Bitcoin (BTC-USD) was trading within a narrow 24-hour price range of $57,200 to $58,200 on Thursday.

Chart indicators suggest that the cryptocurrency is in a precarious position, which could either lead to further declines or stabilisation, followed by gradual appreciation.

Bitcoin rebounded from a low of around $54,600 at the start of the week, to trade at around $58,120.

Bitcoin’s price has steadily declined from $71,000 since the beginning of June.

Multiple sell-pressure factors over the past weeks has caused a spike in price volatility. Some traders fear a potential increase in the digital asset’s supply hitting the market, originating from seized bitcoins held by the German and US governments, according to this week’s CryptoQuant market report. Further sell-side pressure could come from the distribution of funds from the defunct bitcoin exchange Mt Gox.

Read more: Crypto live prices

Data suggests bitcoin could fall further

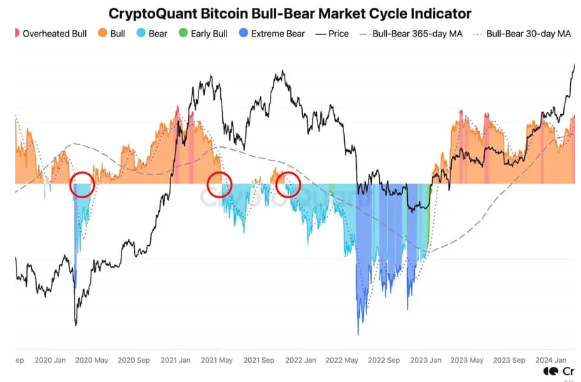

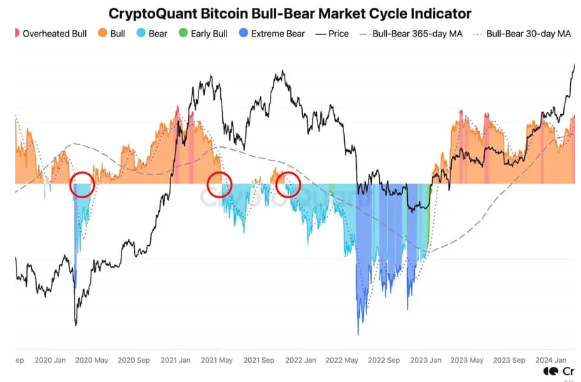

On-chain analysis from CryptoQuant suggests that a major price correction or the onset of a sustained bear market could be imminent, as charts show the profit and loss index is hovering around its 365-day moving average.

Charts from the blockchain analytics firm indicate that previous crossovers below the 365-day moving average preceded significant declines for bitcoin in both May and November 2021, when the digital asset fell by approximately 40% on each occasion.

The case for a price recovery

According to CryptoQuant analysts, bitcoin long-term holders — addresses that have held the digital asset for 155 days or more — are accumulating at the fastest monthly rate since April 2023.

“Bitcoin whales have been increasing their holdings at a monthly growth rate of 6.3%, the fastest pace since April 2023, indicating rising demand for bitcoin,” CryptoQuant said in a market report on Wednesday.

Read more: Why the price of bitcoin is falling

The uptick in demand from the long-term holder cohort is acting as a support for bitcoin’s price, according to the report.

The analysts noted that long-term holders realised substantial profits when prices exceeded $71,000 at the beginning of June. However, they have since incurred some losses and are now more reluctant to sell.

“This could be an early sign of a bitcoin price bottom,” CryptoQuant said.

Bitcoin’s prices could also take longer to commence a new upward trend, as stablecoin liquidity growth is still not in full swing, according to the report.

Lack of stablecoin liquidity

The market capitalisation of USDT (USDT-USD), the world’s largest stablecoin by trading volume, has been decreasing. This could delay or dampen the potential for any significant bitcoin price appreciation, according to the CryptoQuant report.

“Bitcoin’s price usually rallies when more liquidity enters the crypto market through USDT minting, a condition that has not yet been met,” analysts noted.

High liquidity is important for markets because it ensures that transactions can occur smoothly, prices remain stable, and investors can confidently buy or sell assets without causing significant price fluctuations.

Download the Yahoo Finance app, available for Apple and Android.