Germany and the US are seemingly competing for who can spook bitcoin markets more.

Addresses linked to German and US governments have recently sent $737.6 million in bitcoin to exchanges including Coinbase, Bitstamp and Kraken, as well as some to OTC desk operator-slash-market maker Flow Traders.

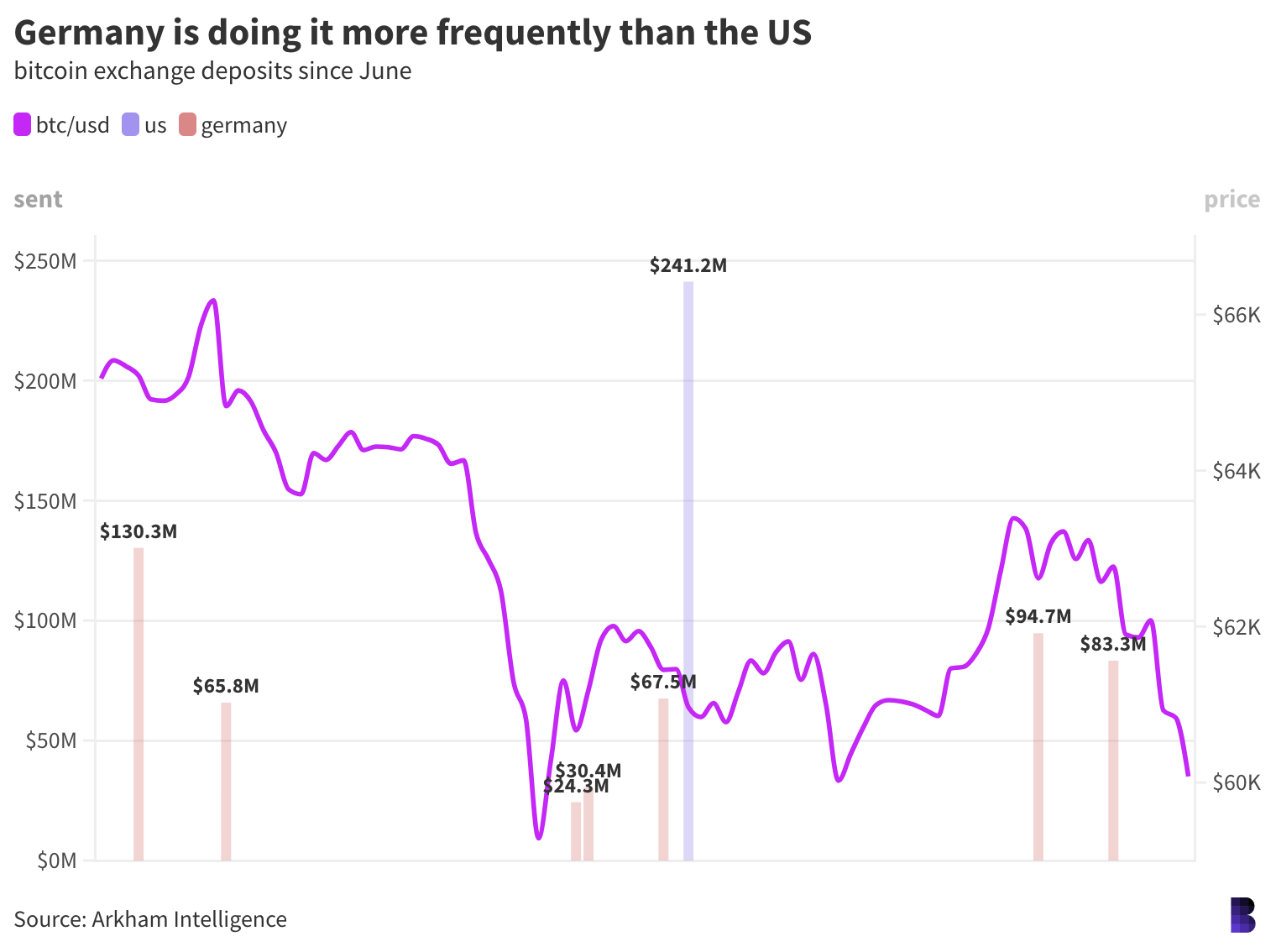

Germany makes up about three-quarters of that total, with its deposits spread across 30 different transactions — usually in the morning around 9 am local time.

While it’s unclear whether all the bitcoin was actually sold (a portion has since been returned to the original addresses), Germany’s transfers to exchanges are believed to be the first ever, at least going by Arkham Intelligence data.

Local authorities had previously seized bitcoin via various criminal cases, including pirate portal Movie2k.

Over the past two weeks, Germany has sent 7,828 BTC in transfers that appear to be part of liquidation efforts.

That bitcoin was altogether valued at $496.4 million at the respective transaction times, implying an average price of $63,400. Bitcoin currently trades for $60,200, although a direct causal link between Germany’s transfers and falling prices is tough to draw.

As for the US, the Feds used to sell bitcoin at auction. Now, it sells on Coinbase.

The US sent a single 3,940 BTC deposit to Coinbase Prime at 11 am ET on June 26. The bitcoin, which once belonged to drug dealer Banmeet Singh, was worth $241.22 million at the time, while the same haul would fetch $237.35 million right now.

Aside from the bitcoin sold at auction in years prior, putting an exact value on how much the US government has offloaded over the years is difficult.

Some transactions are obvious, like the Coinbase deposits. Others only end up on exchanges after being sent through multiple single-use addresses. (For the sake of this analysis, crypto that was first sent to an in-between address before being forwarded to an exchange also counted towards the totals.)

After combing through the chain for exchange deposits, and other transfers that have all the hallmarks of sales, it looks like the US government may have now either liquidated or moved to liquidate almost $590 million in bitcoin since November 2020 (valued at the time of transfer). Which is about 20% more than Germany’s recent moves.

The data suggests that:

- The US sold 15,903 BTC for approximately $37,000 on average since 2020.

- Had the US held all that bitcoin until now, it could’ve netted $958.7 million.

- The US missed out on an estimated $370 million by selling too soon, and that’s not counting the billions missed by selling at auction over the last decade.

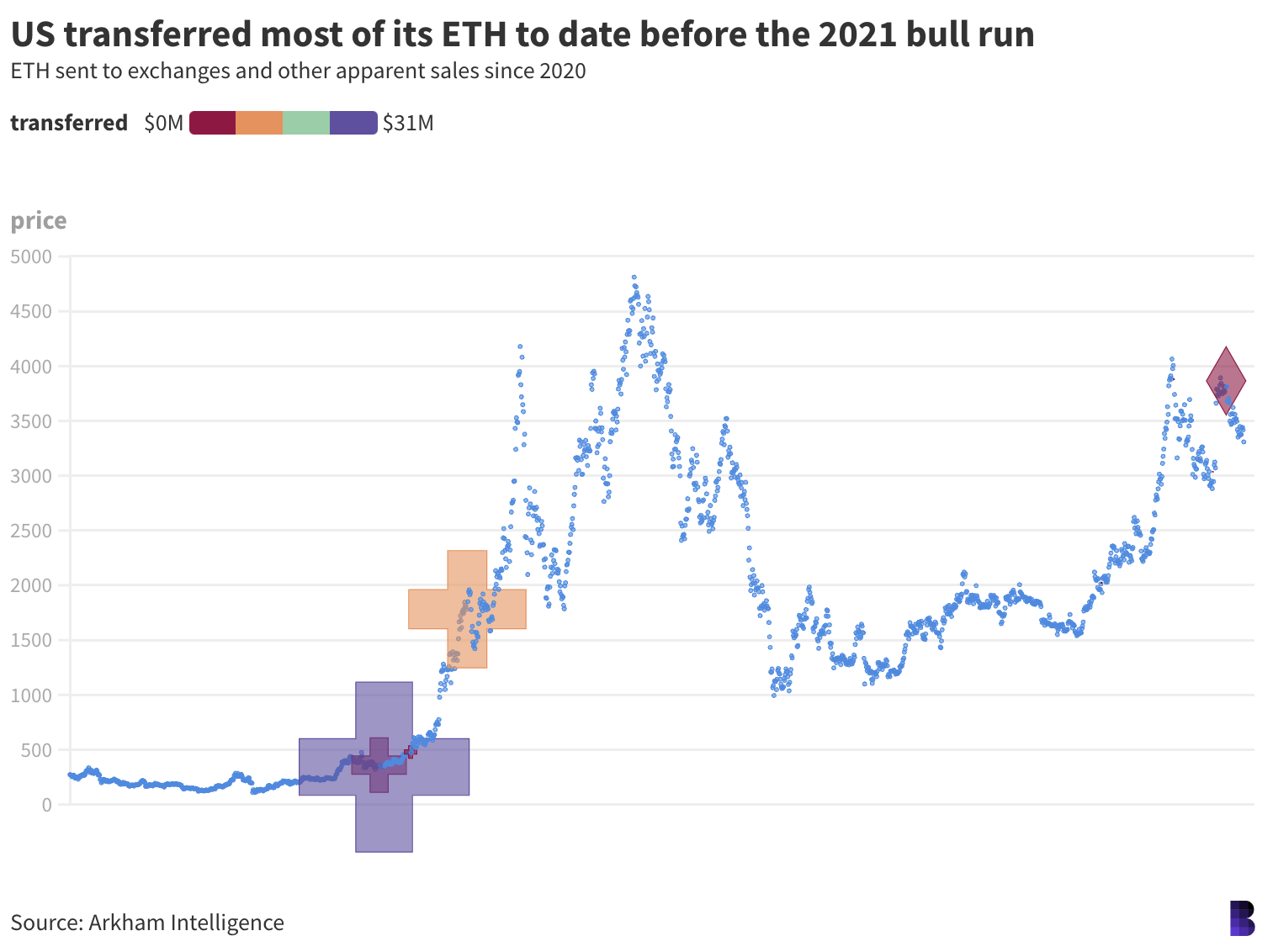

World governments moving around their bitcoin tend to make a lot of noise. But the onchain data indicates that the US has been selling seized ETH for as long as BTC.

Split between Coinbase and Kraken, addresses tagged as the US government have sent $49.1 million in ETH to trading platforms since September 2020. An additional $2.6 million in DAI and a small amount of USDC was also sent to an address that forwarded it onto Kraken.

All up, using the same analysis as the bitcoin exercise above, the US government appears to have liquidated 108,673 ETH for an average price of $452 (current price: $3,300). Had it held all that and sold today, it would’ve scored over $358 million — missing out on nearly $310 million.

The ETH came from wallets designated to seizures from cases involving defunct crypto debit card ploy Centra Tech and Gary Harmon, who, ironically, stole bitcoin seized by the US government, among others.

Combining it altogether shows the US and Germany have directed close to $1.14 billion in seized bitcoin, ether and stablecoins to exchanges and other trading platforms over the past four years.

The US is still sitting on about $13.3 billion in crypto, mostly bitcoin, as well as a combined $300 million in ether and tether. Germany otherwise continues to hold 43,549 BTC ($2.6 billion).

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.

Explore the growing intersection between crypto, macroeconomics, policy and finance with Ben Strack, Casey Wagner and Felix Jauvin. Subscribe to the On the Margin newsletter.

The Lightspeed newsletter is all things Solana, in your inbox, every day. Subscribe to daily Solana news from Jack Kubinec and Jeff Albus.