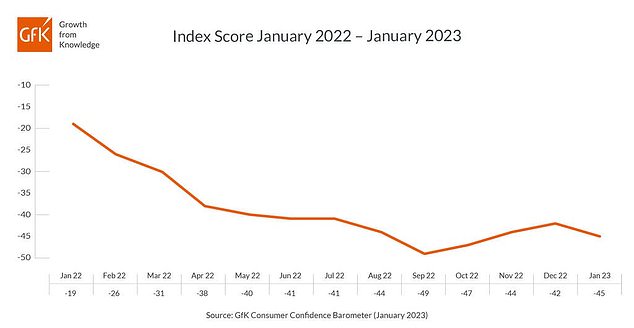

UK consumer confidence drops to near-historic lows amid double-digit inflation and soaring energy prices

- GfK’s monthly Consumer Confidence Index fell by 4 points to -45 in January

- This was only four points above the record low of -49 recorded in September

- Consumer incomes have been hit by record energy bills and rising food prices

Consumer sentiment has fallen close to its historic nadir as steep inflation and sky-high energy bills continued to foster rampant pessimism across the UK.

GfK’s monthly Consumer Confidence Index, a long-running measure of how Britons view their personal finances and the overall economy, declined to -45 in January, a three-point drop from the previous month.

This was only four points above the record low of -49 registered in September just before a controversial ‘mini-budget’ that caused widespread panic in the markets, but 19 points below the same month last year.

Downturn: Figures released by the ONS revealed that retail sales volumes in the UK decreased again last month as shoppers became increasingly conscious about buying festive items

Confidence in the general economy over the past 12 months remained sharply depressed, contracting by another 5 points from December to -71, while the outlook for individual finances across the same period fell to -31.

Meanwhile, the index for major purchases, a measure of confidence in acquiring big-ticket items, shrank by six points to -40, representing a 30-point slump on January 2022.

Joe Staton, GfK’s client strategy director, remarked: ‘Consumers have a New Year hangover – but it’s of the economic kind – with high levels of pessimism over the state of the wider economy. And unlike a conventional hangover, this one won’t vanish quickly.’

Figures released by the Office for National Statistics on Friday revealed that retail sales volumes in the UK decreased again last month as price hikes made shoppers increasingly conscious about buying festive items.

December saw food prices expand at their fastest pace since 1977, with the cost of basic staples like milk, cheese and eggs experiencing the biggest rises.

Consumer incomes have been further squeezed by record energy bills, which have skyrocketed in response to Russia’s full-scale invasion of Ukraine and the relaxation of Covid-19 restrictions.

Pessimism: GfK’s monthly Consumer Confidence Index, a long-running measure of how Britons view their personal finances and the overall economy, declined to -45 in January

As part of the UK Government’s Energy Price Guarantee, a household consuming a ‘typical’ amount of gas and electricity will incur a maximum annual charge of £2,500. From April, however, this sum is set to grow by another £500 to £3,000.

Staton added: ‘With inflation continuing to swallow up pay rises, and the prospect of some shocking energy bills landing soon, the forecast for consumer confidence this year is not looking good.

‘One thing we can be sure of is that 2023 promises to be a bumpy ride.’

The Bank of England has implemented nine successive base rate increases yet is likely to implement another hike next month, given the UK inflation rate remains at 10.5 per cent, far above the central bank’s target rate of 2 per cent.

Its governor, Andrew Bailey, told Media Wales yesterday that inflation was likely to ‘fall quite rapidly’ during 2023 because of waning energy prices.

His comments were echoed by consultancy group Cornwall Insight, which now estimates yearly energy bills will plunge to approximately £2,200 from July, about £300 lower than it had previously forecast.

Advertisement