Banks in the UK are embroiled in the highest number of lawsuits in a decade in a trend that shows no sign of slowing down.

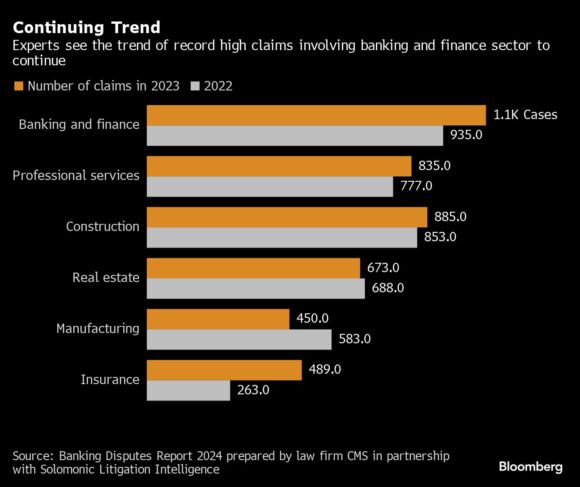

Almost three new cases involving financial services firms were filed every day on average at the UK High Court last year, according to a report prepared by law firm CMS along with Solomonic Litigation Intelligence.

The high numbers of lawsuits not seen since the aftermath of the 2008 global financial crisis have been sparked by increased instances of payment frauds, economic hardship faced by customers and disputes around Russian sanctions, according to litigators.

The sector was more likely to be entangled in fresh litigation than any other last year and “banks will need to be alive to the need to manage historic risks alongside new ones,” Vanessa Whitman, a lawyer at CMS, said.

So far this year London courts have played host to several eye-catching disputes. Billionaire Mike Ashley sued Morgan Stanley over a $1 billion margin call, in a suit that was ultimately dropped.

Elsewhere, HSBC Holding Plc scored a win in its successful fightback against Walt Disney’s £1.3 billion ($1.7 billion) suit over a film finance scandal, and Standard Chartered Plc fights a £1.5 billion claim over Iran sanctions breaches.

Banks continue to be increasingly sued by employees over race and sex discrimination in London tribunals as judges run the rule over potentially toxic working culture.

UK lenders are also staring at the imminent deluge of claims over multi-billion pound misselling saga over car loans.

With over 200 new claims in the first quarter of 2024, the trend is seen to continue as disputes coming out from the past years of sluggish growth, high interest rates and the worst cost-of-living crisis in decades will keep making their way into courts.

Difficult economic conditions result in disputes such as those around defaults, loan guarantees and margin calls, said Christopher Charlton, a lawyer at Macfarlanes. “These trends look set to continue – as do claims relating to, or at least complicated by, expanding sanctions regimes.”

Fraud related cases are also expected to keep stacking up. Nearly £1.2 billion was stolen through fraudulent transactions in 2023, according to trade association UK Finance.

Separately, lawyers see a risk of litigation to banks around the country’s new and far-reaching anti-greenwashing rules, that came into force from May 31, the CMS report said. Litigation funders are looking for opportunities to take on ESG litigation against deep-pocketed lenders.

As was seen during the global financial crisis, claims tend to tick up when economies are sluggish. Market shifts and expectations around long term interest rates trigger disputes where parties entered into contracts on the assumption that a particular economic condition would stay constant.

“Downturns tend to expose wrongdoing as the tide goes out,” Rupert Lewis, head of banking litigation at Herbert Smith Freehills, said.

Copyright 2024 Bloomberg.

Want to stay up to date?

Get the latest insurance news

sent straight to your inbox.