(Bloomberg) — The International Monetary Fund has upgraded its forecast for UK economic growth this year in an early boost for the new Labour government.

Chancellor of the Exchequer Rachel Reeves welcomed the expected pickup but said she was “under no illusion to the scale of the challenge facing the economy and the inheritance this new government faces.”

Labour won the election less than two weeks ago with a promise to make the UK the fastest-expanding Group of Seven economy with growth of around 2.5% a year, by reforming the planning system and ramping up both public and private investment.

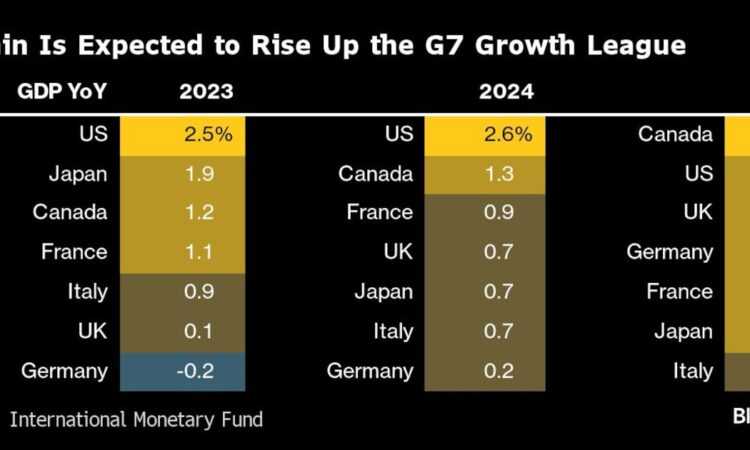

In an update to its global growth outlook, the IMF raised the UK to 0.7% from the 0.5% forecast in April, taking it from the second bottom ahead of Germany in 2023 to a pace equal to Italy and Japan. The US, Canada and France will see more rapid expansions.

The 0.2 percentage point upgrade was the equal largest alongside France. The forecast was unchanged for 2025, when the UK will be the third-fastest growing G-7 economy at 1.5%, behind Canada and the US, according to the IMF.

Despite the better outlook, the forecasts imply Reeves still faces trouble in her first budget – expected in September or October. The Office for Budget Responsibility, the fiscal watchdog, was forecasting growth this year of 0.8% and 1.9% in 2025 and most economists think its long-term outlook is overly ambitious.

The IMF also warned that persistent inflation could derail the recovery. Inflation has fallen more slowly among G7 nations this year than had been hoped, delaying the interest-rate cuts that had been expected by now by the Bank of England and the US Federal Reserve.

“Further challenges to disinflation in advanced economies could force central banks, including the Federal Reserve, to keep borrowing costs higher for even longer. That would put overall growth at risk,” Pierre-Olivier Gourinchas, the IMF’s economic counsellor, wrote in a blog accompanying the forecasts.

Last week, similar concerns were expressed by three of the nine members on the BOE’s Monetary Policy Committee. Huw Pill, the chief economist, Catherine Mann and Jonathan Haskel, both external MPC members, all raised concerns about services prices and wages. They were countered by Swati Dhingra, another external member already voting for a rate cut, who said this week that policy was too tight.

Gourinchas argued that the fall in inflation has been driven by goods but because their price level remains “high relative to services,” they are “comparatively cheaper, increasing their relative demand and, by extension, that of the labor needed to produce them.”

Sticky services inflation and pay growth mean that “even absent further shocks, this is a significant risk to the soft-landing scenario,” Gourinchas said.

©2024 Bloomberg L.P.