Introduction

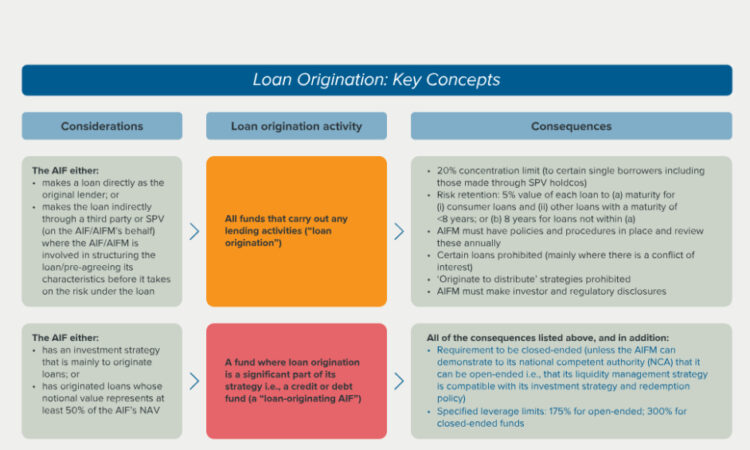

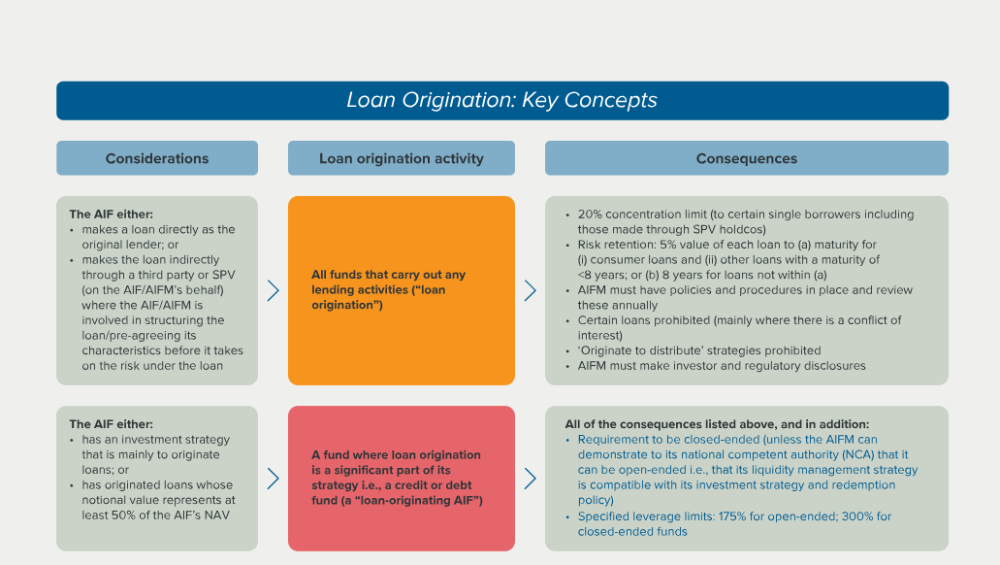

The revised Alternative Investment Fund Managers Directive (AIFMD2) introduces new requirements for funds

managed by EU-based alternative investment fund managers (AIFMs)

that originate loans.

Most of the requirements apply to AIFMs that manage any fund

that originates loans, even on an occasional basis. Additional and

more stringent requirements apply to AIFMs who manage funds that

originate loans (“loan-originating AIFs”) as their

principal activity or investment strategy, i.e., a credit or debt

fund.

The table below identifies the differences between the two types

of funds. AIFMs will need to assess a fund’s categorisation and

whether the fund is closed or open-ended (which may not be obvious

in some cases, for instance semi-open-ended funds) on a

case-by-case basis.

The new requirements are designed to ensure stability and

integrity of the financial system and to introduce proportionate

safeguards.

Timing

Member states have to implement AIFMD2 by 16 April 2026, and the

Annex IV reporting template will take effect a year later, on 16

April 2027. Transitional provisions apply in some cases.

Impact of a Loan Origination Framework

The AIFMD2 changes will allow an AIFM to act for a fund

established in one member state to lend to borrowers in another

member state. The AIF is the originating entity, while the AIFM

acts on its behalf in arranging the loans for which the AIF becomes

the lender.

Although the AIFMD2 loan origination provisions are described as

a harmonising measure, they do not, in our view, create a lending

passport for AIFs; the AIFMD passporting rights apply to AIFMs and

not to the AIFs, which are the usual lenders. Moreover, member

states are free to introduce requirements that are more

restrictive, which include prohibiting AIFs from granting loans to

and servicing credit for individual consumers. Therefore, national

frameworks for product lending may continue to apply. Notably, a

member state will still be free to impose loan origination

requirements on non-EU AIFMs and AIFs marketed in that member

state.

These provisions apply whether or not the AIF is marketed to

professional and retail investors or only to professional

investors. For an EU AIF that is a European Long-Term Investment

Fund (ELTIF), European Venture Capital Fund (EuVECA), or European

Social Entrepreneurship Fund (EuSEF), the other applicable

regulatory restrictions and conditions will apply in addition to

those under AIFMD2.

Requirements and Restrictions

The table below sets out the key requirements: for any AIF that

carries on lending activities, only the requirements shaded green

apply; for those AIFMs of AIFs that are ‘loan-originating’

AIFs, the rules shaded yellow apply in addition to those shaded

green.

| Regulatory requirement | Obligations |

| Restrictions on open-ended funds |

A loan-originating AIF can be open-ended only if the AIFM can

Open-ended loan-originating AIFs will also be subject to the new

|

| Specified leverage limits |

Limits are 175% for open-ended funds and 300% for closed-ended

There are rectification provisions should caps be breached

There is a carve-out for shareholder loans (see below).

|

| Policies and procedures |

AIFMs must have effective and proportionate policies,

There is a carve-out for shareholder loans (see below).

We would expect many EU managers to already have procedures in

This is designed to mitigate risks to financial stability and

|

| Concentration limit |

This is a 20% limit on loans to a single borrower if that

The limit includes loans made through a special purpose vehicle

The limit applies after a ramp-up period of up to 24 months from

This diversification requirement is designed to contain the risk

|

| Risk retention |

An AIF has to retain at least 5% of the notional value of loans

For originated loans whose maturity is up to eight years (and

Various carve-outs apply (but there is no exemption for

This is to avert moral hazard and maintain the general credit

|

| No originate-to-distribute strategy |

Member states shall prohibit AIFs that follow an

As for risk retention, this is designed with the same moral

|

| Prohibited loans |

An AIF cannot lend to its AIFM or its staff, any AIFM delegates,

This is to limit conflicts of interest. The position of AIFM

|

| Proceeds of loans |

The proceeds of loans (minus any administrative fees) must be

|

| Disclosures and reporting |

Pre-contractual investor disclosures: the costs and expenses of

Periodic investor disclosures: portfolio composition of

Regulatory reporting: total amount of leverage used by the

|

Loan Origination: Threshold Issues

The table below identifies structuring considerations that may

affect the impact of the new requirements.

| Shareholder loan carve-outs: where loans can

be so structured at the underlying level (effectively with the loan stapled to the equity), there are two helpful carve outs. |

Definition of ‘loan’: where an AIF is

not involved in the origination of loans, it should not be subject to the loan origination requirements (and, where relevant, including as a loan-originating AIF). |

|

Shareholder loans are exempt from two requirements:

The other requirements set out in the table above will still

Shareholder loans are granted by an AIF to an undertaking in

|

There is no definition of “loan,” and the likely

|

Level 2 Measures to Follow

ESMA is to determine the requirements with which a

loan-originating AIF must comply in order to maintain an open-ended

structure (regarding a sound liquidity management system, the

availability of liquid assets and stress testing, and an

appropriate redemption policy having regard to the AIF’s

liquidity profile). This is to be done by 16 April 2025. Following

the recently-published consultations on AIFMD2 liquidity management

provisions, we expect these level 2 measures to be consulted on

shortly.

Transitional Provisions and Opt-in

The transitional provisions are detailed, and some apply on a

limited basis, as set out in the table below. They will need to be

considered on a case-by-case basis and depending on the activity of

the relevant fund.

| 5-year transitional period (until April

2029) for AIFMs managing AIFs that originate loans before 16 April 2024 |

||

|

For AIFMs managing AIFs that originate loans before 16 April

|

The deemed compliance applies indefinitely for pre-existing AIFs

|

From 16 April 2029, these AIFMs have to comply only with the 20%

|

| There are provisions to allow ongoing management of

loans originated by preexisting AIFs that exceed the 20% limit to any single borrower or the leverage limits for open- and closed-ended AIFs (provided that the AIFM does not increase those values or limits during the transitional period, i.e., up to 16 April 2029). |

||

| AIFMs can choose to be subject to the new

requirements (20% single-borrower limit, leverage limits, and the requirement to be closed-ended for loan-originating AIFs) before 16 April 2029, by notifying their NCA. |

||

Case Studies

We have looked at four case studies in terms of the impact the

new rules are likely to have.

Case Study 1

| Private equity fund granting loans that

launched after 16 April 2024: an AIF that grants traditional loans to its portfolio companies or SPVs (itself or via a third party of SPV) where the notional value of originated loans is less than 50% of the AIF’s NAV |

|

|

AIFMD2 analysis

|

This AIF will be subject to the requirements shaded green in the

It is not a loan-originating AIF and is therefore not subject to

No grandfathering applies.

|

|

Main Impact

|

20% concentration limit: possible issue for an

5% risk retention (but consider if any

Policies and procedures in place and reviewed annually (note

Prohibited loans (mainly conflict situations)

Prohibition on “originate to distribute”

Proceeds of loans

Investor and regulatory disclosures

|

Case Study 2

| An open-ended debt fund that grants loans

as its principal activity that launched before 16 April 2024, and is still raising capital |

|

|

AIFMD2 analysis

|

This AIF will be subject to the requirements shaded yellow and

Some of the grandfathering rules apply.

|

|

Main Impact

|

From 16 April 2026 to 15 April 2029:

|

Case Study 3

| An open-ended debt fund that grants loans

as its principal activity that launched before 16 April 2024, and is no longer raising capital |

|

|

AIFMD2 analysis

|

As for Case Study 2, this AIF will be subject to the green- and

However, as it is no longer raising capital, all of the

|

|

Main Impact

|

No compliance with new requirements (deemed

|

Case Study 4

| A closed-end debt fund that grants

shareholder loans only (which launched before 16 April 2024, and is still raising capital) |

|

|

AIFMD2 analysis

|

This AIF will be subject to the requirements shaded yellow and

But because it grants only shareholder loans, it will benefit

|

|

Main Impact

|

From April 2026: Investor and regulatory

From 16 April 2029: 20% concentration limit

|

Please do not hesitate to speak to one of the authors of this

guide or your usual Goodwin contact if you have any questions or

want to discuss how AIFMD2 loan origination may impact your fund

structures and investments.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.