarding taxation) both for the settlor that

transfers the real estate to the equity trust and for the CBFI

holders. Benefits include:

- FIBRAs offer a way to diversify investment portfolios and

consequently reduce risk. - FIBRAs are obligated to allocate to investors (i.e.,

CBFI holders) 95% of the taxable income (resultado

fiscal), at least on a yearly basis, and to keep at least 70%

of the trusts’ assets invested in real estate assets that

comply with local legal and regulatory provisions. - FIBRAs’ taxable basis (base gravable) consists

only of taxable profits (contrary to what would apply to

traditional companies, where the gross profit is the taxable basis

for income tax purposes). Therefore, the distributable cash

available to the CBFI holders is higher considering that the amount

has not been taxed prior to such allocation. - The withholding rate for cash flow distributions (dividends)

made by FIBRAs to foreign investors is equivalent to the

traditional corporate withholding rate, with certain

exceptions. - Capital profits derived from the price increase of the CBFIs

are exempt from income tax provided that the CBFIs are sold through

an authorized stock exchange in Mexico. - FIBRAs offer direct exposure to assets that are historically

developed to increase their value over time (capital gains). - CBFIs are governed by securities issuance regulations and have

a high standard of corporate governance.

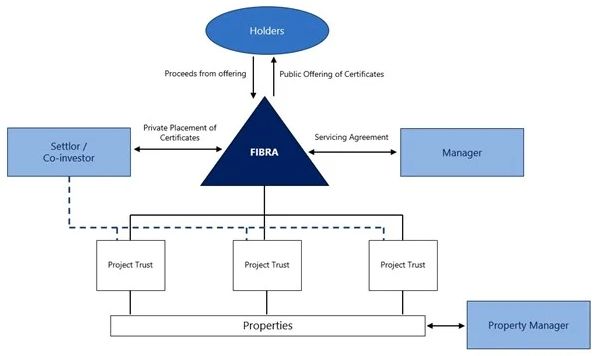

FIBRA typical structure1

Footnotes

1 It is not necessary for the FIBRA Manager to be an

entity external to the vehicle itself. In recent issuances of CBFIs

carried out by a FIBRA, some structures with an

“internalized” Manager have been adopted, which has

additional benefits and challenges.

Visit us at

mayerbrown.com

Mayer Brown is a global legal services provider

comprising legal practices that are separate entities (the

“Mayer Brown Practices”). The Mayer Brown Practices are:

Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited

liability partnerships established in Illinois USA; Mayer Brown

International LLP, a limited liability partnership incorporated in

England and Wales (authorized and regulated by the Solicitors

Regulation Authority and registered in England and Wales number OC

303359); Mayer Brown, a SELAS established in France; Mayer Brown

JSM, a Hong Kong partnership and its associated entities in Asia;

and Tauil & Chequer Advogados, a Brazilian law partnership with

which Mayer Brown is associated. “Mayer Brown” and the

Mayer Brown logo are the trademarks of the Mayer Brown Practices in

their respective jurisdictions.

© Copyright 2020. The Mayer Brown Practices. All rights

reserved.

This

Mayer Brown article provides information and comments on legal

issues and developments of interest. The foregoing is not a

comprehensive treatment of the subject matter covered and is not

intended to provide legal advice. Readers should seek specific

legal advice before taking any action with respect to the matters

discussed herein.

POPULAR ARTICLES ON: Finance and Banking from United States