The European tech ecosystem reached a combined market valuation of €3.5 trillion in Q1 2024, more than doubling in value over the past five years. This growth has been largely driven by venture capital. Currently, Europe has over 2,400 active VC firms, and European VC-backed startups have created 6.3 million jobs. Nearly 200 active unicorn companies have emerged in Europe, fostering innovation and positive impact across various industries.

The new report “Beyond returns – Venture and growth investing fuelling sustainability & societal change” from European Woman in VC, Founders Forum Group and Tech Nation, states that VC-backed companies are the ones that are driving economic growth, creating jobs, and often aligning with the Sustainable Development Goals (SDGs), thus generating substantial social and environmental benefits. Additionally, mixed teams and female-led VCs are particularly effective in this regard, whether in deep tech or digital sectors, fostering positive change within the ecosystem.

More VC money for impact-driven startups

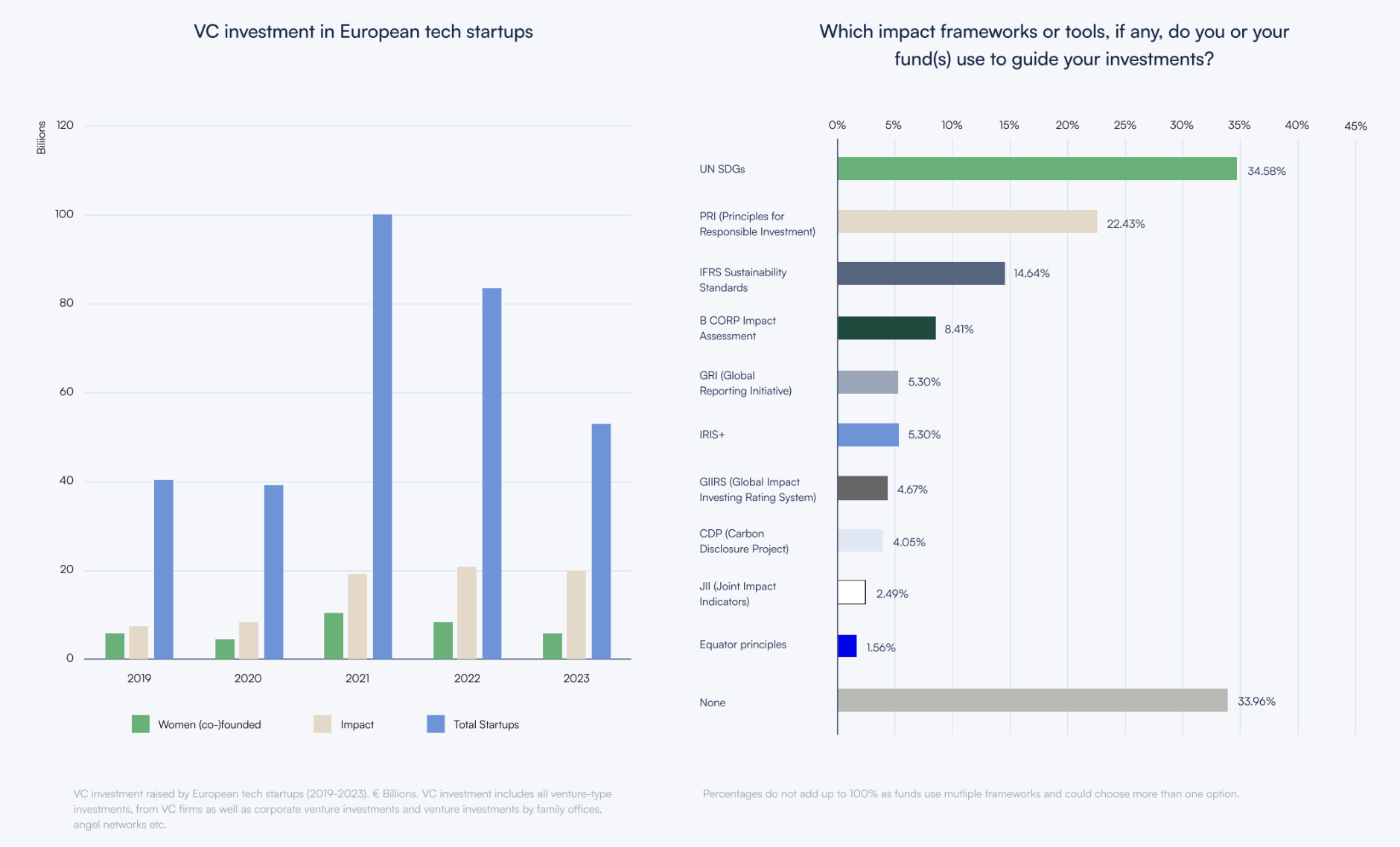

As stated in the report, European tech startups collected €53 billion in VC investment in 2023. Over 37 per cent of this amount went to impact startups that directly address one or more of the UN Sustainable Development Goals (SDG). A similar number of VCs surveyed (around one-third) stated that the UN SDGs are used as a guide for their investments.

The report also finds that the share of total VC investment raised by European impact startups has more than doubled in the last five years (from 18 per cent in 2019 to 37 per cent in 2023). VCs and LPs stated that they prioritize more and more investments with a focus on climate, innovation, health and gender equality. The data show that in 2023 €18.2 billion was raised by climate tech startups, €8.6 billion was raised by health tech startups, and that a similar trend was regarding the investments in women (co-)founded startups.

“Venture capital is critical for the development of vibrant startup ecosystems across Europe and disruptive new technologies and ideas that transform societies for the better. Institutions that don’t back venture miss out on the opportunity to drive Europe’s development, effect real change, and make outsized returns.” – Brent Hoberman, Founders Forum Group, Founders Factory, firstminute capital

LPs want to make a positive impact on their investments

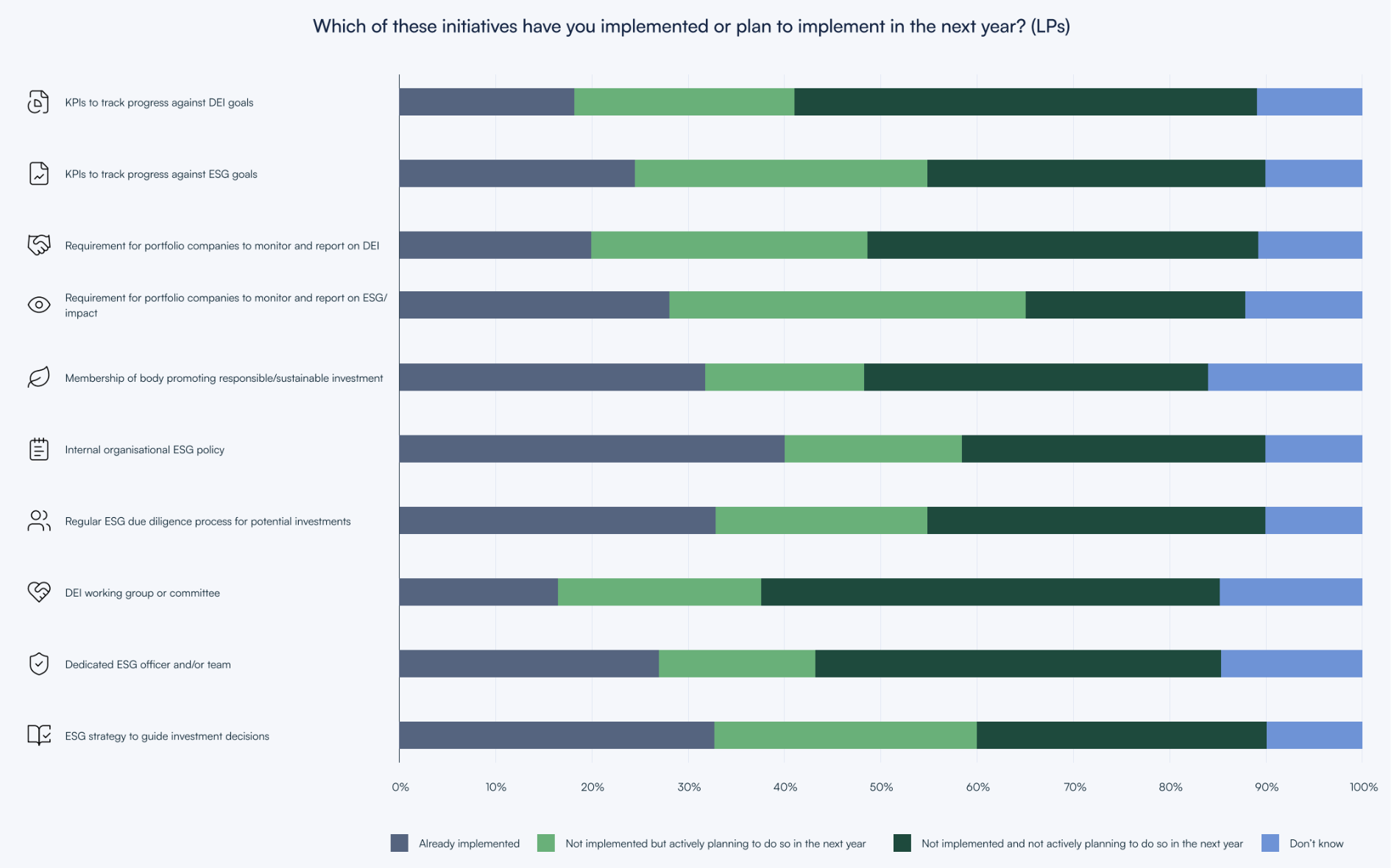

LPs are strongly committed to incorporating sustainability and social responsibility into their investment strategies. The report reveals that 73 per cent of LPs surveyed consider alignment with the UN SDGs. The report shows that 60 per cent of LPs have already implemented or plan to implement an ESG strategy within the next year, while 65 per cent require or will require their portfolio companies and funds to report on ESG performance.

The report also found that VCs and LPs in the Nordics prioritise the SDGs and environmental impact more than elsewhere in their investment decisions. Thus, 75 per cent of VCs and LPs in the Nordics say alignment with SDGs is a crucial factor in their investment decisions, 71 per cent say ESG strategy is key, while more than 62 per cent say the diversity of the founding team is important or extremely important.

A top priority for VCs – ESG performance

Half of the VCs we surveyed indicated that enhancing the ESG performance of their portfolio companies is a top priority for the next 12 months. Additionally, 28 per cent of VCs plan to explore new ESG investment opportunities, and 23 per cent aim to increase the proportion of companies in their portfolio that meet specific ESG standards. Furthermore, 38 per cent prioritize increasing the diversity of their partners, while 33 per cent are focused on advancing climate change initiatives.

As stated in the report, 82 per cent of VCs surveyed have already implemented an internal ESG policy, or plan to do so in the next year.

More diversity means better investment decisions and financial returns

According to the report, there is a strong belief among VCs and LPs (87 per cent) that increased diversity in venture capital leads to better investment decisions and financial returns.

Other primary benefits of increasing diversity noted by VCs and LPs include access to a wider talent pool and a better, more collaborative working environment.

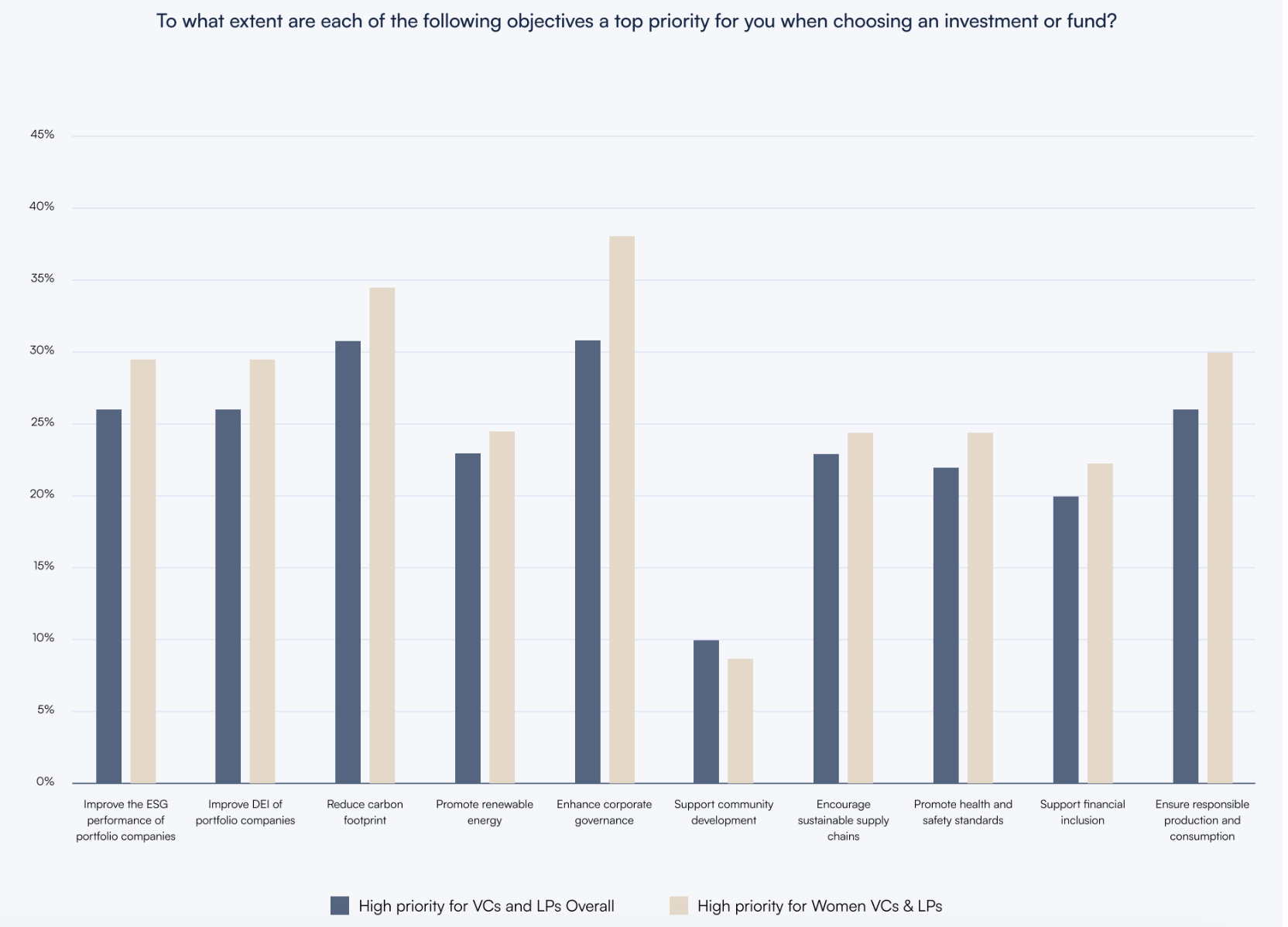

Women’s VC partners are especially focused on making a positive impact with their investments. Thus, one in three women VCs and LPs surveyed say enhancing corporate governance and reducing carbon footprint are high-priority objectives when choosing a company or fund to invest in, states in the report.

For more detailed insights, data, and interviews with strong voices in the VC community, download the full European VC Impact Report 2024.