TL;DR

- If you have existing foreign currency and intend to keep it, you can consider putting your money in a foreign currency fixed deposit account.

- The best 6-month US Dollar fixed deposit rate we found was 5.05% p.a. offered by SBI, for a minimum deposit of US$25,000.

- The best 12-month US Dollar fixed deposit rate we found was 5.25% p.a. offered by SBI, for a minimum deposit of US$25,000.

- The best 3-month US Dollar fixed deposit rate we found was 5.01% p.a. offered by DBS, for a minimum deposit of US$5,000.

- While USD fixed deposit rates are higher compared to Singapore dollar fixed deposit rates, you should beware of foreign currency risk. Also, foreign currency fixed deposits are not covered by the Singapore Deposit Insurance Scheme.

What happened?

With interest rates remaining fairly high, fixed deposit (FD) has become more popular amongst those looking for a safe place to park their savings.

There are two main types of fixed deposit – foreign currency fixed deposit and Singapore dollar (SGD) fixed deposit.

Previously, we presented our guide on the best fixed deposit rates in Singapore.

However, with easing inflation leading to rising expectations that the Fed will cut interest rates, some investors in the Beansprout community have asked if USD fixed deposit rates have declined too.

Let us find out what is the best foreign currency fixed deposit rate in July 2024.

How does a foreign currency fixed deposit account work?

Fixed deposit accounts earn you a guaranteed amount of interest for the money you put in over a specific period of time.

Typically, you will lock in a sum of money and the bank will pay you interest after a fixed period.

Foreign currency fixed deposit works the same way as your usual SGD fixed deposit, except that your funds are held in foreign currency such as USD, GBP, HKD, etc.

By placing funds in a foreign currency with the bank, you will earn interest rates in that particular foreign currency.

For example, you put in USD with DBS as a foreign currency fixed deposit, and DBS will pay you interest in USD at the agreed rate.

Here are a few things you’d need to know about a foreign currency fixed deposit account

- There is a foreign currency conversion fee charged whenever you convert SGD to foreign currency and vice versa. Spoiler alert: This fee is not cheap.

- You will need a multi-currency account to deposit your funds in foreign currencies.

- You might not get a return of 4.55% if you are looking to convert your funds in foreign currency back to SGD.

The best foreign currency fixed deposit rate in Singapore (July 2024)

For your convenience, I’ve compiled a list of the fixed deposit interest rates for USD offered by banks in Singapore.

The best 12-month US Dollar fixed deposit rates in July 2024 are as follows:

| Bank | Interest rate per annum | Tenure | Minimum amount |

| State Bank of India | 5.05% | 12 months | US$25,000 |

| RHB | 5.00% | 12 months | US$5,000 |

| ICBC | 4.60% | 12 months (via e-banking) | US$500 |

| Bank of China | 4.55% | 12 months | US$2,000 |

| HL Bank | 4.48% | 12 months | US$50,000 |

| UOB | 4.26% | 12 months | US$100,000 |

| CIMB | 4.20% | 12 months | US$10,000 |

| UOB | 3.96% | 12 months | US$5,000 |

| DBS | 3.91% | 12 months | US$5,000 |

| Source: Company websites as of 8 July 2024 | |||

The best 6-month foreign currency fixed deposit rates in US Dollar are as follow:

| Bank | Interest rate per annum | Tenure | Minimum amount |

| State Bank of India | 5.25% | 6 months | US$25,000 |

| RHB | 5.00% | 6 months | US$5,000 |

| ICBC | 4.85% | 6 months | US$500 |

| Bank of China | 4.75% | 6 months | US$2,000 |

| Maybank | 4.65% | 6 months | US$10,000 |

| HL Bank | 4.59% | 6 months | US$50,000 |

| UOB | 4.59% | 6 months | US$100,000 |

| DBS | 4.33% | 6 months | US$5,000 |

| OCBC | 4.30% | 6 months | US$5,000 |

| CIMB | 4.30% | 6 months | US$10,000 |

| UOB | 4.29% | 6 months | US$5,000 |

| Source: Company websites as of 8 July 2024 | |||

The best foreign currency fixed deposit rates in US Dollar for 3 months and below are as follows:

| Bank | Interest rate per annum | Tenure | Minimum amount |

| DBS | 5.01% | 2 months | US$5,000 |

| DBS | 4.89% | 3 months | US$5,000 |

| ICBC | 4.85% | 3 months | US$500 |

| Bank of China | 4.80% | 3 months | US$2,000 |

| Maybank | 4.80% | 3 months | US$10,000 |

| UOB | 4.78% | 3 months | US$50,000 |

| State Bank of India | 4.75% | 3 months | US$5,000 |

| HL Bank | 4.68% | 3 months | US$50,000 |

| OCBC | 4.63% | 3 months | US$5,000 |

| CIMB | 4.39% | 3 months | US$10,000 |

| Source: Company websites as of 8 July 2024 | |||

What are the disadvantages of foreign currency fixed deposit accounts?

#1 – Foreign currency fixed deposit are subject to foreign currency risk

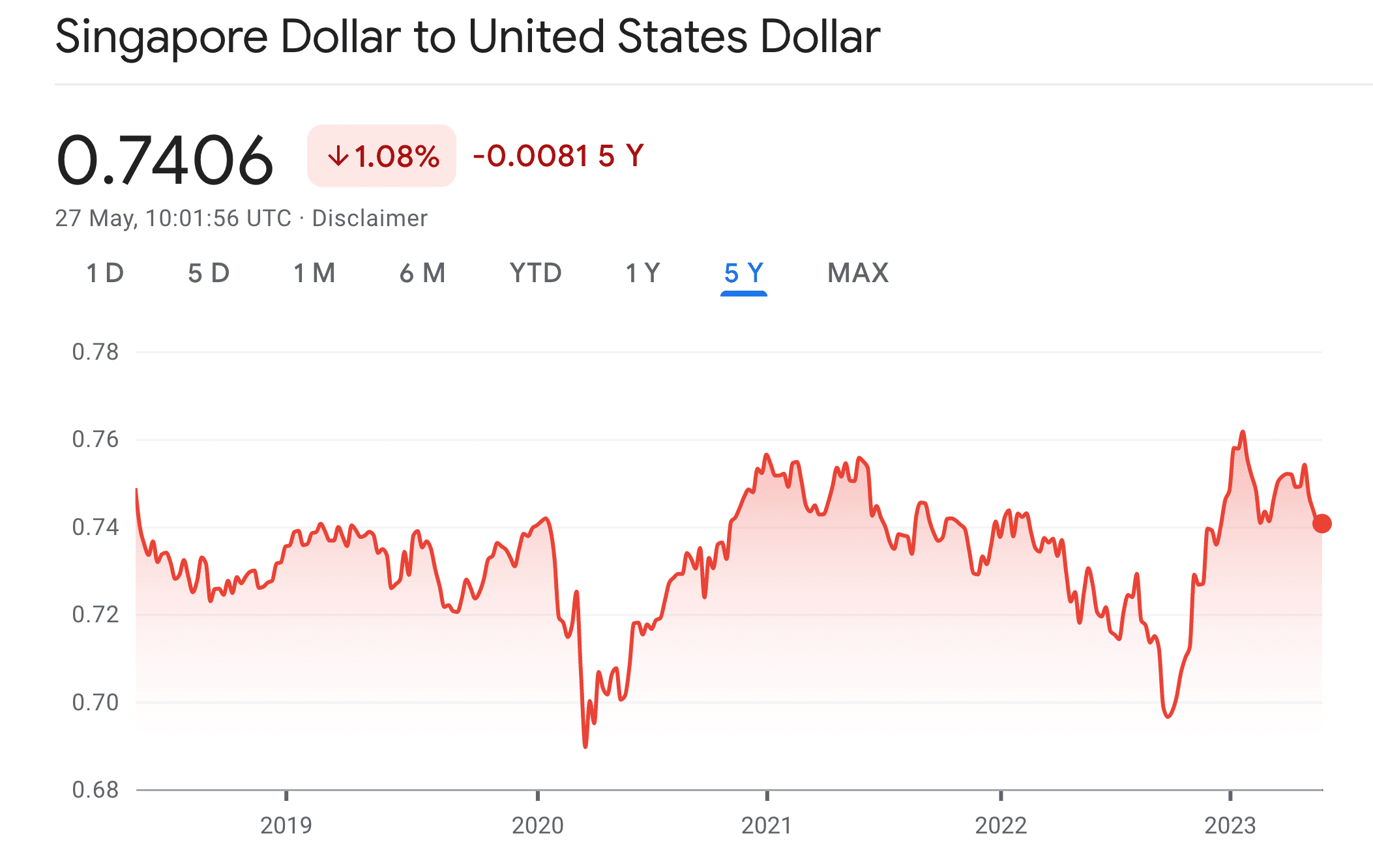

Before deciding to put your money into a foreign currency fixed deposit, you should be aware of foreign currency (FX) risk.

If you are looking to convert your funds in foreign currency back to SGD after the end of the FD cycle, you need to care about FX risk.

Let’s assume you have SGD$ 20,000 and would like to put it into a 12-month 4.55% foreign currency FD to earn a higher interest rate.

First, you would have to convert the SGD$ 20,000 to USD.

At the end of 12 months, you will have to convert the principle + interest back into SGD.

If you think that you might be getting SGD$20,910 (inclusive of the 4.55% interest) … nope. You might be wrong.

The truth is, you may or may not get it. It depends on the FX rate at which you exchange your currency at.

FX rates fluctuate over time. If SGD appreciates against the USD after 12 months, chances are you will get back less SGD per US dollar.

This means that your return will be less than 4.55%.

Too chim? Let me use numbers and show you an illustrative example.

|

|

Amount you have |

Remarks |

|

Initial funds |

SGD$20,000 |

|

|

Convert to USD FX |

USD$14,300 |

Assume FX rate = 0.715 SGD/USD |

|

After 12 months |

USD$14,950.65 |

4.55% interest = US$650.65 |

|

Convert back to SGD |

SGD$20,622 |

Assume FX rate = 0.725 SGD/USD |

|

|

Total interest earned = $622 Return = 3.11% |

|

#2 – Foreign currency fixed deposit accounts are not insured

One of the reasons why we like fixed deposit accounts is because our savings are insured by the Singapore Deposit Insurance for up to S$75,000 in a single account.

However, foreign currency deposits are not covered under the Singapore Deposit Insurance Scheme.

Should you consider a foreign currency fixed deposit account?

You can still consider a foreign currency fixed deposit account in the following circumstances:

- You have an existing holding of USD and/or have spending in USD

- You have holding power and do not mind keeping the USD until you are able to get a good exchange rate

Otherwise, I do not see any point in putting your money into a foreign currency fixed deposit.

Are money market funds a good alternative to USD fixed deposits?

Cash management accounts aim to provide higher potential returns compared to savings accounts, and greater flexibility compared to fixed deposits.

By putting your money in a cash management account, you will be investing in money market funds or bond funds. These professionally managed funds will put your cash in instruments such as bank deposits or short-term debt to earn higher interest rates.

These funds may be denominated in Singapore Dollar or US Dollar. As of 8 July 2024, the yield on US dollar money market funds is typically higher than the yield on Singapore dollar money market funds.

Examples of cash management accounts include Moomoo Cash Plus, Tiger Vault and Webull Moneybull.

As all investments carry risks, we will need to make sure we understand the funds that we are purchasing with these cash management accounts. You can learn more with our comprehensive guide to cash management accounts.

#1 – Tiger Vault

Tiger Vault is a cash management solution by Tiger Brokers which offers you a way to earn a potentially higher yield on your spare cash.

With Tiger Vault, you can buy into the CSOP USD Money Market Fund or Phillip USD Money Market Fund.

Tiger Brokers is offering a interest bonus coupon that allows you to earn 6.8% p.a. for 30 days with Tiger Vault. Learn more about the Tiger Vault promotion.

#2 – Moomoo Cash Plus

Moomoo Cash Plus aims to generate potential returns for your idle cash with greater flexibility.

With Moomoo Cash Plus, you can buy into the CSOP USD Money Market Fund.

Moomoo SG is offering a guaranteed return of 6.8% p.a. for 30 days with Moomoo Cash Plus. Learn more about the Moomoo Cash Plus promotion.

#2 – Webull Moneybull

Moneybull is Webull’s cash management tool that aims to help you earn a higher potential return on your idle cash by investing in money market funds.

With Webull Moneybull, you can buy into the CSOP USD Money Market Fund.

Webull is offering new users a 1.8% p.a. interest booster coupon for up to 180 days. Learn more about the Webull Moneybull promotion.

Final verdict on foreign currency fixed deposit accounts

If you have noticed, USD foreign currency fixed deposits offer the highest interest rate now. This is because interest rates in the US are higher than other countries such as Japan.

If I am not looking to convert my foreign currency back so soon, I will probably pick the one with the highest interest rate and place my money there.

Of course, there are always risks for foreign currency fixed deposit, including foreign currency risks and no coverage by the Deposit Insurance Scheme.

Please always exercise due diligence and do not fall prey when people tell you this or that product pays better.

Remember: there is a reason why it offers a higher interest rate. The product may be good for some people but may not necessarily be suitable for everyone.

If you are looking to earn a higher interest rate on foreign currency savings, you may also look at various cash management accounts.

If you would prefer a safer option, check out our guide to the best Singapore dollar fixed deposit rate.

As usual, you can get updates on the best fixed deposit rates on Beansprout’s Telegram group.