(Bloomberg) — European nations pushing for joint borrowing to fund shared projects have long been stymied by German opposition.

But the German government has its own bogeyman in the form of the Federal Constitutional Court. Leaning on the judges’ aversion to new liabilities has become a habit, with German leaders citing it both in public and private to slap down their neighbors’ enthusiasm for tackling shared problems together.

Vladimir Putin’s maneuvering on the continent’s doorstep has focused European officials on what may be the most imminent of these problems — and the most expensive. Beefing up European Union security to deter Russia comes with a price tag that starts at €100 billion ($108 billion), according to Kaja Kallas, the EU’s top diplomat-elect.

The true cost of putting the continent on a surer military footing may run to two or three times that number, according to a senior defense official who asked not to be named when discussing confidential matters of strategy.

In that context it helps the leaders of the bloc’s richest and, at times, most frugal country to blame the judges. It’s a convincing case to make: after all, this is the same body that sent the economy into a tailspin when in November it torpedoed the government’s budget plans.

If Donald Trump — who’s vocally criticized Europe’s reliance on US military largesse — clinches November’s election, this refusal to consider issuing joint debt to ramp up defense capabilities would constitute a dangerous complacency, according to Moritz Schularick, head of the Kiel Institute for World Economy.

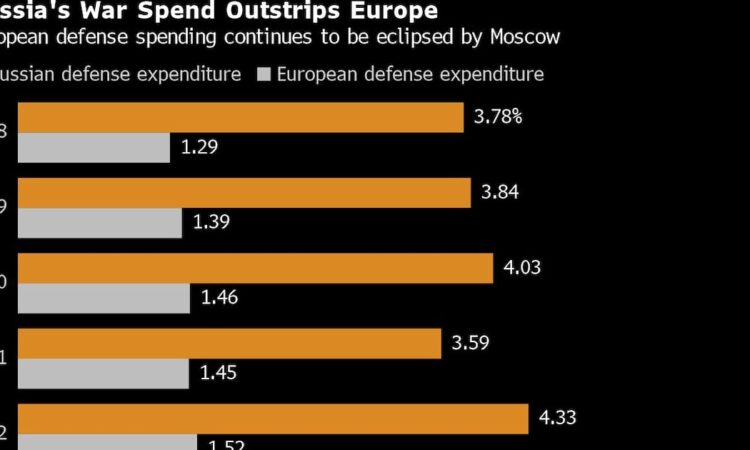

“German budget policy is currently a security risk for Europe,” he said. The continent’s lack of preparedness was laid bare by Russia’s 2022 invasion of Ukraine, and while countries have raced to build up their individual defense capabilities, continent-wide proposals have gained limited traction — despite the high stakes.

In Germany, the obstacles extend beyond the jurisdiction of the court in Karlsruhe. “Party political considerations certainly play a role,” Schularick added.

It doesn’t help the EU’s prospects of raising the debt that the country’s Finance Minister Christian Lindner is himself adamantly opposed. And on this issue, at least, he and his coalition partner the chancellor seem to be aligned.

“I had one concern,” Scholz told reporters in June, after meeting fellow European leaders. “Do I want to accept that we issue sovereign bonds, so-called eurobonds, for defense financing? The answer is no.”

Thin Ground

While Spain’s economy minister Carlos Cuerpo told Bloomberg earlier this year that the EU ought to be able to find a mechanism that’s acceptable to the red-robed judges in Karlsruhe, legal experts from inside the country aren’t so sure.

The first session of the new EU parliament in Strasbourg last week revitalized the question of whether Germany’s top court could be persuaded to play along. And Poland, one of the bloc’s top contributors on defense, is planning to put joint borrowing for that purpose on the agenda when it takes over the EU’s rotating presidency in January.

“I would be careful with any predictions on how the federal constitutional court would judge this case,“ said Cornelia Manger-Nestler, a law professor at HTWK Leipzig University of Applied Sciences. “With regard to defense, there are only very vague powers at the EU level. It’s all on extremely thin ground.”

The federal constitutional court in Karlsruhe has a long tradition of policing the limits of Germany’s contributions to multinational debt raises. During the financial crisis almost every step to rescue the euro landed before the judges.

While the government formally won all those cases, the judges regularly voiced objections and attached strings to give the national parliament more say, in cases that came to be known as the “yes, but” rulings.

The closest direct precedent to the proposals Putin’s warier neighbors are putting on the table lies in the bloc’s €800 billion pandemic fund. Yet replicating a vehicle that depended on a rule covering natural disaster-like emergencies wouldn’t be appropriate to the question of European security, according to Manger-Nestler.

She and constitutional law professor Alexander Thiele, who teaches at the Berlin-based BSP Business and Law School, both agreed in separate Bloomberg interviews that the EU’s industrial policy competence would be a more plausible basis, as that’s an area where Brussels has jurisdiction. The bloc could rely on that to set up its own defense industry, though such an approach might not go uncontested either.

And both said that would only be half of the battle. The industry-policy power merely provides for where the EU can spend its money. The question how it raises those funds is a separate issue altogether.

“The EU’s ability to raise debt is highly controversial because there’s no explicit power to do so in the treaties,” said Thiele. “Raising debt must always be justified on a case-by-case basis.”

The top court’s 2022 ruling clearing Germany’s participation in the EU’s pandemic fund already stretched the judges’ limits, according to Thiele. Then a year later the judges shocked everyone by striking down a special budget vehicle designed to get around the country’s tight borrowing restrictions — a case in which he unsuccessfully defended the German government.

That blow shows the judges are tending toward an increasingly restrictive view on fiscal rules, he added.

“It was already wobbly” with the pandemic fund, Thiele said. Now, “there’s the risk that the constitutional court will say: wait a minute, you can’t increase the debt every few years.”

Legal Trick

Matthias Ruffert, a professor at Berlins Humboldt University, has been very critical about the legal “trick” used to set up the pandemic fund, which essentially involved declaring the loans to be another form of EU revenue. Yet, he said, opposition is now pointless.

“The court has ruled that it’s possible as long as the funds don’t exceed the EU budget in the multi-annual financial framework,” Ruffert said. “If you look at that seven-year plan, which ends in 2028, there is still room for improvement — €100 billion would not go beyond that.”

Still, that would need the ratification of all member states — something that could take too long to prevent grave setbacks for Ukraine in the war with Russia. He argued that other funding mechanisms that don’t rely on debt could be faster: like the European Peace Facility, an instrument into which member states directly pay in money.

Such an approach might also appease Lindner, Germany’s finance minister, who has said he’s opposing joint debt for both, political and legal reasons.

“Communitization of risks, liabilities and debt doesn’t contribute to stability and therefore Germany won’t support it,” he told reporters in Brussels last week.

His European colleagues aren’t backing down. At the same Brussels gathering of finance ministers, the EU’s Economy Commissioner Paolo Gentiloni said: “We have to start a discussion on the possibility of new common tools, of common funding. And that means raising resources in financial markets.”

–With assistance from Arne Delfs, Michael Nienaber, Marilen Martin, Sonja Wind and Alberto Nardelli.

©2024 Bloomberg L.P.